Transcom - Proposal

All,

Please find our existing analysis on Transcom here.

Transcom has announced a consent solicitation and exchange offer for all of its Senior Secured Notes. In summary, the Company is proposing a 15% cash paydown, with the remaining balance subject to a 3-year maturity extension. The coupon steps up over time, beginning with a 250bps increase, of which 175bps may be paid in PIK.

Our View

- The proposal broadly aligns with our initial expectations, but several areas raise concern. The cash component is higher than we anticipated and without an amendment to the RCF, post-transaction liquidity appears very tight. We had assumed the sponsor might provide incremental liquidity to support an amend-and-extend proposal.

- The coupon is higher than expected, with the FCCR projected to fall to 1.0x under the increased interest burden.

- The structure allows the Company to pursue a full refinancing prior to 2026, given the absence of call protection before December 2026.

- Our understanding is that several major bondholders have been engaged in discussions with Transcom and Altor regarding the refinancing and extension. However, the announcement does not indicate any pre-agreement with the informal bondholder group.

The Proposal

- The current notes total €380m, pay Euribor + 525bps (cash), and mature in December 2026. Under the proposal, 15% would be repaid in cash (plus a 50bps consent fee). The remaining 85% would be extended to 31 January 2030, creating approximately €323m of new notes.

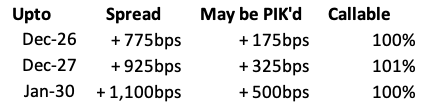

- The new notes would carry the following coupon and call schedule:

- The transaction will require a drawdown of the RCF, with cash on balance sheet at only €39m. The cash paydown of €57m, plus associated fees, implies at least €20m of RCF usage.

- This assumes the RCF lenders have already amended and extended the facility, because under the current terms, only €30m of the €75m facility is drawable, with approximately €12m allocated to letters of credit and guarantees. (Only 40% is drawable when leverage exceeds 4.0x.)

- We have contacted the Company to clarify the status of the RCF and will update once confirmed.

Happy to discuss,

Tomás

E: wfelix@sarria.co.uk

T: +44 203 744 7003

www.sarria.co.uk