- for speed listening, go to the settings wheel on the bottom right of the video and choose playback speed -

Intro, Cap and Legal Structure-29 Sep 23

Industry Description - 29 Sep 23

Inflation and ERC - 29 Sep 23

Financials - 29 Sep 23

Sum of The Parts - 29 Sep 23

Investment Discussion - 29 Sep 23

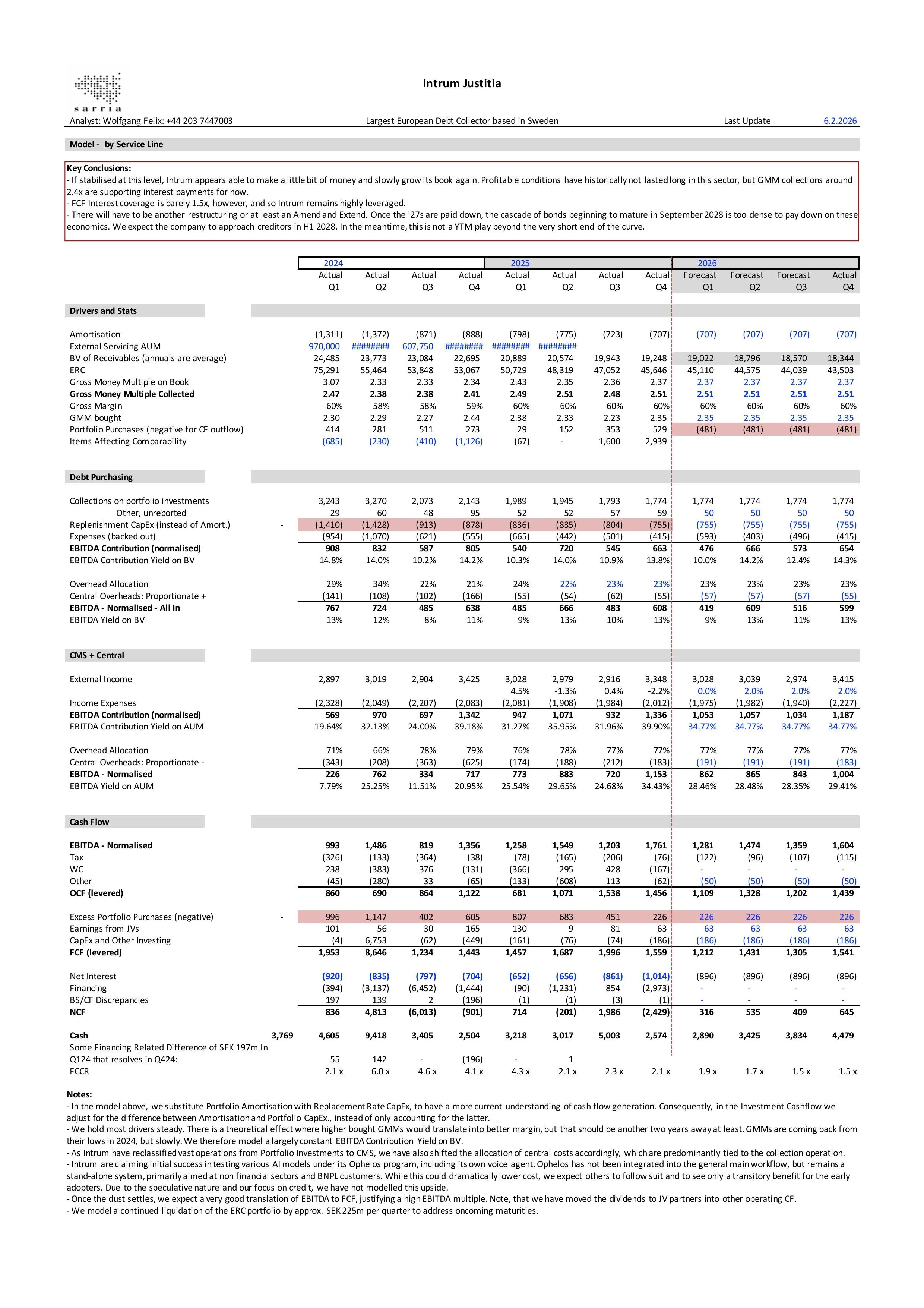

Please find our updated analysis on Intrum here.

Perhaps not enough to simply refinance in 2028, but better. So much better, in fact, that it had us recalculate the entire model to

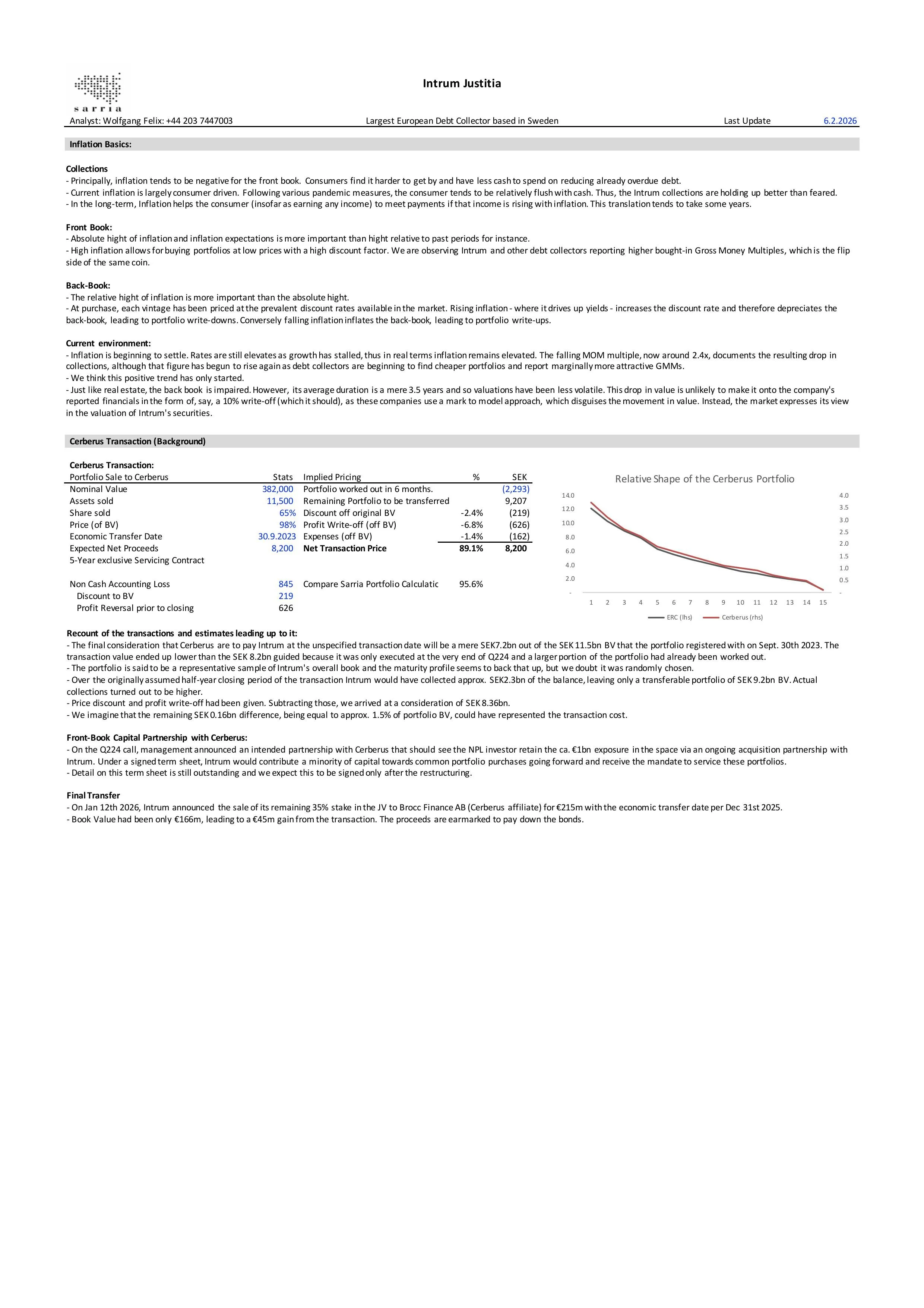

We are taking the short off this morning. Following the news that Cerberus had bought Intrum’s minority stake in the JVs, we had shorted the

The Intrum Idea Pitch video is now available.

You can find them on the Sarria website landing page as well as on each individual company’s dedicated page.

We are shorting the 2027 Euro bonds at 96.75, going into the strategic review that the company is to unveil at the end of the month. Looking across to

The latest tender offer, at an average price of 94c/€ was entirely taken up by the €-denominated ‘27s that now have a

We are reading that Intrum is starting a second tender offer for its bonds this month. This time, the maximum volume is a little

The tender was popular. Intrum had applied a waterfall of priorities between the bonds, prioritising the front end and the

Intrum are buying back €75m of SSNs, not in pro rata amounts between them, but instead with a waterfall of priorities at

Management will include weighing up possible further liability management in the upcoming strategic review. Q3 was soft, with

T’is done. At 94.4c/€, bondholders tendered 10x more bonds (half the outstanding) than the €250m in play and the scaling factor was

The succinct message from your favourite debt collector today is as per our commentary: "Intrum has today been informed that

Intrum have disclosed that Masih Yazdi, formerly CFO of SBB, will be joining to fulfil the same role for the freshly restructured

94.4 c/€ is the price at which Intrum uses its tenders for notes from the stash provided by the New Money Notes that’s currently

Even though fundamentally this is only an incremental update - beyond the admirable cost control, we find few incremental insights - this is a major update financially. Following the conclusion

We’re proud to support our community and collaborate with reporters on the names we cover — always careful to keep key findings exclusive to our clients.

Sarria’s quote is reproduced below as featured in Debtwire’s latest piece: “Intrum delivers strong Servicing EBIT margin as haircut to reduce debt burden”