- for speed listening, go to the settings wheel on the bottom right of the video and choose playback speed -

after a few seconds, the video quality improves.

Intro Capital and Legal Structure - 27 Sep 24

Industry - 27 Sep 24

Company and Shareholder 27 Sep 24

Financials and Model 27 Sep 24

Investment Discussion - 27 Sep 24

Headline leverage metrics show an apparent reduction, but this improvement was driven almost entirely by the €50m sponsor equity injection rather than

With 86% of the bonds already committed to the amend and extend proposal, it is unsurprising that, following the early

Altor has provided a larger equity injection than we anticipated, with the €50m contribution funding the 15% cash element under the

Please find our existing analysis on Transcom here.

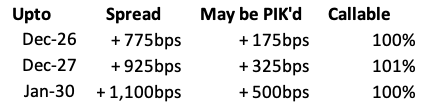

Transcom has announced a consent solicitation and exchange offer for all of its Senior Secured Notes. In summary, the Company is proposing a

Please find our updated model and analysis post Q3 numbers here.

Q3 results were marginally better than expected, supported by effective cost control that contributed to higher margins. Revenues were

Although revenue came in slightly below expectations, Transcom delivered a modest outperformance at the EBITDA level, driven primarily by

Cecilia Bergendahl was appointed interim Chief Financial Officer in August 2025. Yesterday, Transcom announced that she will

We are hearing that the largest bondholder is in discussions with Transcom regarding an Amend and Extend to address its

Please find our updated analysis on Transcom here, following the Q2 results.

The poor Q2 results have resulted in our exiting the name. Although we hadn’t expected a traditional full refinancing, we were expecting an uptick in performance from

Revenue from e-commerce and tech were disappointing as the company reported Consolidated net revenues some €10m below our forecast, impacted by

Please find our updated analysis post Q1 results, here.

We have focused our attention on the options available to the Company, the sponsors, Altor and bondholders regarding the refinancing of its

With less than two years to maturity, Transcom bonds still languish in the mid-70s. Today's Q1 results will do nothing to change that. The path to

There is never a good time to lose senior management but with the industry in flux and a refinancing required for its Dec 2026 bonds, now is

Q4 and FY24 numbers were broadly in line with our and market expectations. EBITDA margins are showing modest signs of improvement, but doubts remain over

The Swedish BPO operator got downgraded by Moody’s to Caa1 from B3 and its probability of default rating to Caa1-PD from B3-PD. Moody’s also

Please find our model post the release of the Q3 2024 results on Transcom here.

There is a slow & steady progress on the turnaround. While Transcom is suffering from lower customer volumes (in eComm & Tech) which

Please find our initiation note on Transcom, here.

Transcom is suffering from lower customer volumes (in eComm & Tech) which started in Q2 2023 and continues at the present, the