- for speed listening, go to the settings wheel on the bottom right of the video and choose playback speed - after a few seconds, the video quality improves.

Intro Capital and Legal Structure - 23 Jul 24

Company Description - 23 Jul 24

Assets Valuation - 23 Jul 24

Investment Discussion - 23 Jul 24

CPI is tendering at the short end of its curve. The EUR 1.75% 01/2030 now trades at around 5.75%, so the coupon shock of

The buy-back reduces the external shareholders’ base, but this was small anyway. Credit investors were already looking to the

Please find our updated analysis here

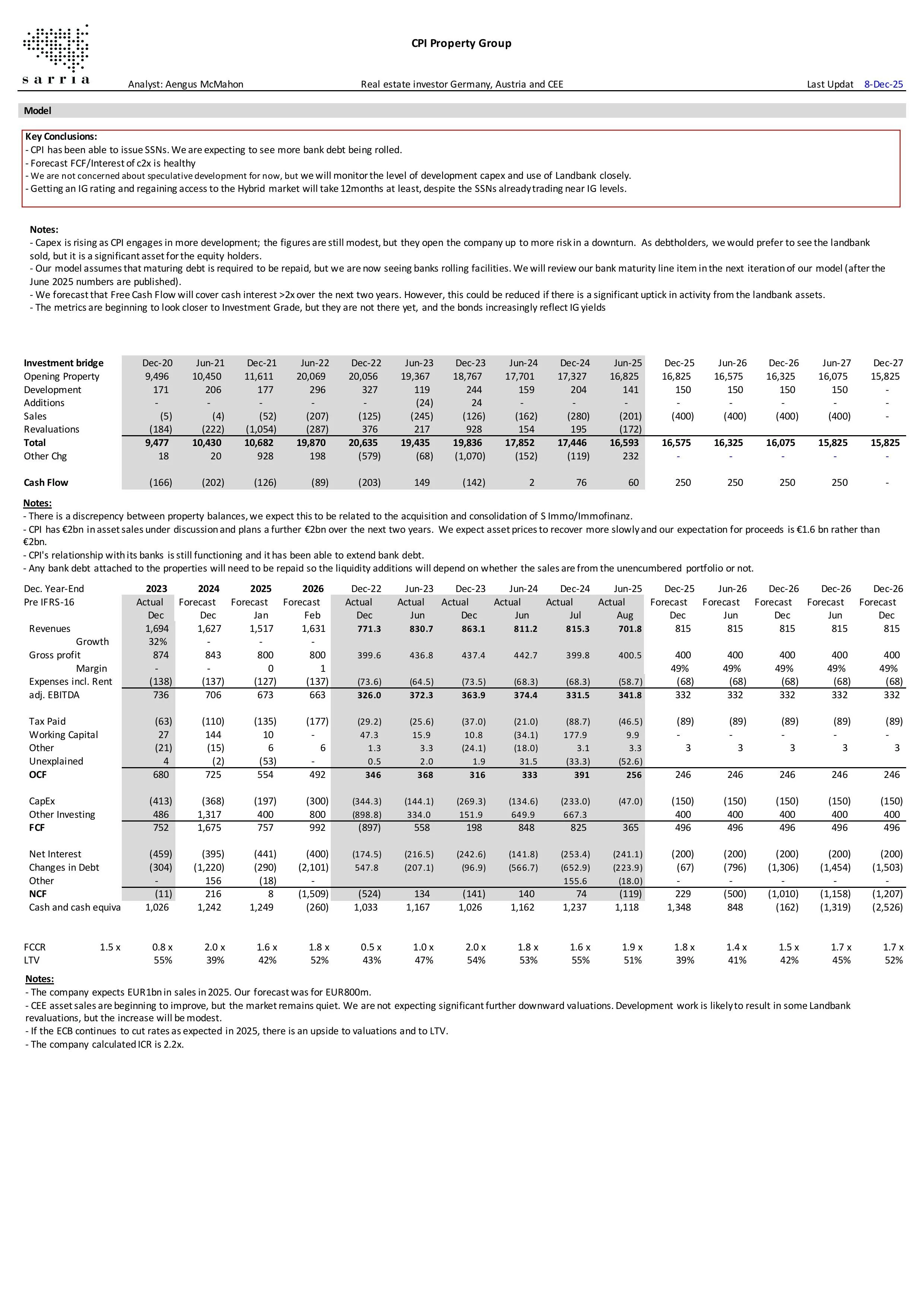

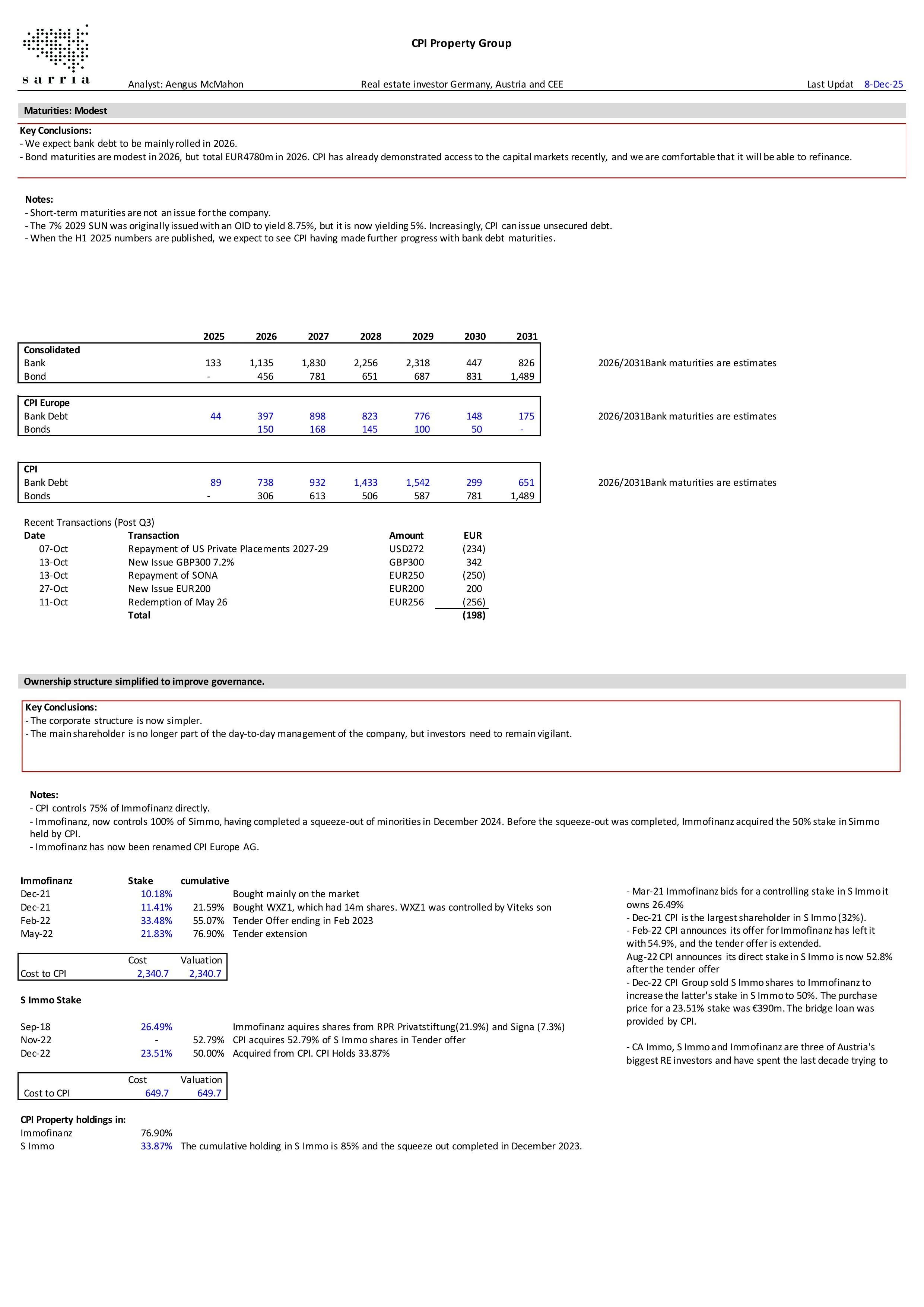

CPI’s Q3 2025 trading statement followed on from its H1 results; valuations have stabilised, LTV is <50%, and the company has access to the SUNs and

The Q3 25 trading statement held no surprises for us. CPI debt has moved out of the stressed universe, and the company recently placed

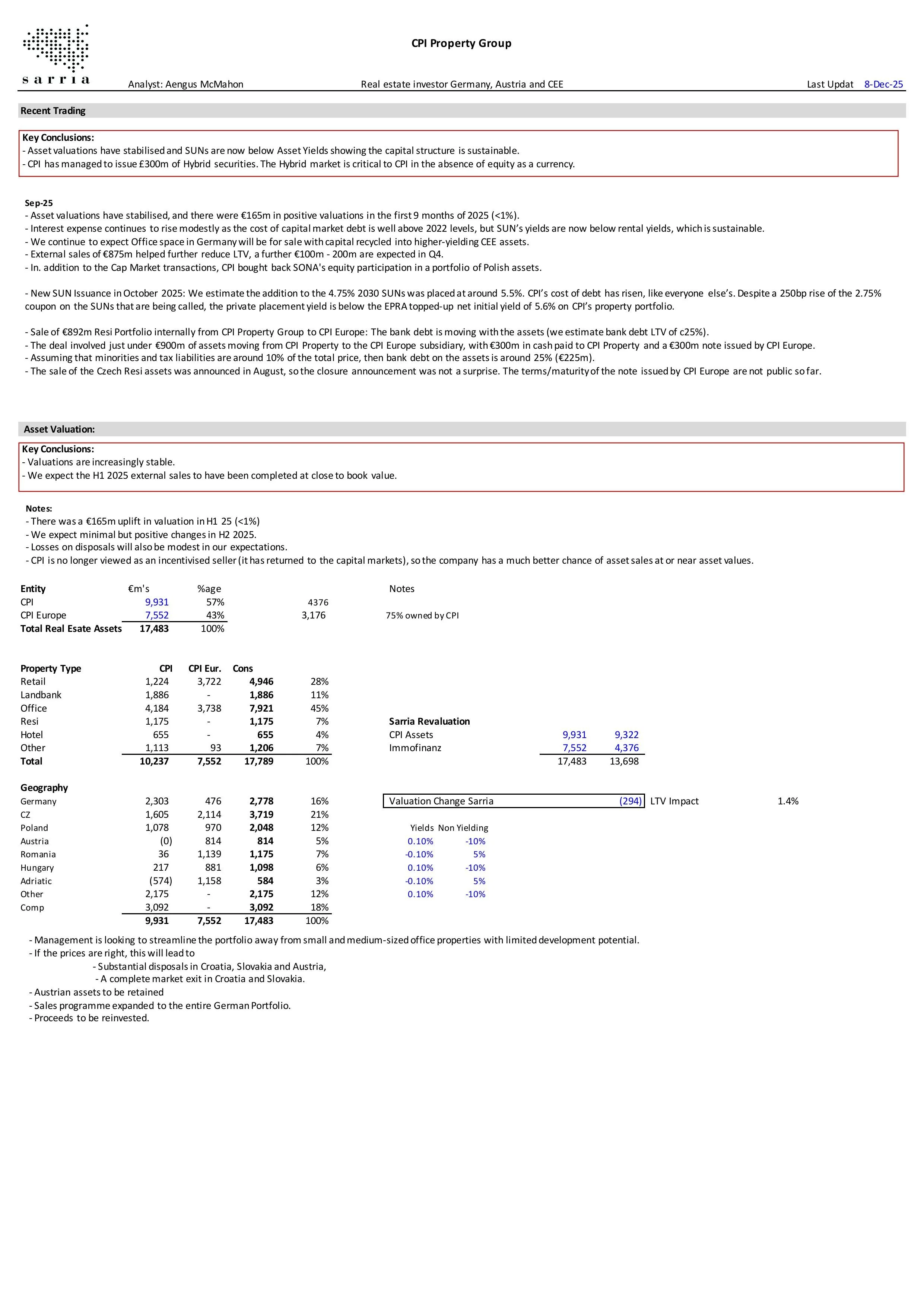

The bank debt is moving with the assets (we estimate bank debt LTV of c25%). The deal involved just under €900m of assets moving from

CPI’s cost of debt has risen, like everyone else’s. Despite a 250bp rise of the 2.75% coupon on the SUNs that are being called, the private

Buying back the Sona stake in CPI FIM SA is rational, as the newly issued Hybrid will receive 50% equity treatment. CPI needs

Please find our updated analysis here

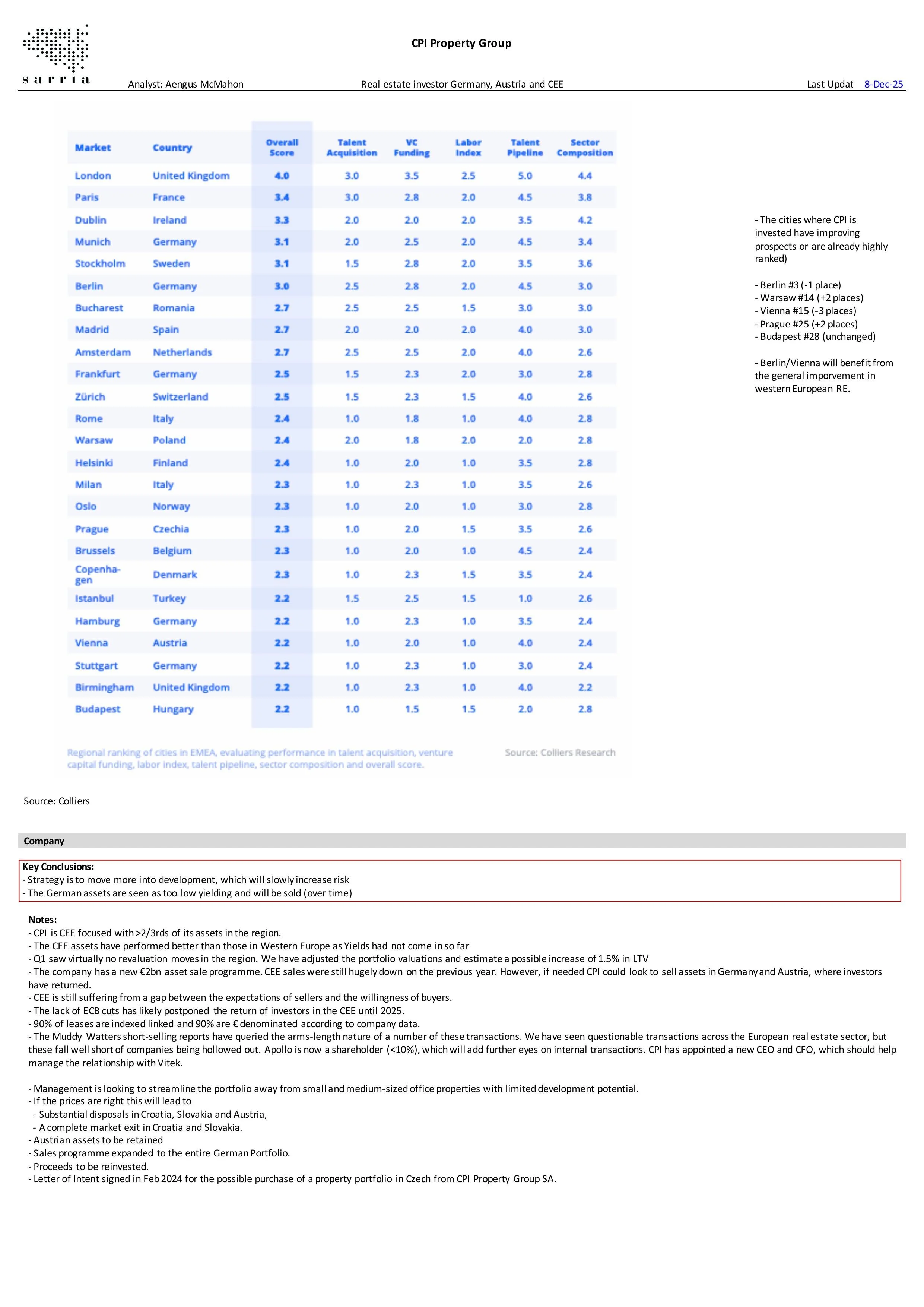

CPI has weathered the European real estate crisis and its governance issues well. In 12 months, CPI’s five-year debt has tightened from 8.75% to 5.5%. CPI is

The tender offer was a resounding success. CPI increased the maximum tender offer from EUR100m to EUR180m, and over

The tender price of 107.75 is nearly 2 points above the offer price for the 7% May/2029 SUNs over the last couple of weeks, and we would expect

Demonstrating that the CEE markets are open for Real Estate sales is an important plank for CPI. The €55m (gross asset value) retail park

The sale price is undisclosed, but we estimate the gross value to be around €82 million. The hotel has 364 rooms, and we estimate the

Management has said it needs to issue Hybrids as it doesn’t have public equity as a currency. The Exchange Offer is attractive,

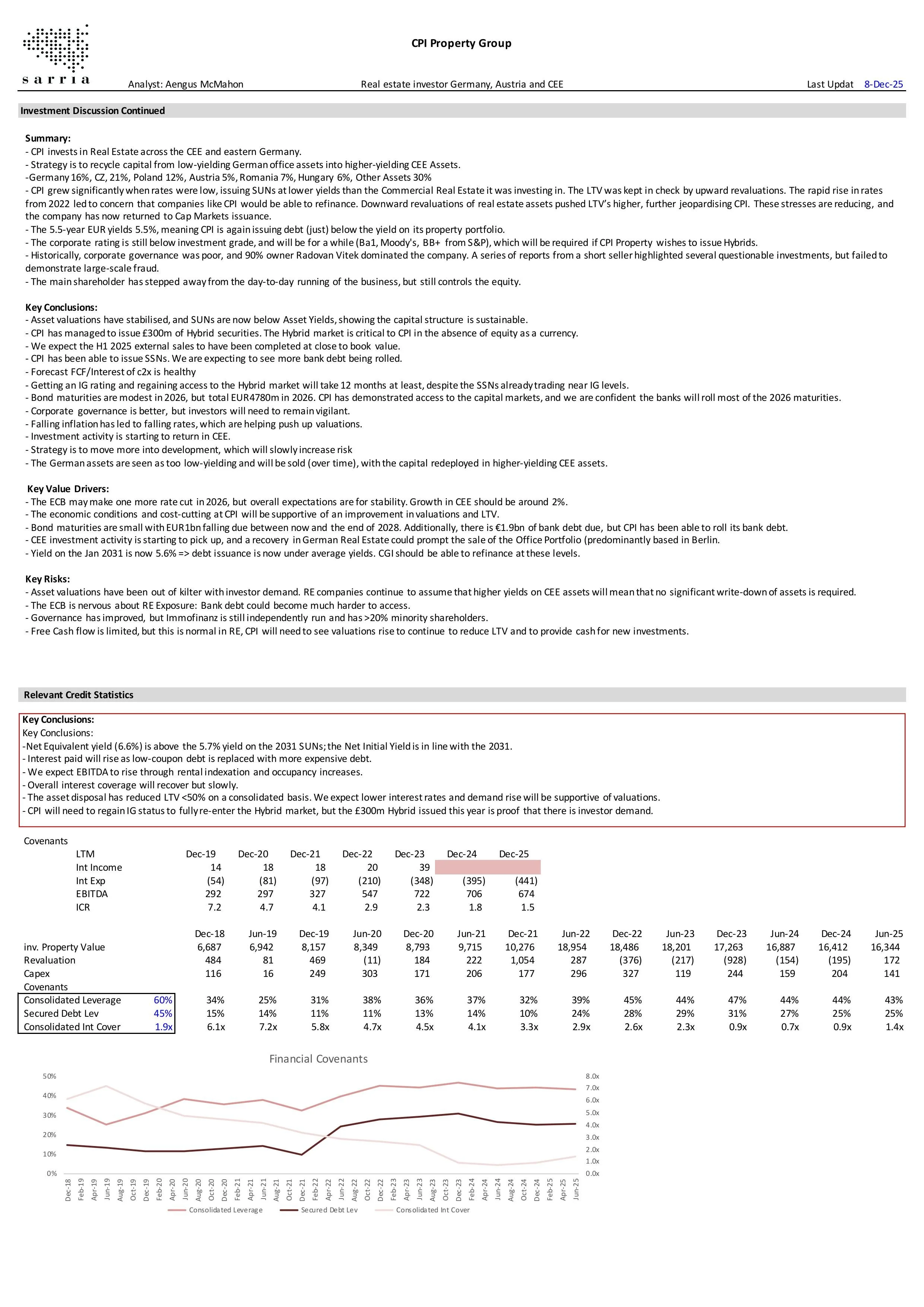

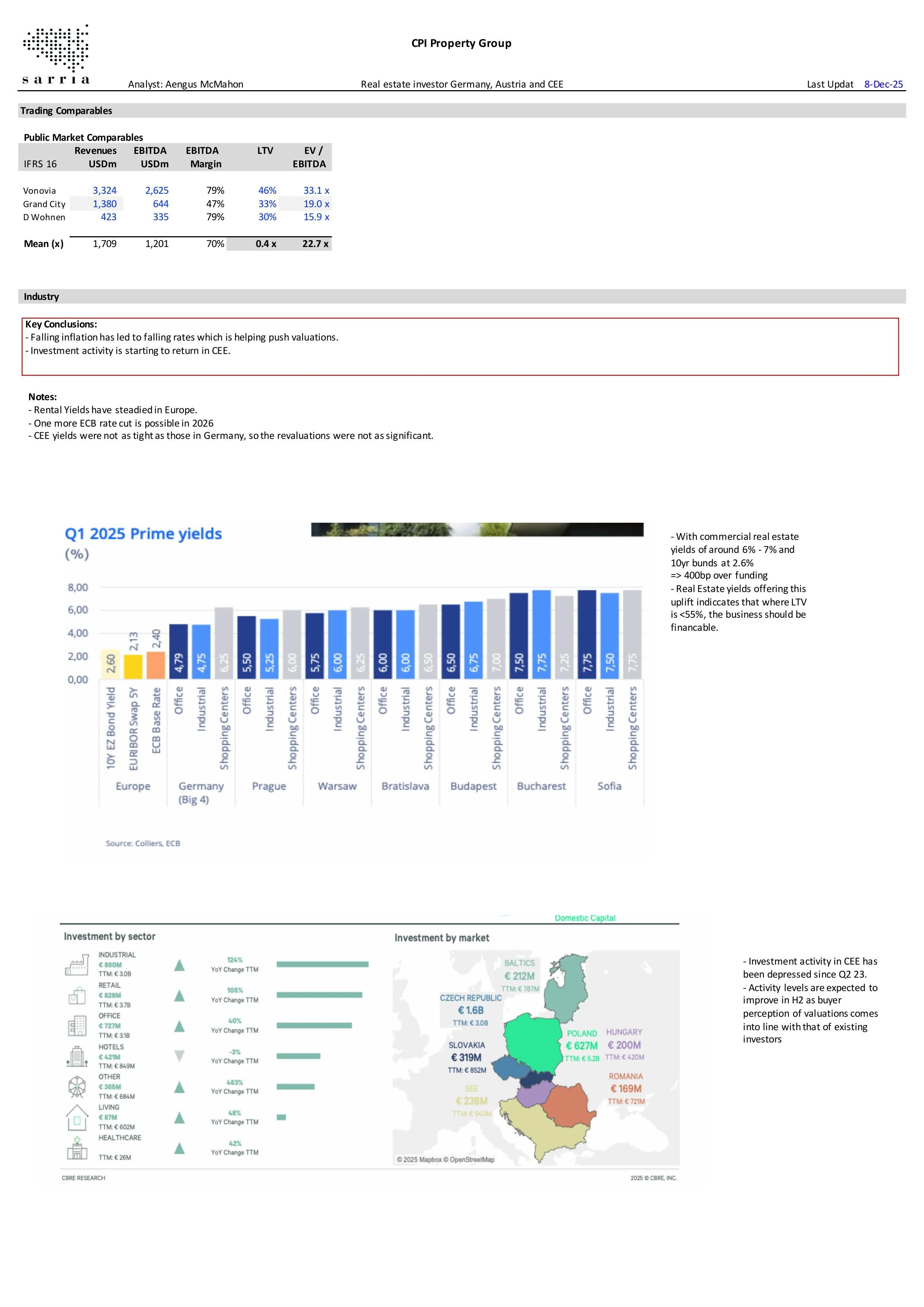

The FY results were in line with our forecast. Property write-downs were 1.8% in FY 24, but the picture differed across the various portfolios. Office valuations

The disposal is small but in line with CPI's focus on its larger markets. Immofinanz has total investments in Slovakia of €431m. We estimate the total value of the

CPI will need to regain an IG rating to issue new hybrids, but this will require two things at a minimum. Firstly, an LTV of 40% (currently 50%) will be necessary. This will

Neither the size of the sale nor the valuation is public, but the disposal is in line with concentrating on markets where

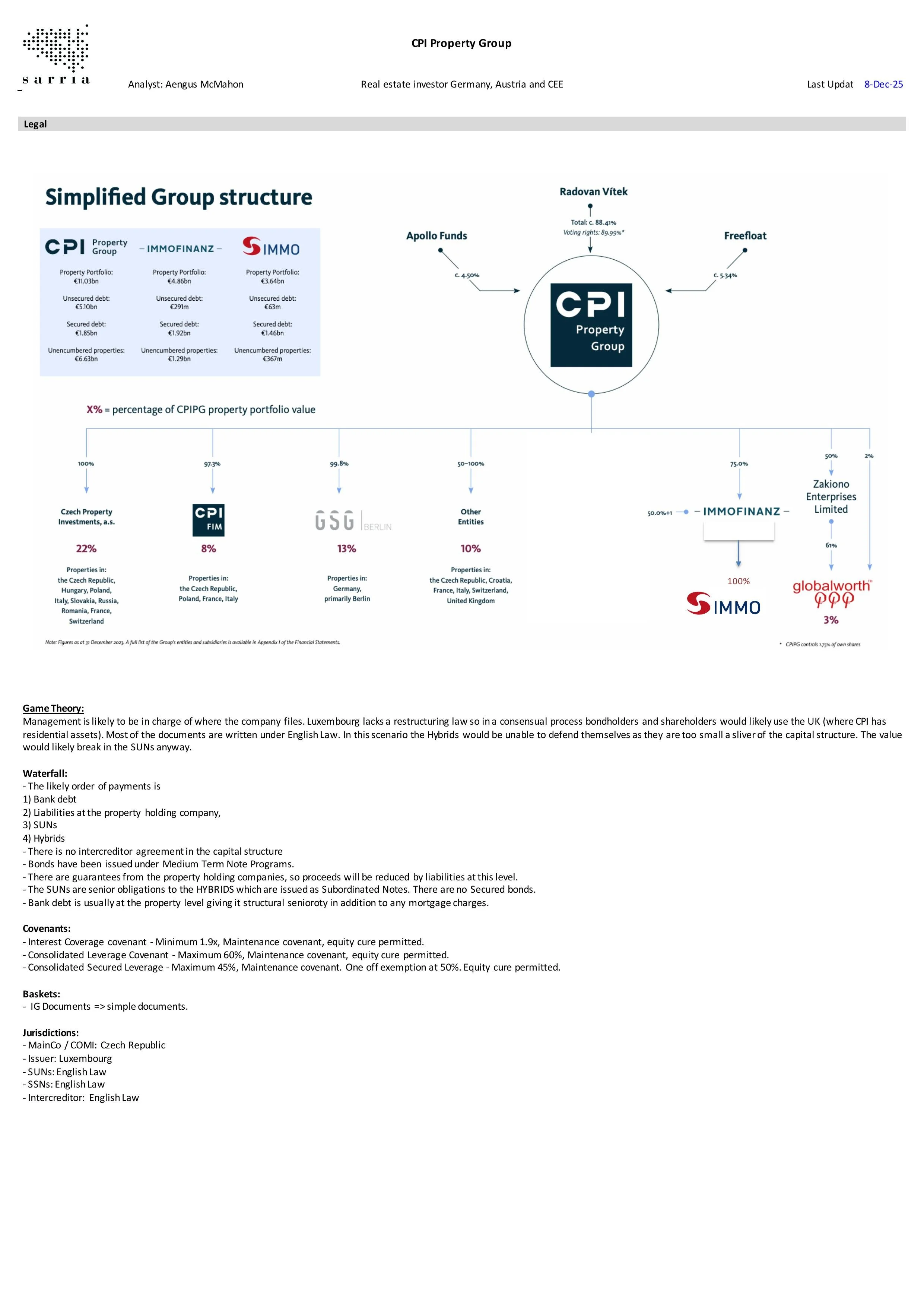

CPI has plans for Immofinanz and was unlikely to want to involve a potentially hostile shareholder. Petrus’ 11% stake in Immofinanz didn’t

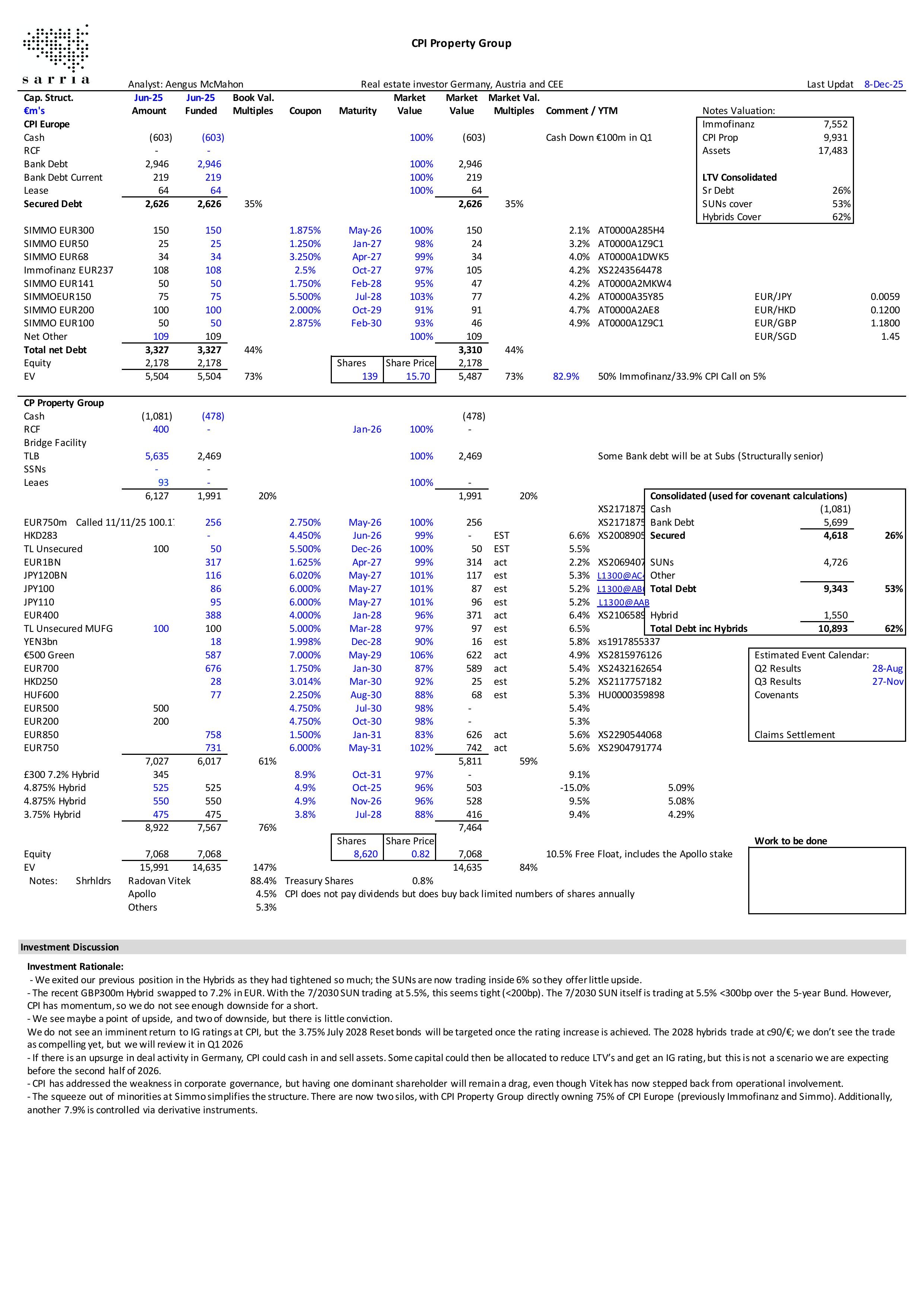

The cash up to CPI for its S Immo shares will be around €100m, and the remainder is via a €500m intercompany loan. CPI had

Petrus taking an 11% stake in Immofinanz is irritating, but ultimately CPI’s 75% stake gives it control. Petrus claims the stock could be

CPI should be pleased with the pricing of its deal to yield 6.875%; we had expected >7%. Our point from yesterday stands with debt of

The €600m of new debt to finance the tender offer for the 2.75% 2026 and 1.625% 2027 bonds (€1.24bn outstanding) will cost around 550bp more

Our main takeaway from the Q2 call was tidying up CPI's capital structure. CPI is selling its stake in S Immo to Immofinanz, leaving Immofinanz with

The 38.4% of S Immo directly held by CPI will cost around €620m. Our analysis shows a gap in Immofinanz's cash of about €325m. CPI Property may arrange finance to

Immofinanz’s squeeze out of minorities at S Immo will cost €116m; the price proposed is €22.05 per share. Immofinanz will likely be able to fund

The H1 results contained no surprises; a modest €150m downward revaluation on €17bn of assets echoes recent sugestions from other RE companies that

The latest update doesn’t change anything for creditors. With €21bn in assets, a block on reducing assets beneath €535m will only have a small impact on

The proposed 10:1 stock split will not change anything for debt investors. The main

With the squeeze out of minorities at the S Immo level, we are not surprised that CPI and Immofinanz are looking at a possible combination of