- for speed listening, go to the settings wheel on the bottom right of the video and choose playback speed - after one minute video becomes high-resolution.

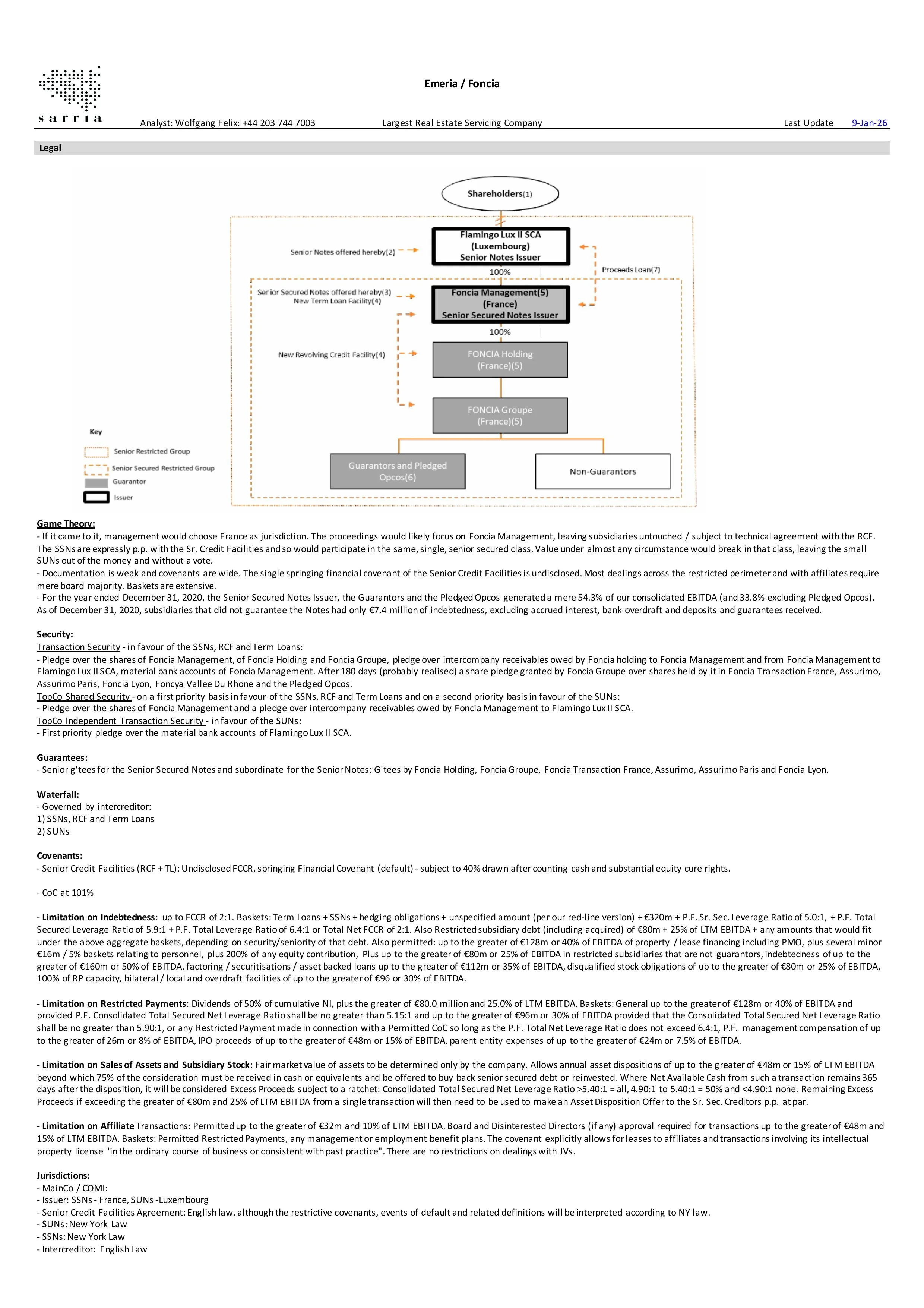

Intro Capital and Legal Structure - 25 Jun 2024

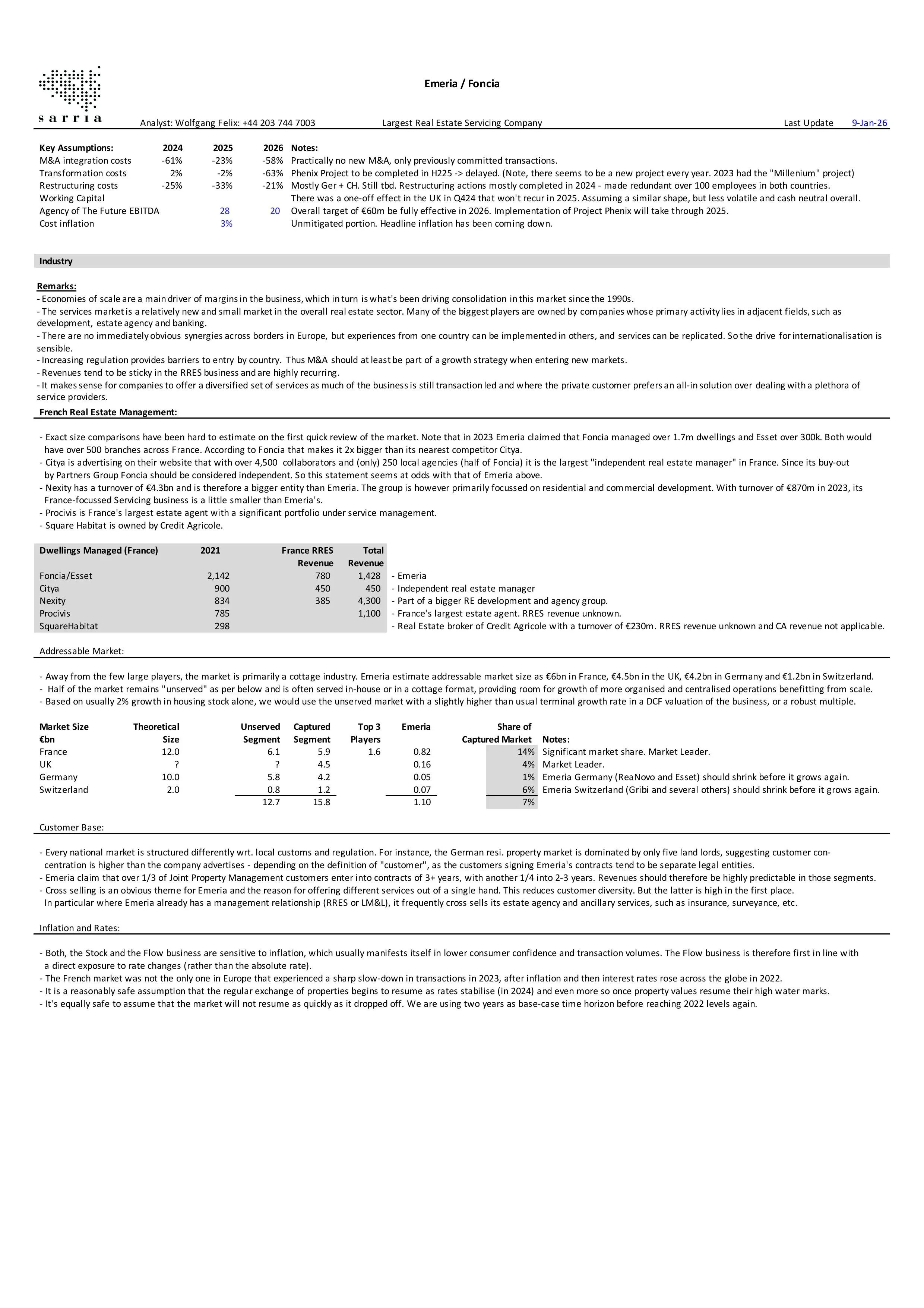

Industry - 25 Jun 2024

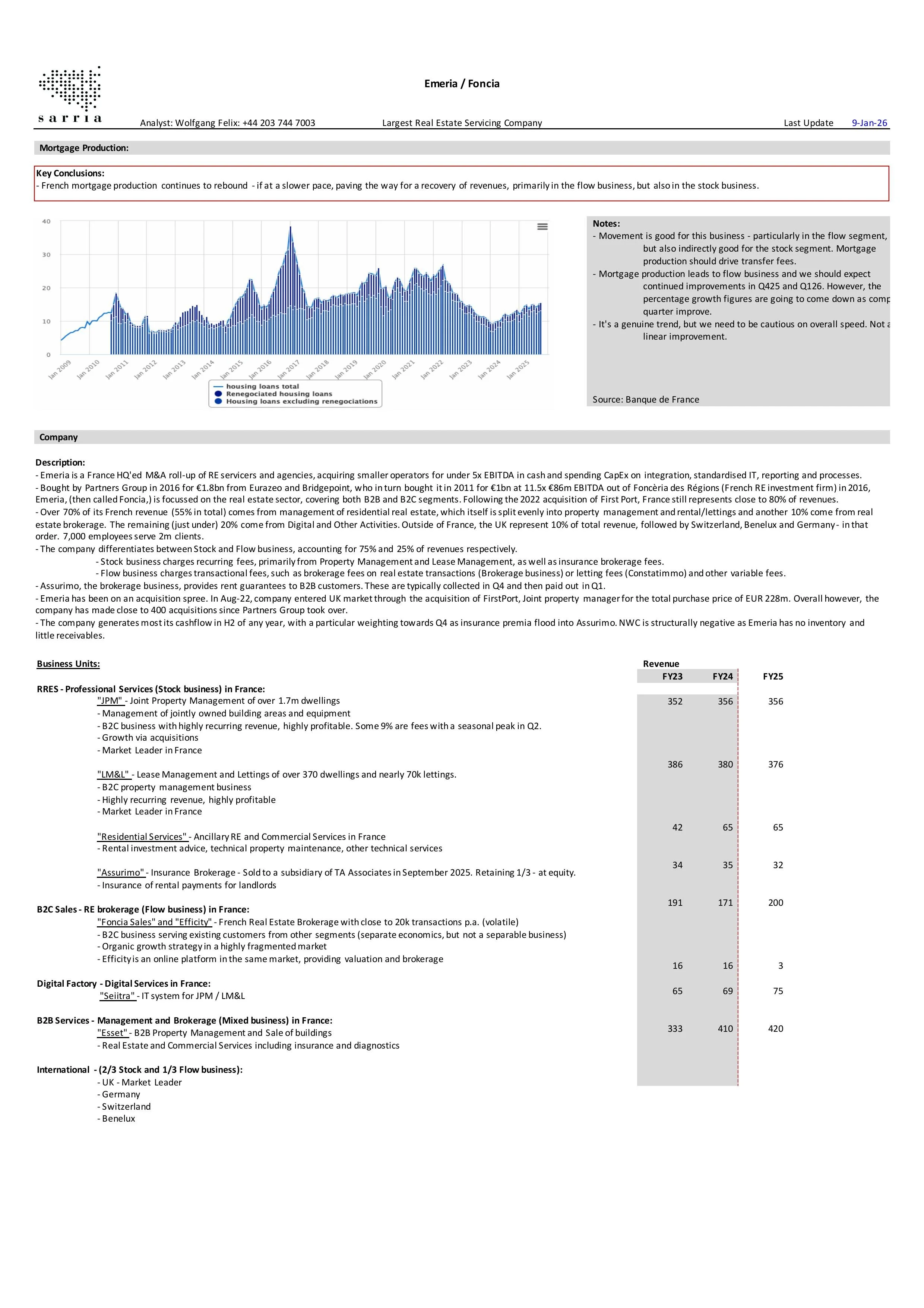

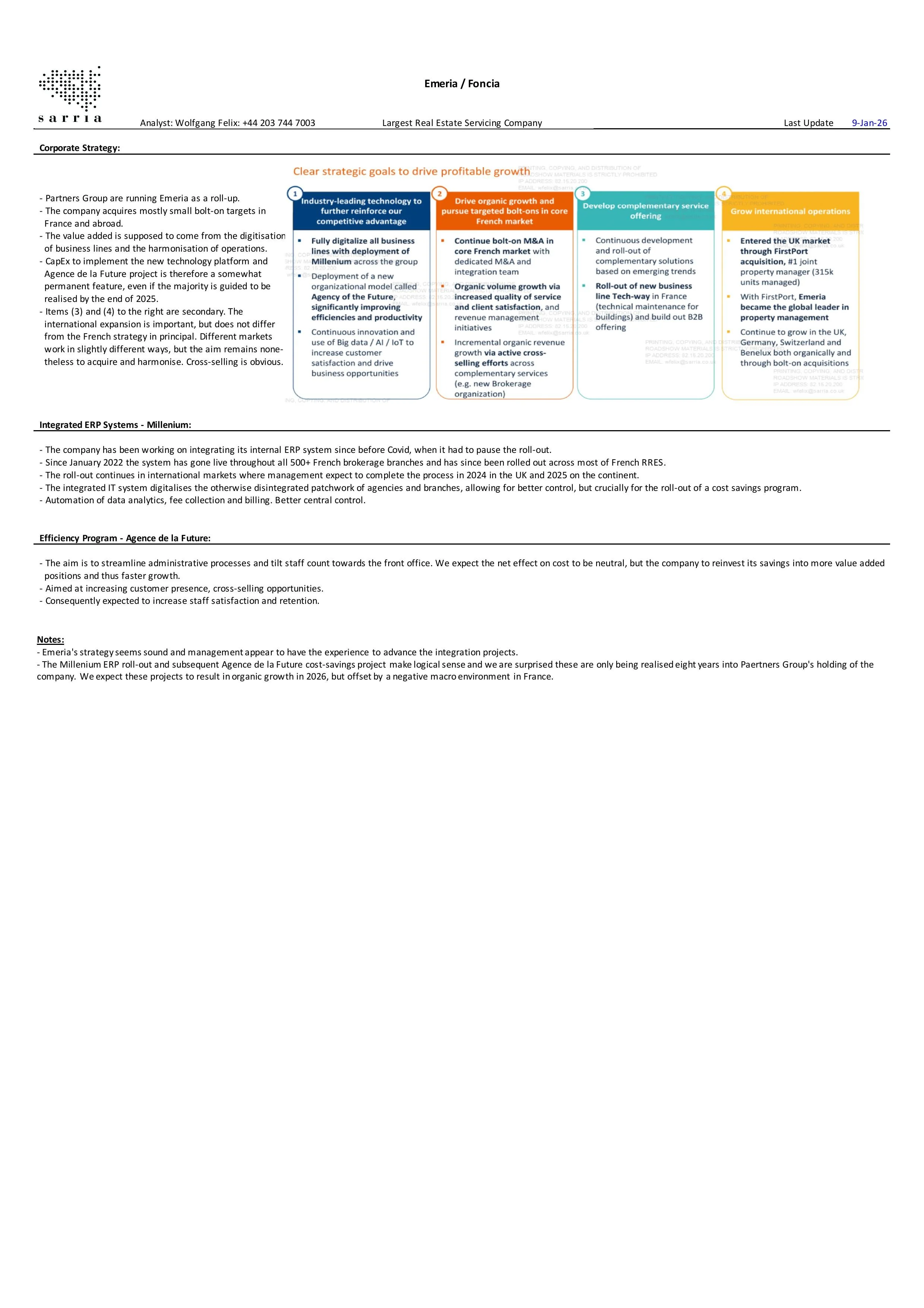

Business Description - 25 Jun 2024

CF Model, Forecasting - 25 Jun 2024

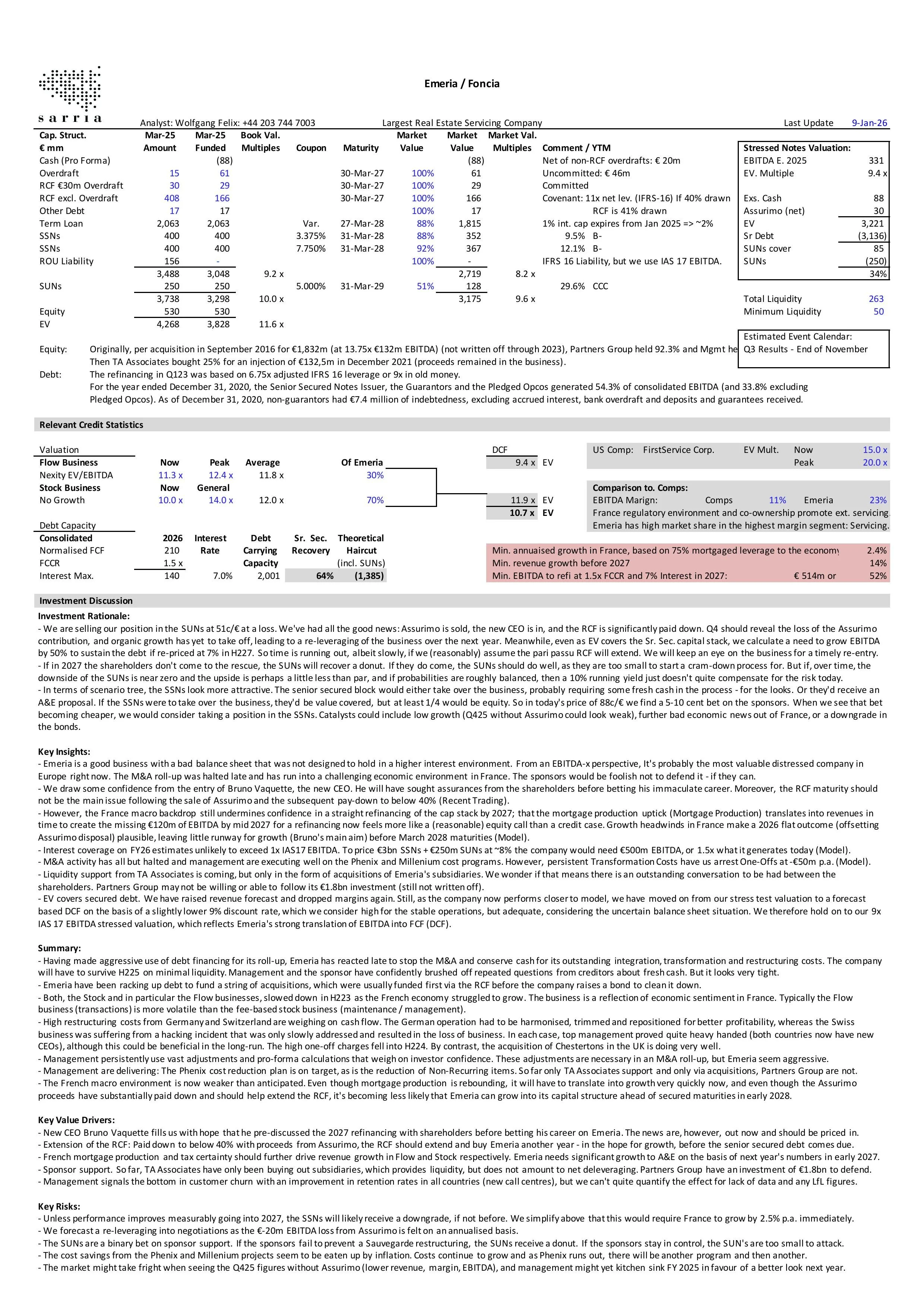

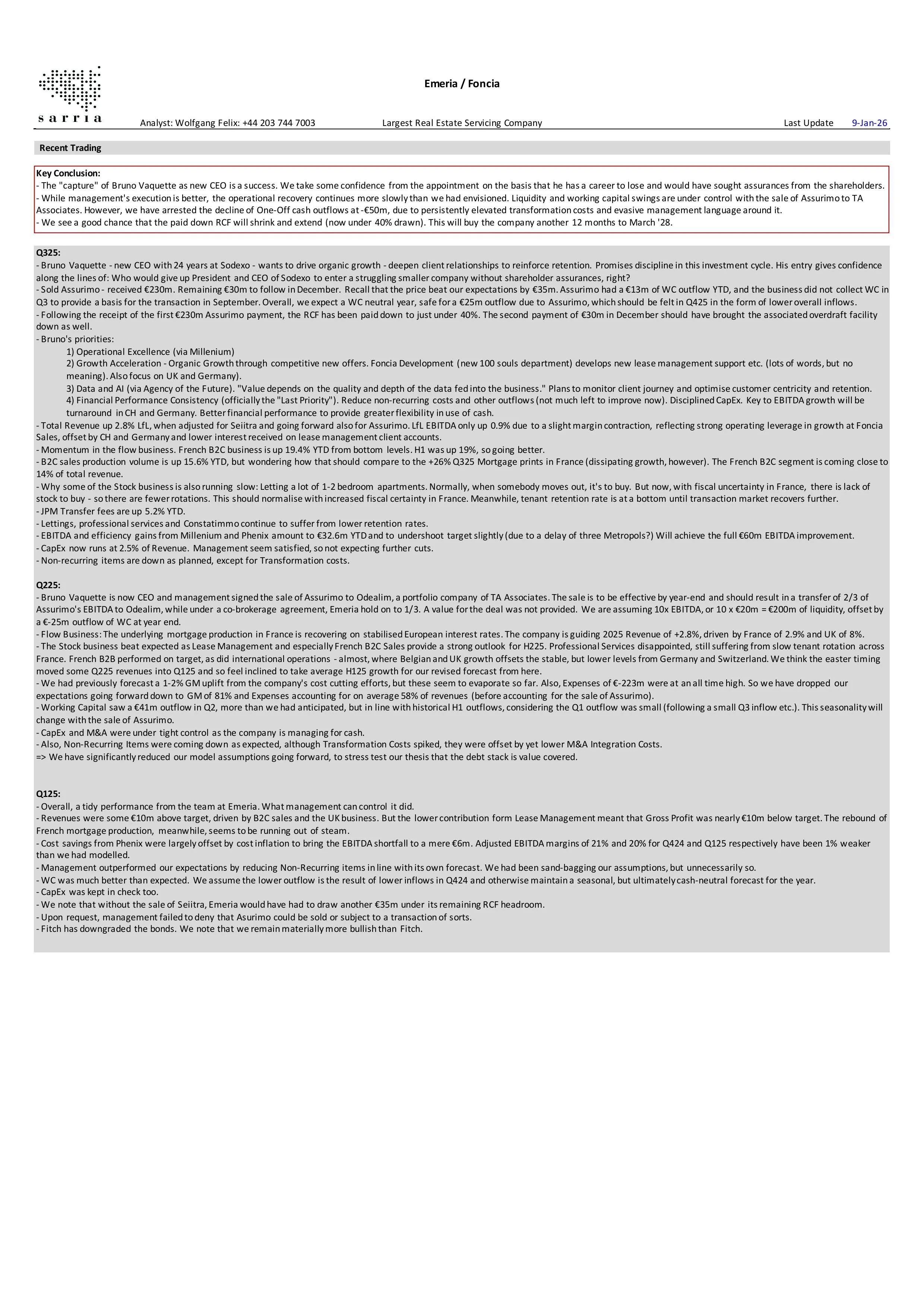

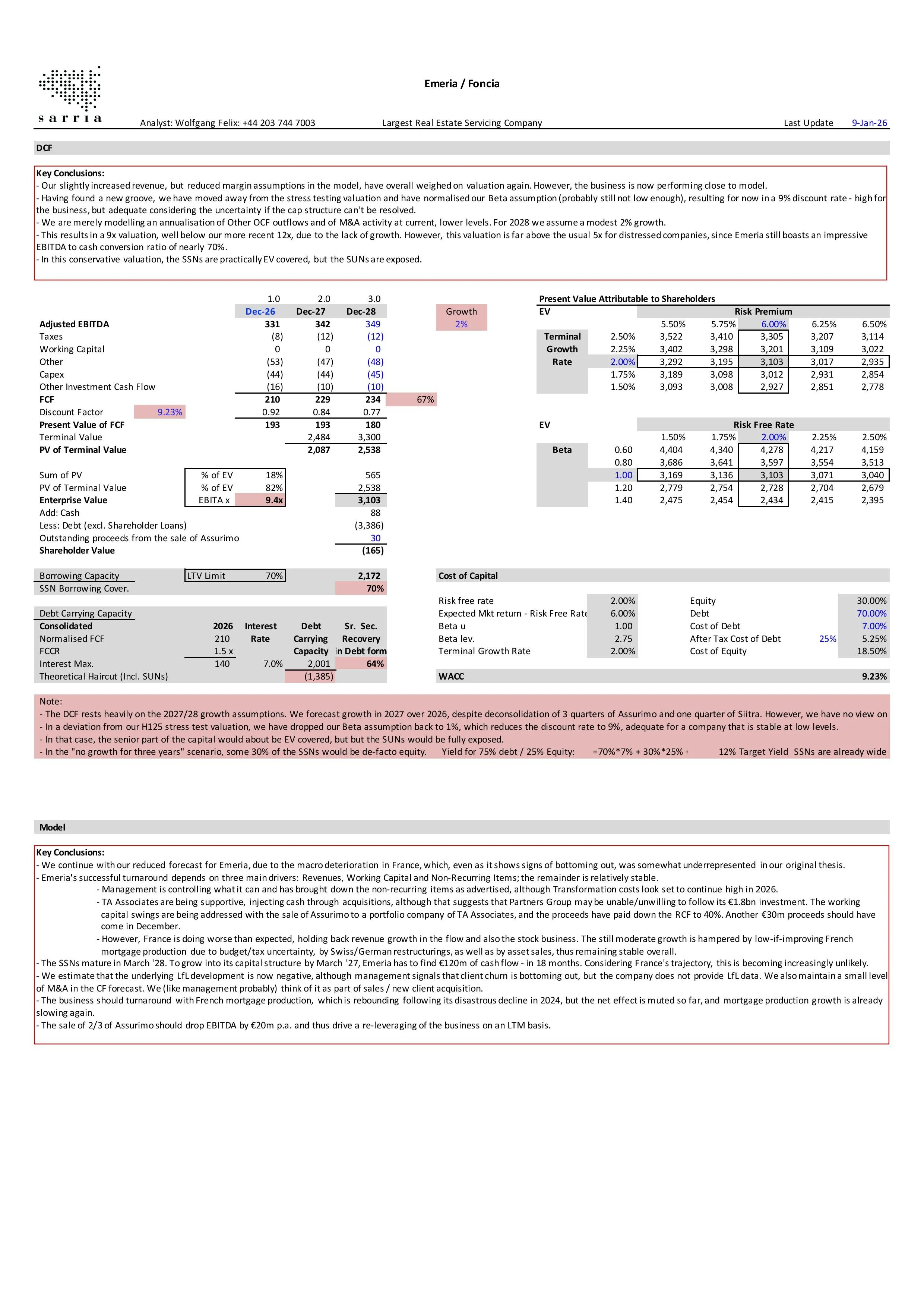

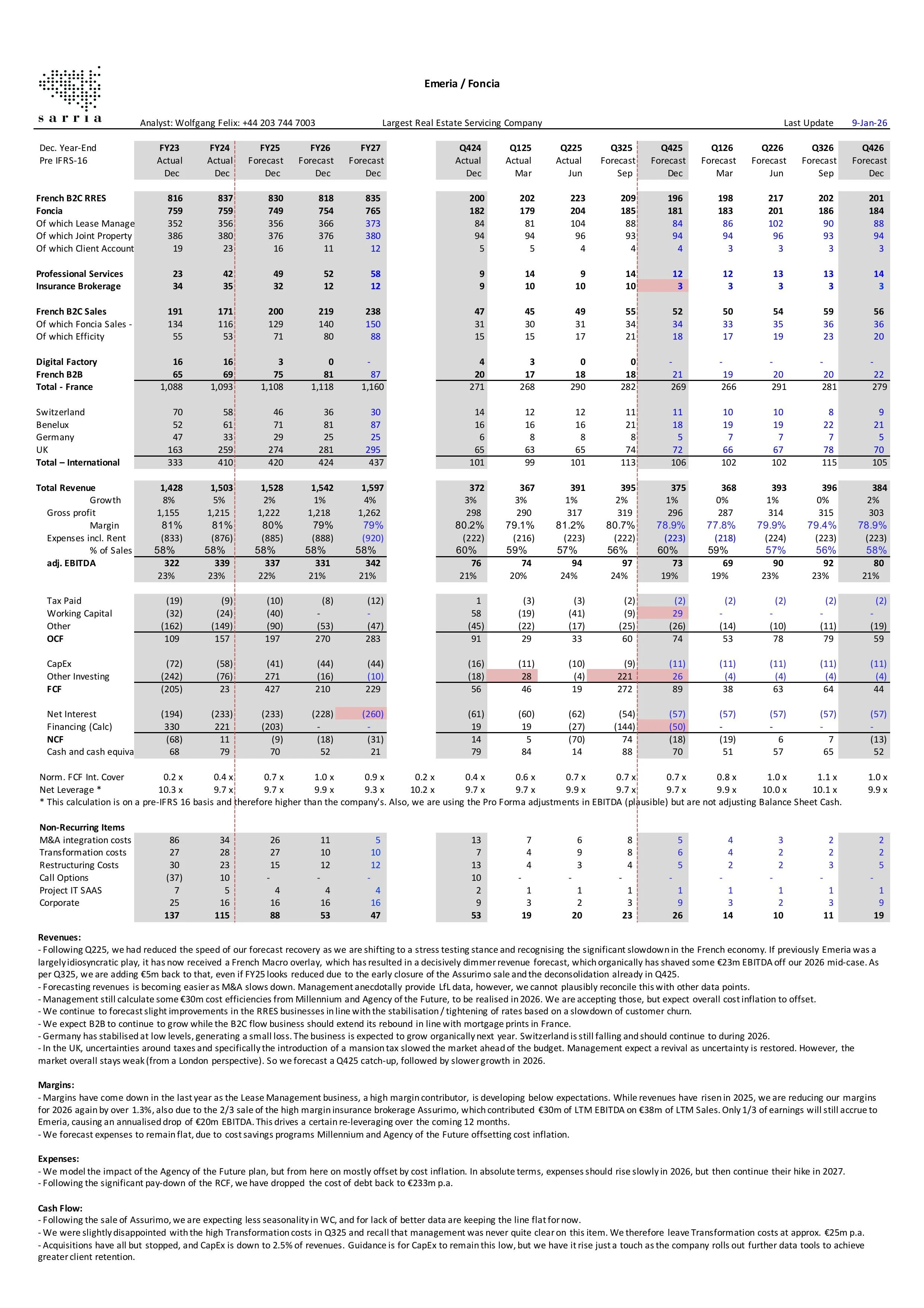

Investment Discussion - 25 Jun 2024

We are glad to have sold last week as the company disclosed the hire of CFO Laurent Carozzi, a change not previously announced to

Please find our updated analysis of Emeria here.

We’ve had several good news from the company recently. The sale of Assurimo should smooth WC swings and, accretive as it was from

Management did not comment on the senior equity rumours, but earlier in the call had already floated the idea of resuming M&A activity, now

Please find our updated analysis on Emeria here.

France’s problems have been weighing on Emeria for several quarters and have gotten worse recently. Lecornu’s resignation on the morning after Macron named his

Incremental news on the Assurimo sale was scant, but within expectations. Overall, the results are fair. We will need to do more work on why Efficity would be

The sale of Assurimo to Odealim, another entity owned by TA Associates, promises to be very good news for bondholders. The deal, which mirrors the

The new Idea Pitch videos are now available: Amara NZero, Emeria, Kem One and Rekeep.

You can find them on the Sarria website landing page as well as on each individual company’s dedicated page.

Fitch has maintained Emeria’s bond ratings at B and CCC for the senior secured and senior unsecured, respectively, but revised

Please find our updated analysis of Emeria here.

It is June, and the end of Q225 is less than a month away. If the WC outflow still represented a problem, we’d have heard of it now. It’s inflows from here. The company’s strong market position in France should allow it to hold on to the Phenix cost savings, and

Q1 results this morning are encouraging. EBITDA came in slightly ahead of expectations and WC was managed much more tightly, to the point where

A downgrade is "not an option” were the words from management on the last call. Moody’s downgrade was on the cards, and apparently,

The call yesterday was as long as they usually are at Emeria, although the company’s policy to issue the financial report only a month later felt a little

Crucially the company has not yet released the Q4 financial statements. Revenues are right on target and cost management has been some €10m worse than

Emeria Pitch video is now live. You can find it on the Sarria website landing page and on the dedicated Emeria page.

Please find our unchanged analysis of Emeria here.

We have been singing the song for some time, but following an initial short in the name were keen not to flip-flop from short to long in one transaction. Emeria is

Please find our updated analysis of Emeria here.

On Emeria's website, Philippe (CEO) and Antoine (CFO) do not look particularly closely shaven. All the more ambitious then seems their pledge to keep

Emeria delivered solid operating performance, but very much underwhelmed with undiminished WC and thus lower liquidity than we had

We are excited to introduce a new feature to more readily deliver to you our top ideas at any time. We are not YouTubers, but we are now recording our ideas in short 2-5 minute videos, which you can find on our website right on top of the landing page.

We are closing out our position in Emeria. Having lost two points and some carry, we are unwinding this position in line with timing originally outlined in our

Across the board, Q2 results were slightly stronger than expected, but not by a long way. We continue to see the company requiring fresh

Please find our initiation of Emeria here.

Sometimes the equity story is better than the credit story and so it is with Emeria. The roll-up strategy makes sense and from a shareholder’s view should