- for speed listening, go to the settings wheel on the bottom right of the video and choose playback speed - video quality will improve to HD after 1minute.

Introduction - 30 Jan 25

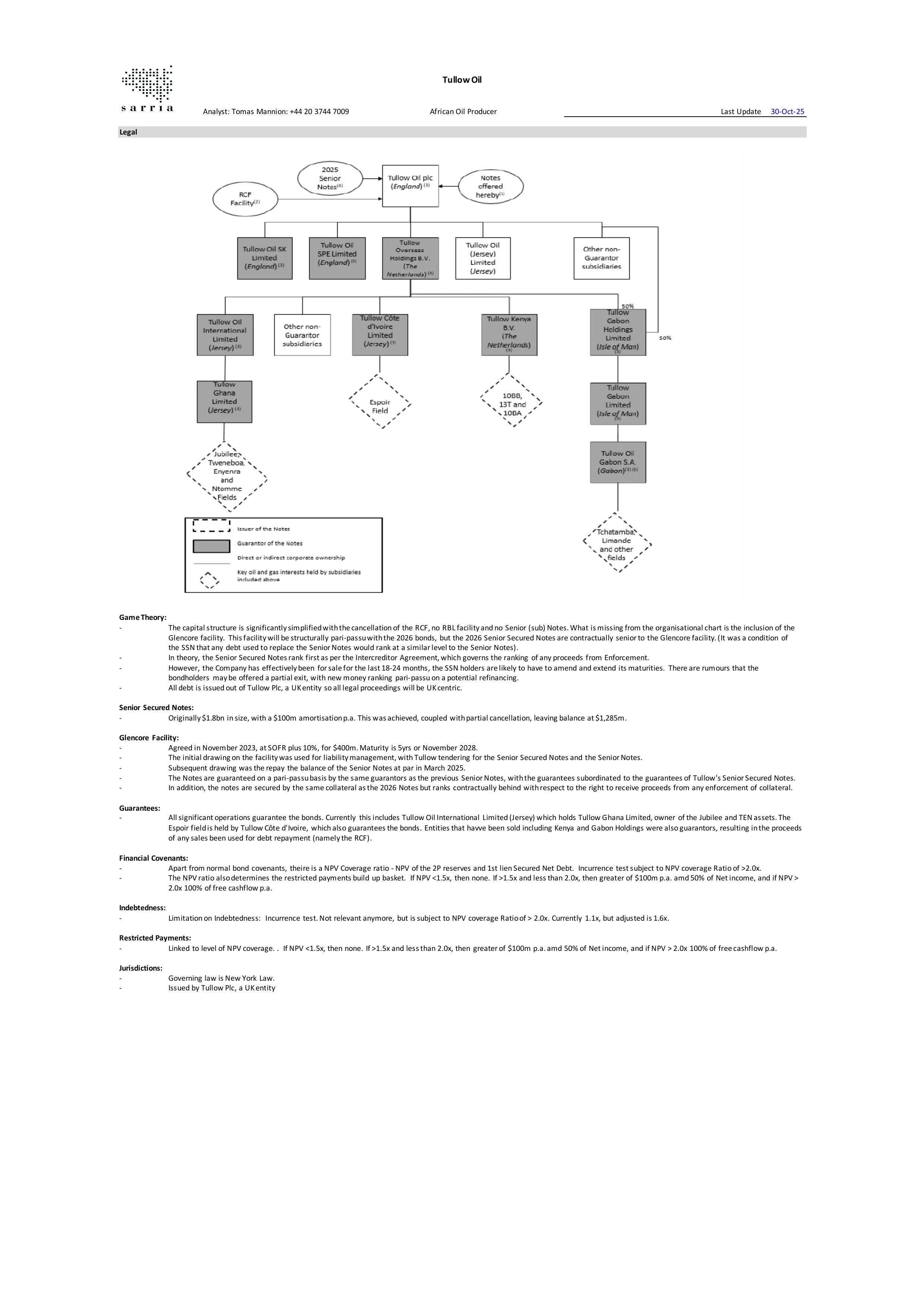

Legal and Capital Structure - 30 Jan 25

Ghana Production - 30 Jan 25

Valuation | Sum of the Parts - 30 Jan 25

Investment Discussions - 30 Jan 25

Please find our previous Tullow Oil analysis here. We will update our assumptions and models when the Company release its full-year numbers.

Tullow Oil made multiple announcements this morning (Friday 20th), but in substance, little has changed. While the proposed Amend and Extend transaction provides the Company with an additional 30 months of runway, this period is clearly intended to facilitate a sale of the business, which now appears to be the sole viable exit route.

In early September, we noted that the Company was unlikely to appoint a new CEO, arguing that the CFO and Chairman were adequately positioned to oversee a sale process. The subsequent appointment of Mr Perks briefly raised market expectations that the company was pursuing alternative strategic outcomes. However, it has now become apparent to all stakeholders that this is fundamentally a liquidation-led equity story.

With options exhausted, the proposed A&E represents the Company’s only viable path. 66% of bondholders, alongside Glencore, have agreed to

There are several headlines concerning the ongoing court case between Tullow and Vallourec, but in reality, the litigation remains at

Tullow has experienced a significant departure of its independent non-executive directors, with the Chairman and three other directors stepping down with

Tullow’s endgame may be approaching, or perhaps not. As we stated previously, a delisting, debt for equity and/or Amend and Extend are the only

Although Tullow does not publish quarterly results, its Ghanaian partner, Kosmos, does, providing a useful read-across. The implications for

Please find our updated analysis on Tullow here.

The Tullow Oil situation has changed significantly over the past few years, yet we once again find ourselves concentrating on the same fundamental issue, production, as we

Tullow appointed Ian Perks as its new CEO. Mr Perks worked for BG Group and Total, but since January 2021, he has been working as a

Tullow remains without a clear strategic direction, with the first half results offering little additional clarity. Jubilee production came

Last man standing, and not as planned. The Senior Secured Notes, issued with a springing maturity and other protections, now find themselves the

Tullow has taken another step in completing the sale of its Kenyan assets, signing the sale and purchase agreement with Auron Energy, an affiliate of

In acknowledgement that Tullow will not be able to make it on its own, management has been attempting to initiate merger talks with

The Ghanaian Government (Ghana National Petroleum Company) have signed a Memorandum of Understanding to extend oil

Tullow issued a trading update before hosting its AGM later this morning. With no drilling in Q1, which included a 2-week planned

The exit of Tullow from its Kenyan operations is confirmation that the equity story is dead. Tullow Oil have agreed heads of terms for 100% of its interests in Kenya for $120m, $40m of which is payable on completion and an additional $40m by June 2026 at