Tullow - Postponement of Pain - Model Update

All,

Please find our updated analysis on Tullow here.

The Tullow Oil situation has changed significantly over the past few years, yet we once again find ourselves concentrating on the same fundamental issue, production, as we have repeatedly done in the past. Tullow Oil is due to release a trading update towards the end of November, and this note outlines the current position and the limited options available to the Company. We remain sceptical that the Company will achieve its $1.1bn net debt target at year-end, which would place further pressure on the bonds.

Investment Considerations

- We are not taking a position in the Senior Secured Notes at current levels. It has been reported that major bondholders are in private discussions with the Company regarding a potential comprehensive refinancing transaction. Against this backdrop, it is challenging to make any definitive investment decision.

- Our initial view is that a refinancing is not viable. In the absence of a consensual restructuring, we expect the bonds to trade lower. However, in theory, there appears to be sufficient asset coverage to support the bond debt.

- We find it difficult to reconcile Tullow’s forecast of $1.1bn net debt as at December 2025. This estimate excludes potential tax liabilities from ongoing arbitration cases and decommissioning obligations. Even allowing for these adjustments, we believe the Company’s net debt is likely to be around $200m higher.

- On recent calls, the Company has indicated it is in discussions with private capital providers to assist with the refinancing. While such a solution may be possible, we suspect that delisting may be required for new investors to participate in potential equity upside. A straightforward debt refinancing appears unlikely.

- Although the theoretical upside is par, we view this as unrealistic. Our base case remains an Amend and Extend transaction, given the limited prospects for new capital entering the structure and the Company’s reliance on a single producing asset. We had previously speculated that Tullow might have pursued the sale of its Ghana assets before the appointment of the new CEO; however, the September appointment likely reduces the probability of a short-term exit strategy.

- The downside risk could easily exceed 20 points. An adverse ruling in the tax arbitration would raise serious questions regarding directors’ responsibilities and potential trading while insolvent. Tullow’s own NPV estimate of its producing assets stands at approximately $1.5bn, compared with the Company’s optimistic projection of $1.1bn net debt at year-end. It should be noted that decommissioning liabilities of around $300m, along with lease and tax litigation liabilities, are excluded from the net debt calculation.

The Way Forward:

- Tullow has exited all assets with potential equity upside, effectively transforming the Company into what resembles a managed wind-down. With the bonds maturing in May 2026, management now has very limited options. In the absence of a sale of the Ghana assets, Tullow will likely need to seek an extension of maturities from bondholders.

- Bondholders also face limited alternatives. In theory, they could compel Glencore either to withdraw its support or to inject additional capital to enable repayment at par. Glencore might consider contributing a portion of capital for a partial repayment in exchange for an elevation of its claim.

- These discussions are complicated by the imminent outcome of arbitration cases, which may significantly affect the Company’s financial position and negotiating leverage.

- Another potential option is the sale of contingent payments associated with previously disposed assets, estimated at around $150m. Any proceeds would be directed towards partial repayment of the Senior Secured bonds at par. However, even with this sale, and potentially that of Tullow’s working interest in the Espoir field, the proceeds would only modestly reduce the approximately $1.3bn bond balance.

- Ultimately, the way forward is a debt-for-equity swap. This will likely be delayed by a bond extension, but there is no doubt that Tullow Senior Secured Bondholders are taking equity risk here, and their recovery is subject to further asset sales. An extension allows Bondholders and the Company to postpone any restructuring. The recovery for bondholders will be determined by the success or failure of the next phase of drilling, the ultimate equity risk.

What is Tullow now?

- Tullow Oil is now effectively a single-asset company. It has disposed of several producing assets in recent years to reduce leverage. Approximately 95% of its production comes from its fields in Ghana, with around 80% derived from the TEN and Jubilee oil fields. A further 10–14% of production guidance is gas from the Ghana fields, while the remainder is attributable to the Company’s working interest in the Espoir field in Côte d’Ivoire.

- Tullow also retains contingent payments linked to prior divestments, including asset sales in Kenya, Gabon, and Uganda. We estimate the total potential value of these contingent proceeds at approximately $150m.

- Kenyan Asset Sale: $40m was received in September 2025, with a further $40m expected by June 2025. Additional contingent payments under Tranche C total $40m (payable in FY28 over five years), alongside a buy-back-in clause and royalty payments.

- Ugandan Asset Sale: Payments are linked to oil price and production levels and may range between $5m and $47m per annum based on an oil price of $70–100/bbl.

- Gabon Asset Sale: A smaller contingent payment is due, subject to first oil from adjacent discoveries and an oil price above $55/bbl. The total consideration is $24m, payable over five years.

Production Issues:

- Tullow’s principal challenge has always been production risk. While oil price movements clearly influence cash flow, the fundamental issue remains the Company’s production levels.

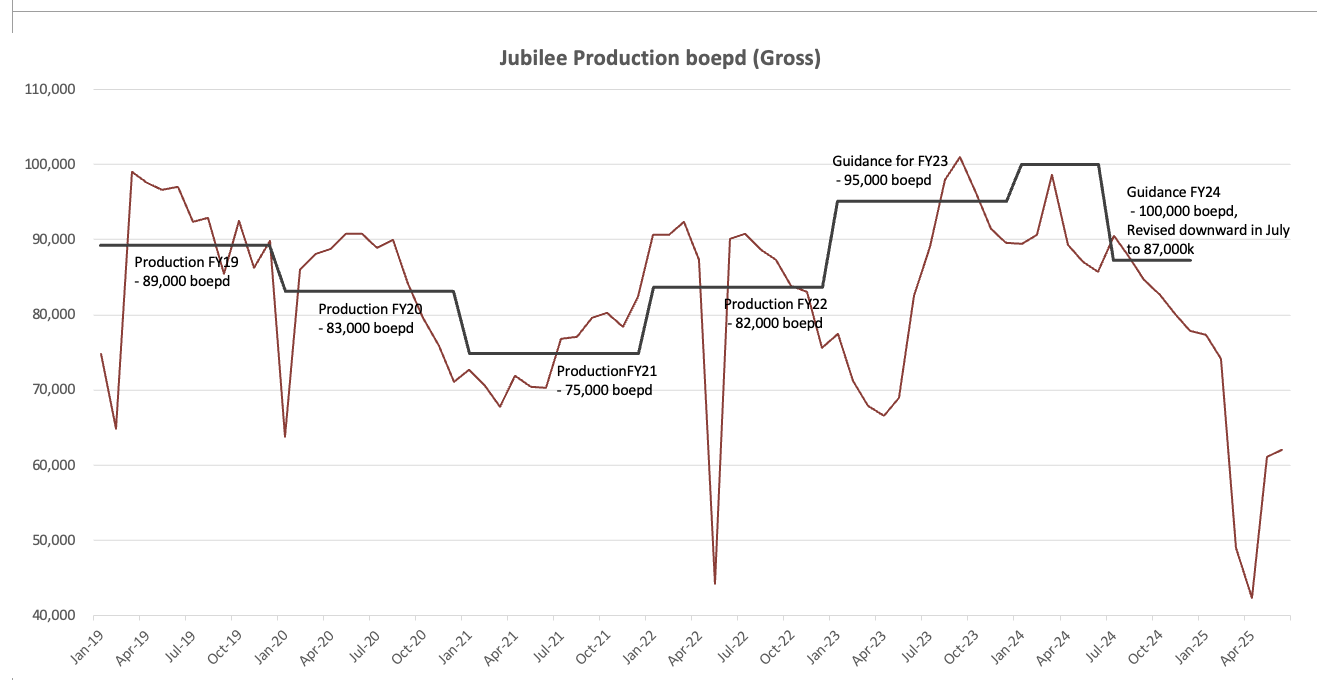

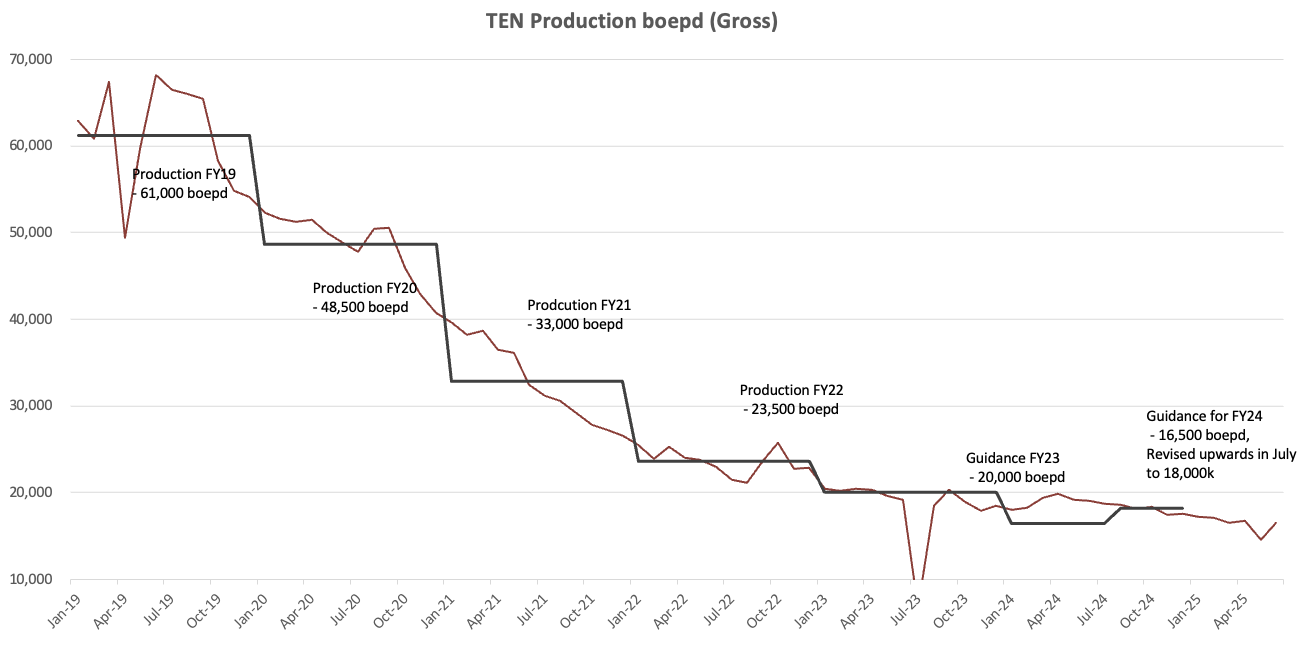

- A glance at the trend in Jubilee and TEN field production over recent years illustrates the difficulties Tullow faces in Ghana. Although certain issues can be explained by operational or technical factors, the underlying problem remains a lack of drilling activity and declining reserves.

Jubilee:

- Historically, Jubilee has been the stronger of Tullow’s two main fields, resulting in significantly greater allocation of resources and capital expenditure. During 2024, Tullow completed its drilling programme, bringing three producer wells and two water injector wells online. The programme concluded six months ahead of schedule, with no recordable safety incidents and total cost savings of $88m compared with the original budget.

- However, gross production was lower than planned due to issues with one producer well (J69), a lack of pressure communication from water injection, poor injection performance, and increased water cut in certain wells. Tullow expects stable water injection performance, supported by production optimisation activities, which should help slow the rate of decline observed in the second half of 2024.

- These improvements have not yet materialised in the first-half results. Part of the decline in H1 2025 was attributable to a planned maintenance shutdown. Nonetheless, the Jubilee field continues to experience higher-than-expected water cut in some wells, leading to reduced output. Although there was an overrun in the maintenance schedule for the water injection system, monthly production figures remain weak.

- Drilling operations are set to recommence in the fourth quarter, following a period of rig maintenance, with the new Jubilee producer well (J73-P) expected to come on stream by year-end. A further four Jubilee wells are planned for 2026.

- Processing of the 4D seismic data, acquired in the first quarter, is ongoing and expected to be shared with the market at the FY25 results. This will inform well placement for the next phase of drilling. Additionally, Tullow plans to enhance its data set with an Ocean Bottom Node (OBN) seismic survey in the fourth quarter of 2025, which will underpin infill drilling across both Jubilee and TEN.

TEN:

- The TEN field has historically been the underperforming asset, caught in a cycle of underinvestment leading to weak performance, which in turn has reinforced the lack of investment.

- The fundamental issue lies in the relatively poorer reserve quality at TEN compared with Jubilee. This has long been recognised; at the Capital Markets Day in November 2020, payback and IRR estimates for TEN were already lower than for Jubilee. The limited drilling activity since then has significantly reduced gross production levels.

- In FY22, Tullow drilled four wells at TEN, two in the Enyenra area, which were successfully brought online, and two in the Ntomme area, which did not encounter economically recoverable reserves. In FY21, one gas injector was drilled at TEN.

- To Tullow’s credit, gross production in FY24 exceeded expectations. Although output continues to decline, the rate of decline is being managed effectively, with both Enyenra and Ntomme wells responding well to ongoing injection and production interventions.

- Nevertheless, TEN remains a secondary consideration for further capital expenditure. The Company continues to explore operational efficiencies, cost-saving initiatives, and potential infill drilling options.

- Production at TEN during H1 2025 also marginally exceeded guidance. This was supported by reopening a previously shut-in production interval at Enyenra and additional water injection activity. The replacement of the FPSO flare tip in May 2025 is expected to reduce flaring by approximately 50% from July 2025 onwards.

Happy to discuss.

Tomás

E: tmannion@sarria.co.uk

T: +44 20 3744 7009

www.sarria.co.uk