- for speed listening, go to the settings wheel on the bottom right of the video and choose playback speed - after one minute video becomes high-resolution.

Intro, Cap, and Legal Structure - 22 Apr 24

Sector, Business - 22 Apr 24

Drivers & Model - 22 Apr 24

Investment Discussion - 22 Apr 24

SHORT Idea

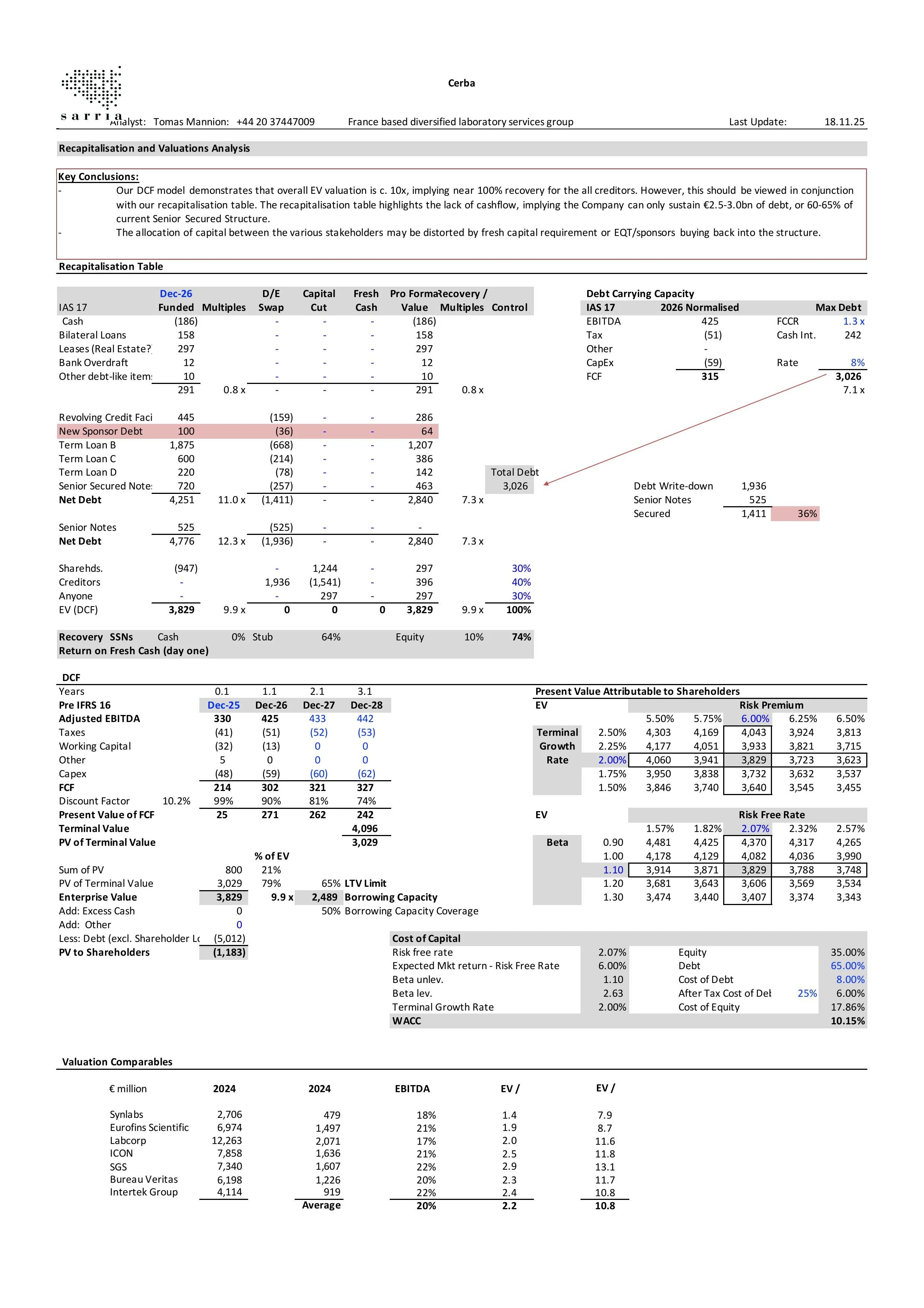

The long-awaited cooperation agreement at Cerba is now in place. It is reported that 66% of senior creditors have signed the agreement,

Please find our updated analysis on Cerba post Q3 numbers here.

The equity sponsors are in the process of injecting an additional €100m of liquidity into the Company, pari passu with the

The tone of the Cerba call continues to centre on self-help measures and cost savings as the Company attempts to grow into its

The ratings downgrade at Cerba doesn’t change the situation. The company remains highly leveraged, with a capital structure that is

One of the sources of the turmoil in French politics is the 2026 Budget and the debt reduction plans used to narrow France’s deficit from its current

Please find our updated model post Q2 results here.

Following the Q2 results, we are maintaining our short position in the Cerba Senior Secured Bond, even as our initial view had been to close out, given the lack of

Initial reaction is that the numbers are better than we had expected, but regardless, the capital structure is unsustainable and needs restructuring. There are rumours

Cerba and other medical laboratory groups experienced a decline in bond prices following a wider circulation of a report released by the

It appears there may be IT issues, or perhaps the upcoming restructuring, which has affected Cerba’s investor relations site, resulting in the removal of all historical financial results. Fortunately,

Banks and bondholders are coordinating efforts and conducted a beauty parade for financial advisers in July. While no formal confirmation has

S&P downgraded Cerba bonds yesterday on unsustainable capital structure and strained liquidity. It is as if S&P have read ou

Please find our updated model reflecting Q1 results here.

The release of Q1 numbers has not altered our fundamental view on Cerba. While the results were broadly uneventful, we were surprised by

While the latest figures do not alter our overall view, we are reviewing them in greater detail. The bonds have

The call currently is ongoing, but the initial view of the numbers is worse than we expected. Liquidity will remain tight going forward and we fully expect the

Please find our unchanged analysis here.

A lot has happened since we took a short position in early February across Cerba’s capital structure. There were rumours, counter-rumours and eventually a statement from the Company stating that Cerba, like any other company, has regular discussions

Cerba Idea Pitch video is now live. You can find it on the Sarria website landing page and on the dedicated Cerba page.

Cerba has lost its CEO, Emmanuel Ligner, who left immediately on March 14th. Mr Ligner was only appointed in March 2024, and this announcement, coupled with

We are staying short. The Cerba/Houlihan Lokey story isn’t disappearing. An article in Bloomberg alleges that EQT is discussing a liability management

Unconfirmed, but Cerba is rumoured to have appointed Houlihan Lokey to advise on its outstanding debt, which has applied further pressure to the trading level of

Please find our updated model on Cerba here.

As we stated in our November note post Q3 results, Cerba remains significantly overleveraged on a reported EBITDA basis, with the sponsor likely out of

Cerba SUNs are up on news released in December that in the context of a new healthcare framework in France signed by biologist unions and the

Please find our updated analysis post the Q3 2024 results on Cerba here.

The organic growth continued (post-COVID normalisation) for the routine & specialty testing business. The forward looking KPIs for the Research Division (backlog,

Cerba reported Q3 2024 which showed progress in their turnaround. The company reported €439m revenue in Q3 2024, up by +0.2% which was

We are excited to introduce a new feature to more readily deliver to you our top ideas at any time. We are not YouTubers, but we are now recording our ideas in short 2-5 minute videos, which you can find on our website right on top of the landing page.

It seems like the rating agencies are only catching up. Moody’s downgraded the corporate family rating to Caa1 from B3, the ratings on the senior

Please find our updated analysis post Q2 2024 results here.

We are changing our outlook on Cerba from a negative to a positive stance as we see signs of a turnaround. While we might be early on

While the credit story seems to going in the direction we laid out in our initiation, we will review our position post-call this week. Cerba reported Q2 2024 results of

Please find our updated model post the Q1 2024 results, here.

Since our initiation and short position in both the 2029 and 2028 notes, the only material change in the story is the announcement of the sale of the vet

Q1 2024 results were saved by the vet, otherwise, it was more of the same. In a quarter (that was strong seasonably), revenues came in at €503 million which were boosted by