- for speed listening, go to the settings wheel on the bottom right of the video and choose playback speed - after one minute video becomes high-resolution.

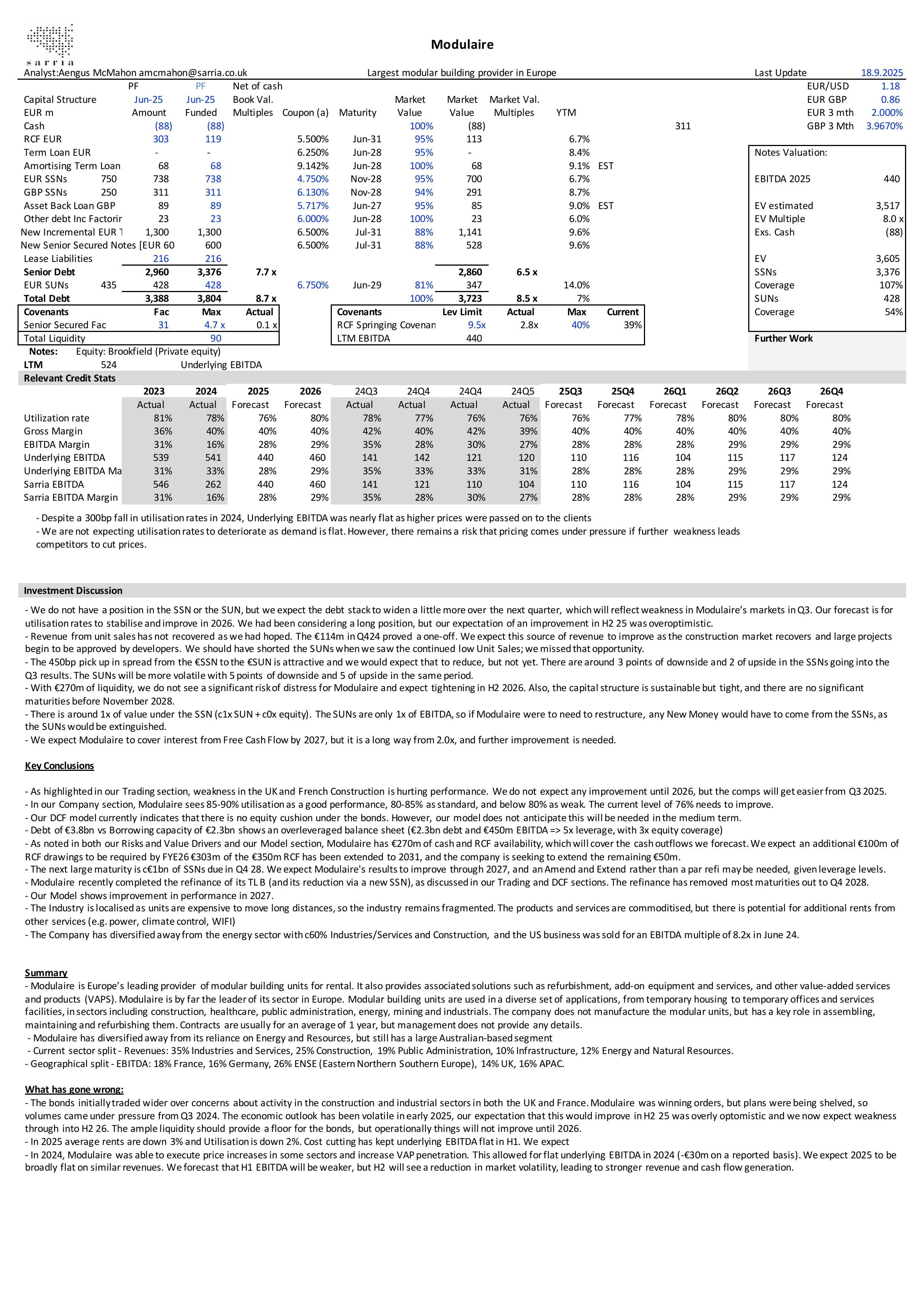

Intro, Capital and Legal Structure - 8 May 25

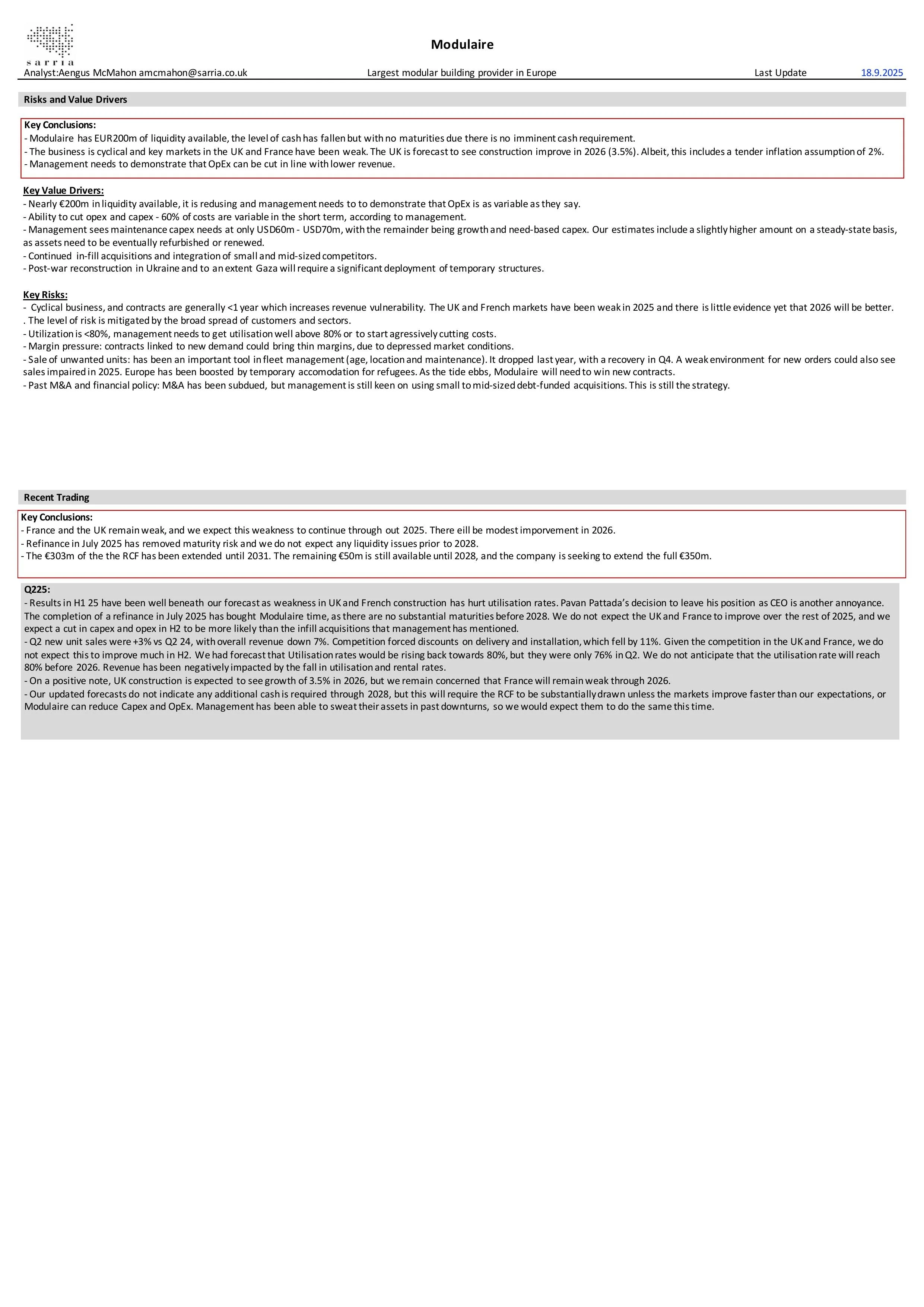

Description of the Industry and the Company - 8 May 25

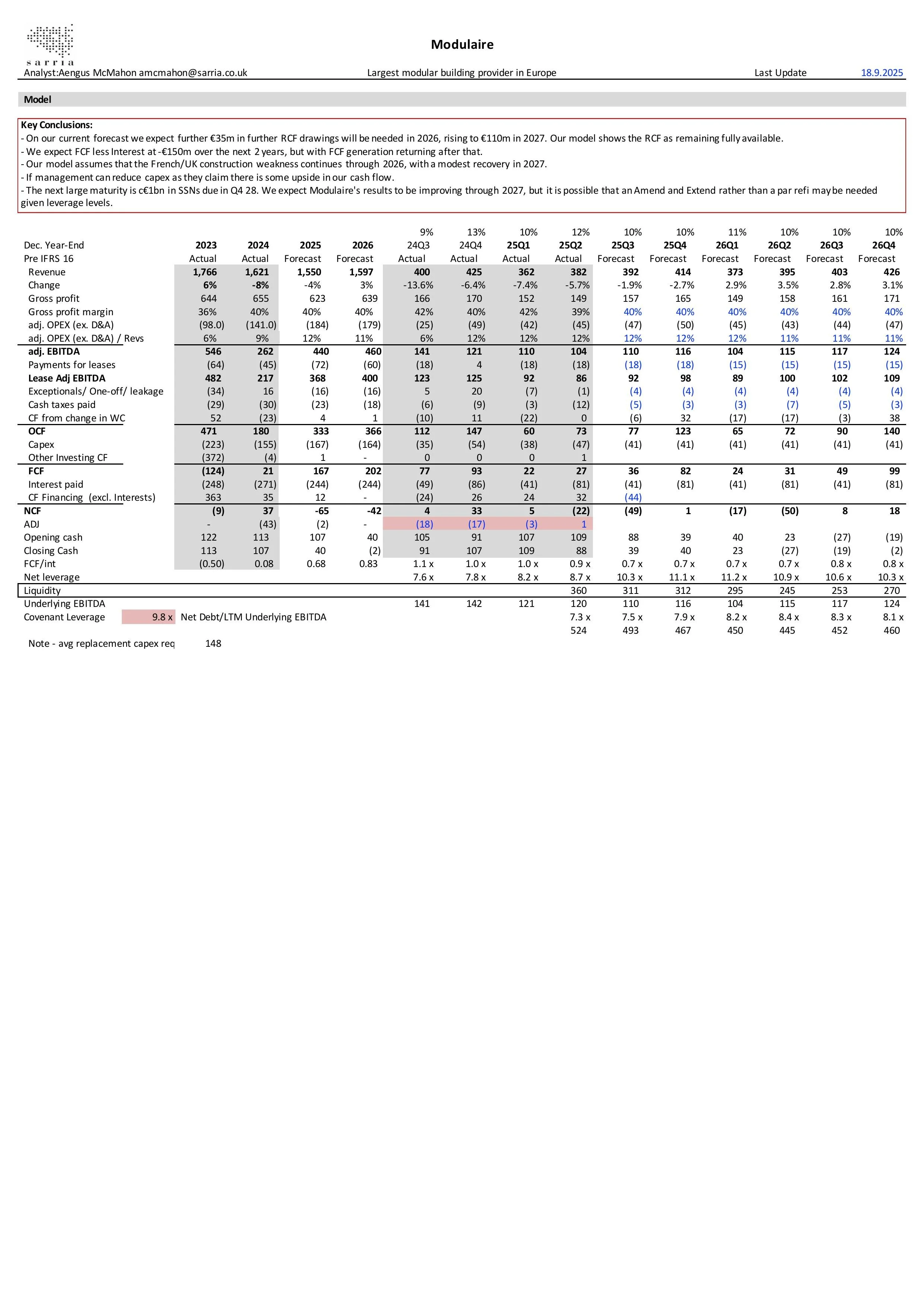

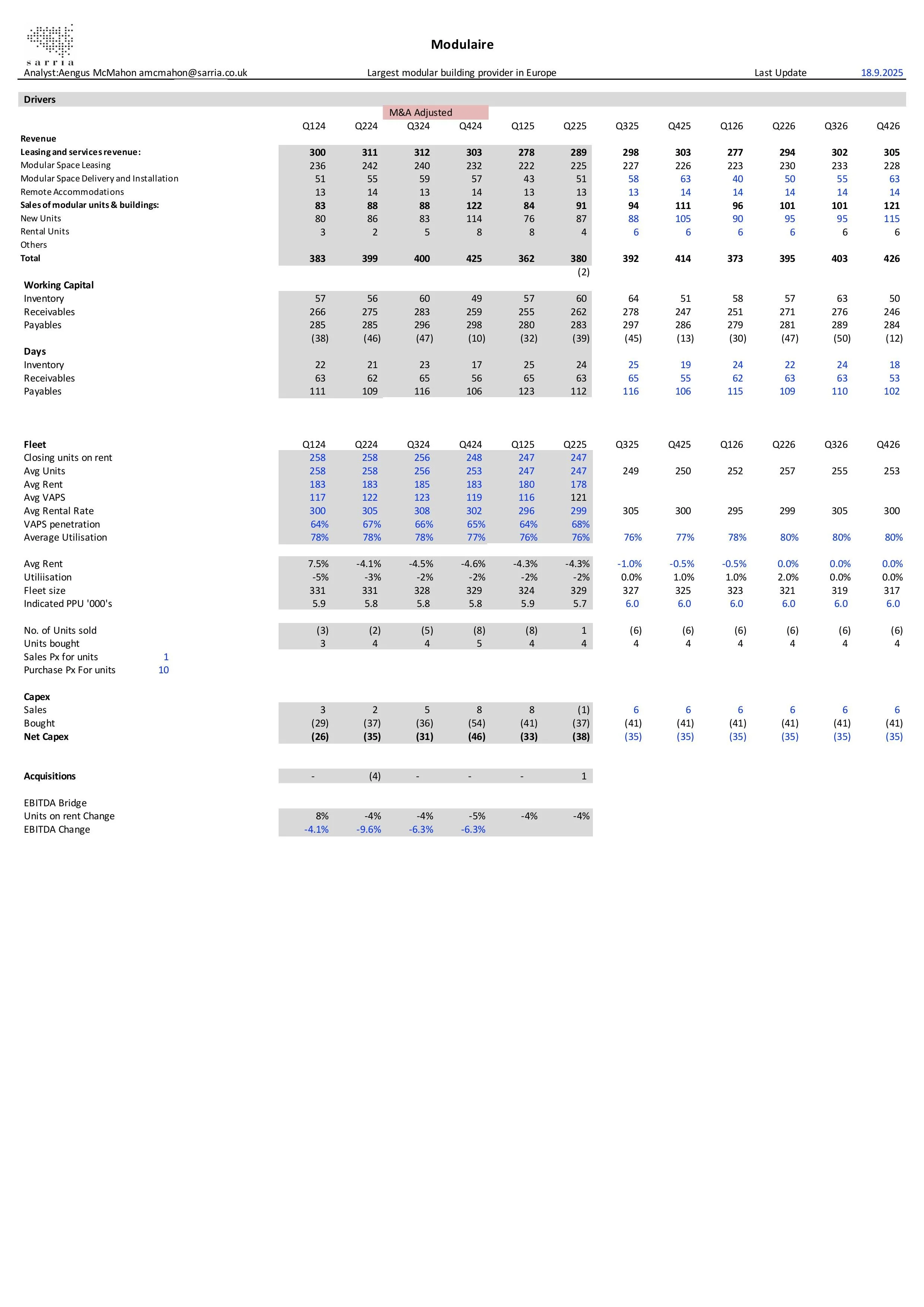

Model and Drivers - 8 May 25

Investment Discussion - 8 May 25

Q4 25 Underlying EBITDA of €133m is about at the market consensus, and we expect cash EBITDA to be above the

Things aren’t getting worse at Modulaire, but management acknowledges that the UK and French divisions are unlikely to see much improvement before

Please find our updated analysis here.

Operational performance at Modulaire has been poor since Q3 2024, and although the comparisons will be easier in H2 2025, we do not expect any

Q2 results fell below our expectations due to continued weakness in the UK and French construction markets. Although the Q2 results were poor, they

A successful refinancing operation, with the new TLB and SSN both being upsized and priced within the initial price talk. The TLB was

Modulaire's new €1bn TLB pushes bank maturities out to June 2031 from June 2028. The cost of the new TLB is similar at 7% (margin is 25bp higher

The results were below our estimates, but an improving gross margin and stable unit sales will keep the bonds from widening as

Modulaire Live Discussion is now available on Modulaire’s page, here.

Please find our new analysis, here.

Modulaire protected cash flow by cutting capex, and with assets that can last 25 years or more, it is a trick that they repeat whilst they wait for

Please find our unchanged analysis here.

After months of speculation and a review the fate of the Modulaire Group has now been decided with TDR selling it to Brookfield for US$5bn. This represents

Please refer to our unchanged analysis here.

While VAPS continue to drive strong LfL growth and the IPO remains in discussion, we are now urgently looking to

With a potential exit or refinancing event increasingly likely in the near term, we retain

Please refer to our unchanged analysis here.

The company’s confirmation it is exploring a potential IPO confirms our underlying thesis that following the

Please refer to our updated analysis here.

We have upgraded our model to reflect a better bottom-up granularity of revenues and improved working capital estimates. We have also

Please refer to our unchanged analysis here.

Modulaire’s results were significantly better than our projections. Q3 20 revenues came at EUR335m (+6.5% yoy before M&A impact), above our EUR287m estimate. The outperformance is both