- for speed listening, go to the settings wheel on the bottom right of the video and choose playback speed - after one minute video becomes high-resolution -

Capital Structure - 2 Sep 25

Fundamentals - 2 Sep 25

Valuation - 2 Sep 25

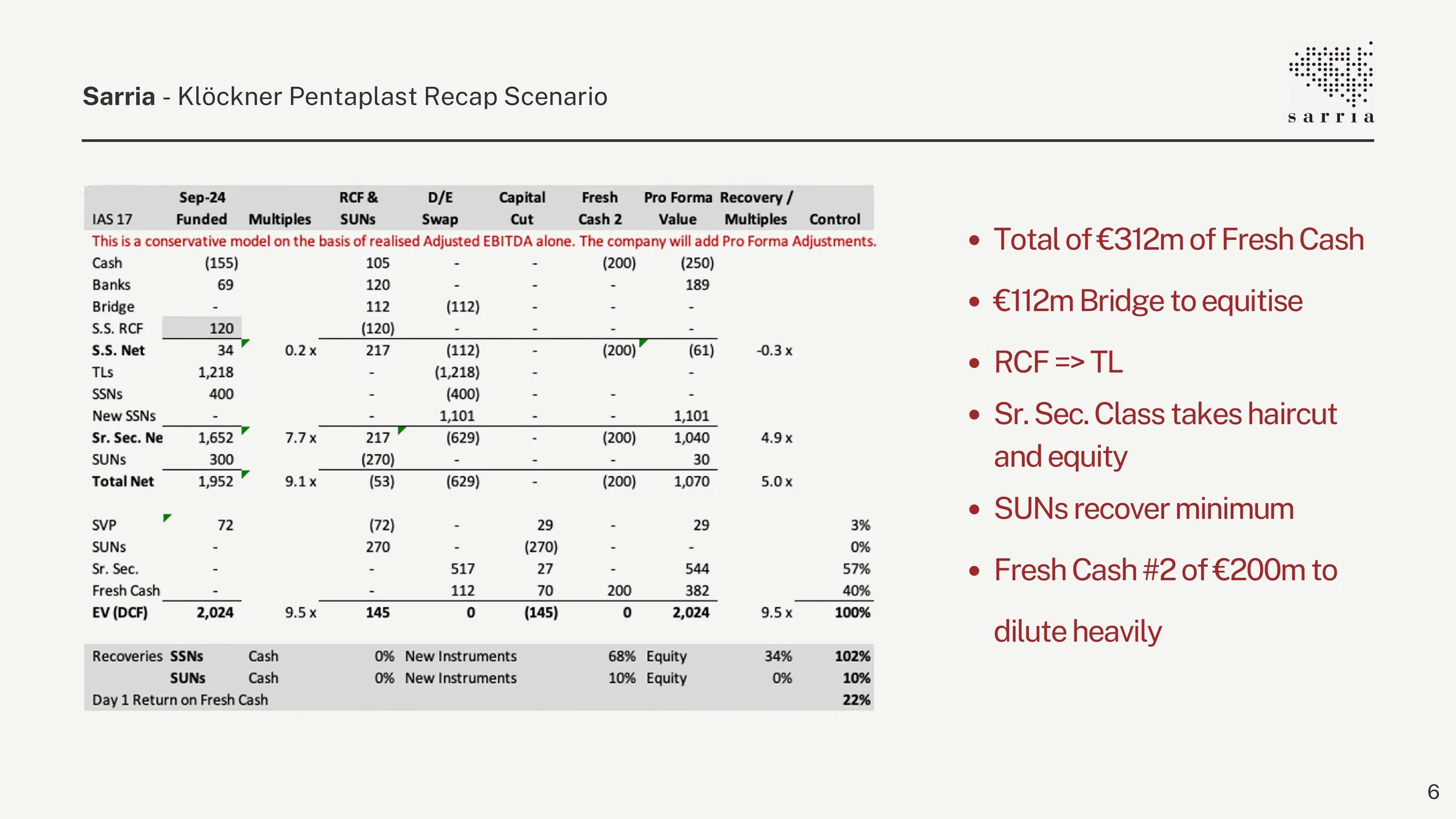

Recap Scenario - 02 Sep 25

Investment Discussion - 2 Sep 25

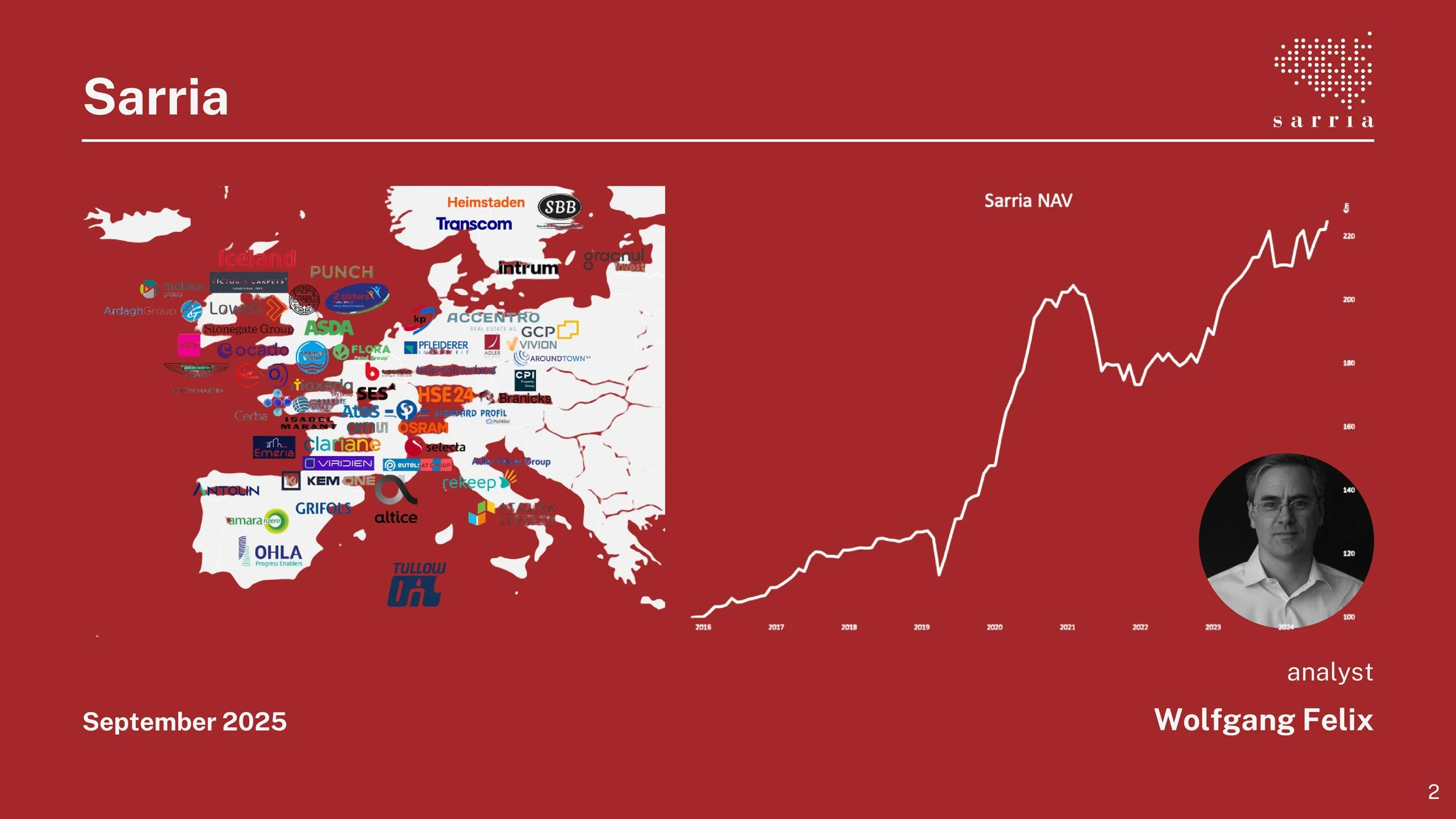

Presentation

Q&A

Initiation

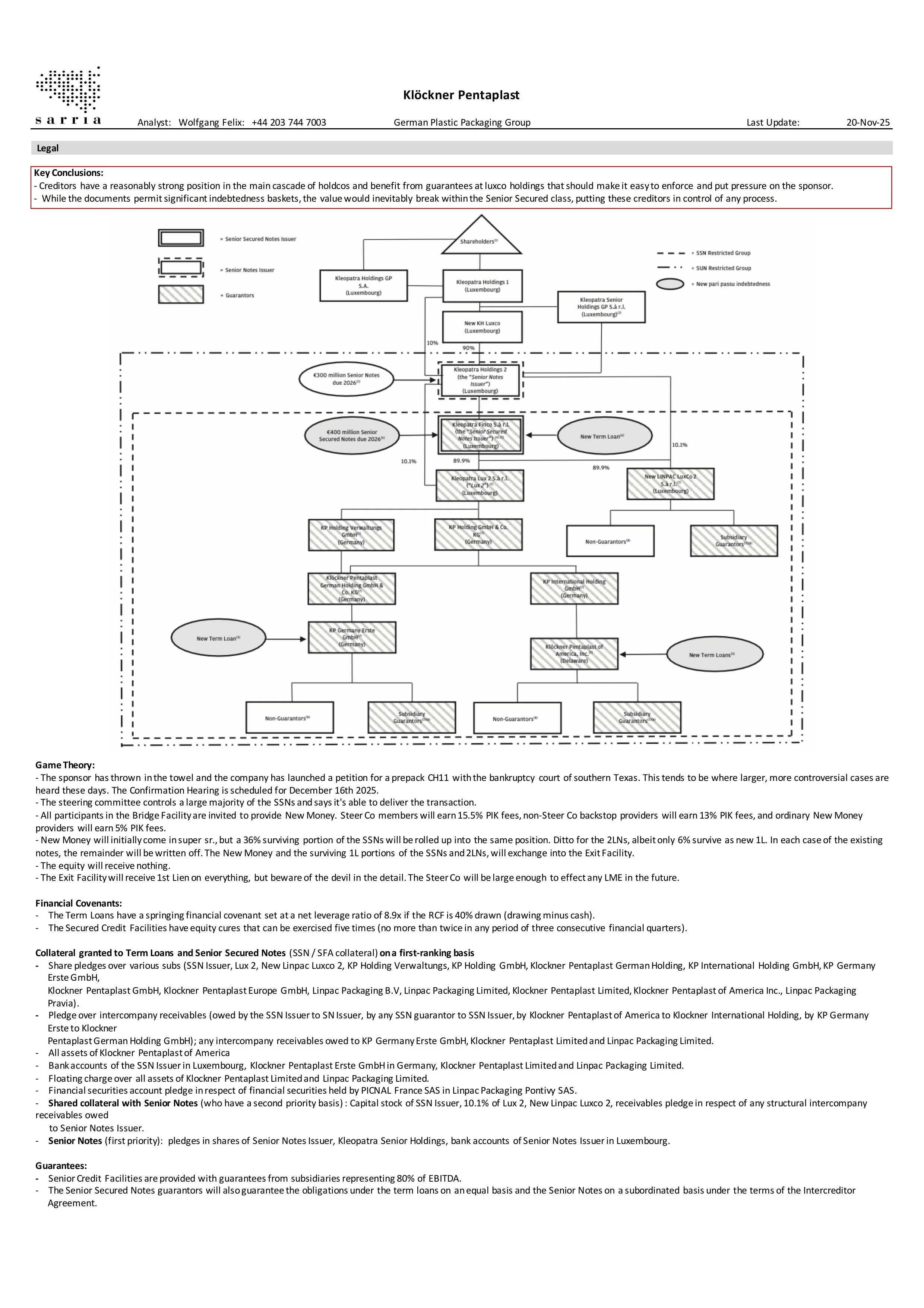

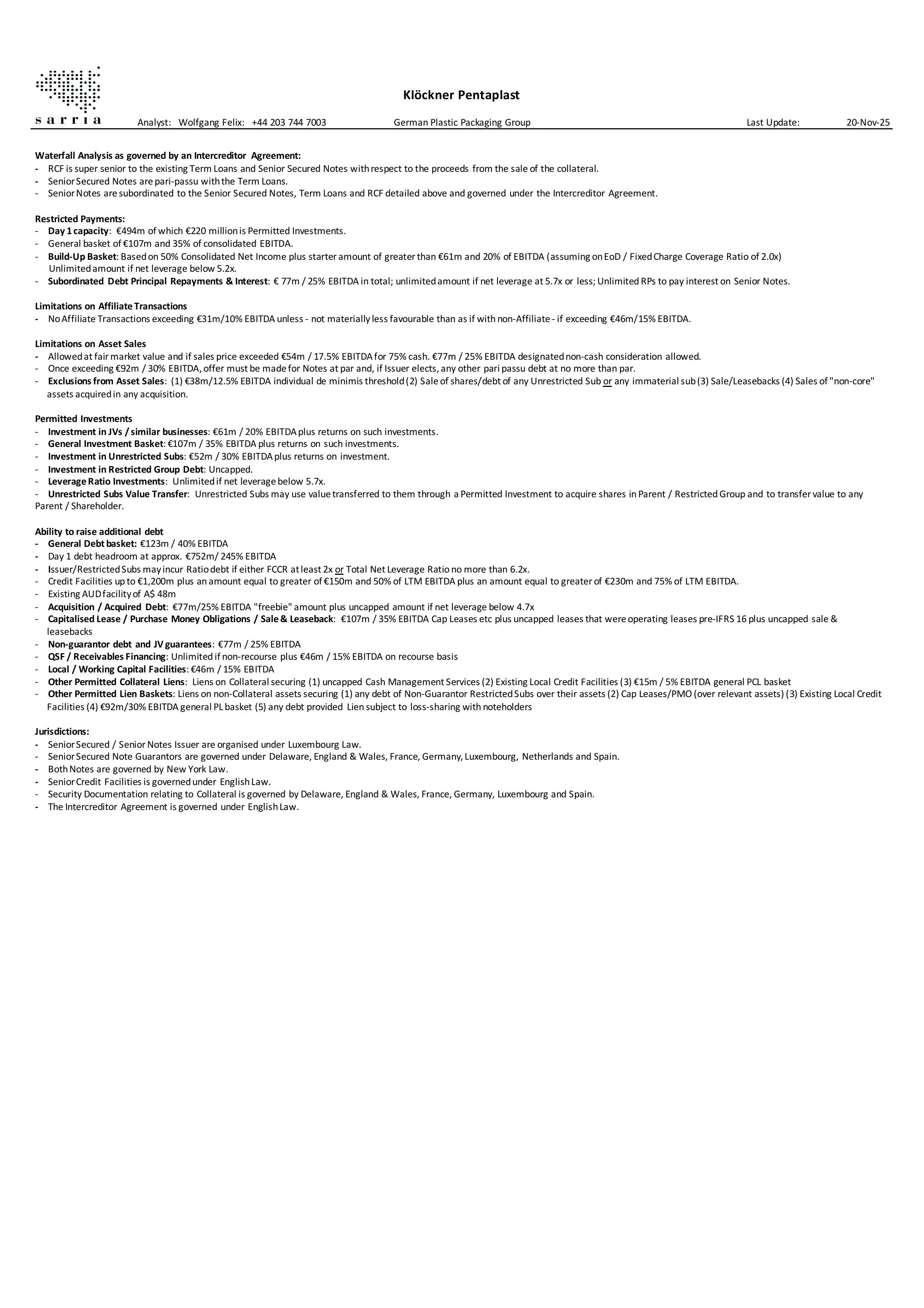

Intro, Legal and Cap Structure - 28 Jan 25

Investment Discussion - 28 Jan25

Company and Industry - 28 Jan 25

LONG Idea

Model and Drivers - 28 Jan 25

Valuation and Recap Scenario-28 Jan 25

The company has held up well enough last year. Q4 financials released in a presentation on Tuesday are right on target, even as we have had to guess our

The company announces its completion of the CH11 restructuring. The restructuring had overall resembled expectations of a

The US Bankruptcy Court of Southern Texas has

Having filed for their Prepack Ch11 yesterday, Klöckner Pentaplast disclosed the full suite of advisors, including

Please find our updated analysis of Klöckner Pentaplast here.

Where there is no smoke, there is no fire, or perhaps where there is no queue, there is no value. In Klöckners case, that means that we can’t

To line up its CH11 prepack, the company has agreed on a restructuring plan involving a bigger write-off than we had modelled only in

As per popular demand, we’ve made the Client Call presentations available as part of our new Client Call layout.

Please find our answers to your questions raised during Tuesday’s Klöckner Pentaplast call on the website.

Please find a light update on Klöckner Pentaplast here.

Negotiations have hit an impasse as we hear that the so-called Pharma division is still not doing well. We read reports of €80m of overdue payables and

In line with our recent decision to sell our position, the packaging name is said to be struggling to convince suppliers to send their goods. Less than

We recently sold our position in the SSNs, whose deal has been elusive since January of this year. The bonds are due in February, less than

We have sold our 2% position in the KP SSNs yesterday for 91.25c/€. It is August, and our January thesis of a satisfactory refinancing of the

€300m make sense mathematically. KP has debt capacity of approx. €1.4bn and €300m is roughly the difference if you

The A&E of the SUNs, now 2LNs, is done. The new €300m paper will mature in September 2029 and have a 2.5% PIK element added to

The company now has support from almost 97% of SUN holders for the A&E, and the transaction is expected to settle tomorrow. The new 2nd Lien notes will receive

As tariffs continue to influence market dynamics, we've taken a comprehensive look across our coverage to highlight the names most likely to be affected. For full transparency, we've also included those that remain unaffected—it's just as important to understand where the impact isn't being felt.

The idea here is

S&P view the reasonably generous offer to the SUNs as a distressed exchange and have lowered their rating to CCC-. We do not foresee

So we were wrong about the popularity of the deal for the SUNs. As of Friday, 87% of SUN holders had signed up to the somewhat coercive deal. We had expected a

Holding out on the Jr. deal looks attractive. The deal is very good, but given SVP have committed to playing nice, why would any pure SUN holder want to

SVP are playing nice. The deal is simple enough - and a lot simpler than we thought. Exchanging into 2L bonds is clearly coercive, but even a

Thank you for the participants yesterday on the Live Discussion. Please reach out to Wolfgang, wfelix@sarria.co.uk, if you have further questions .

Please find an updated analysis of Kloeckner Pentaplast here.

Sometimes your model surprises you. Perhaps that’s what modelling is for, but in the case of Kloeckner Pentaplast, our recap scenario certainly surprises us

Please find our updated analysis post the Q3 2024 results on Klockner Pentaplast here.

KP delivered a disappointing Q3 2024 earnings report with a reduction in guidance for EBITDA and free cash flow driven by continued pharma de-stocking

We have decided to sell our 2% position in the senior secured notes at 96.5 giving us a nice profit of ten points in five months as we feel the upside is limited given the

As part of the wall crossing process in their current refinancing discussions, the German plastic packaging group through its advisers have asked new investors (which are

As the primary markets open up to “story” credits, the SVP owned German plastic packaging group appears to be pre-marketing a €2 billion debt refinancing which

Please see our updated analysis and model post the Q2 2024 results on Klockner Pentaplast here.

KP delivered a mixed Q2 2024 earnings report with good performance in the PHD segment which compensated for weakness in the FP segment

Over 50% of the EUR TLB lenders have signed a cooperation agreement along with the majority of the USD TLB lenders. As a reminder, this is considered a

The company underperformed our Q2 2024 revenues by EUR 28 million (by nearly 6%) due to lower pharma volumes, rigid films and reduction in raw material and

KP released preliminary trading results in which the Company have guided to higher Adj. EBITDA for Q2 and to the higher end of