- for speed listening, go to the settings wheel on the bottom right of the video and choose playback speed - video quality will improve to HD after 1minute.

Intro, Capital, Legal Structure 25/01/23

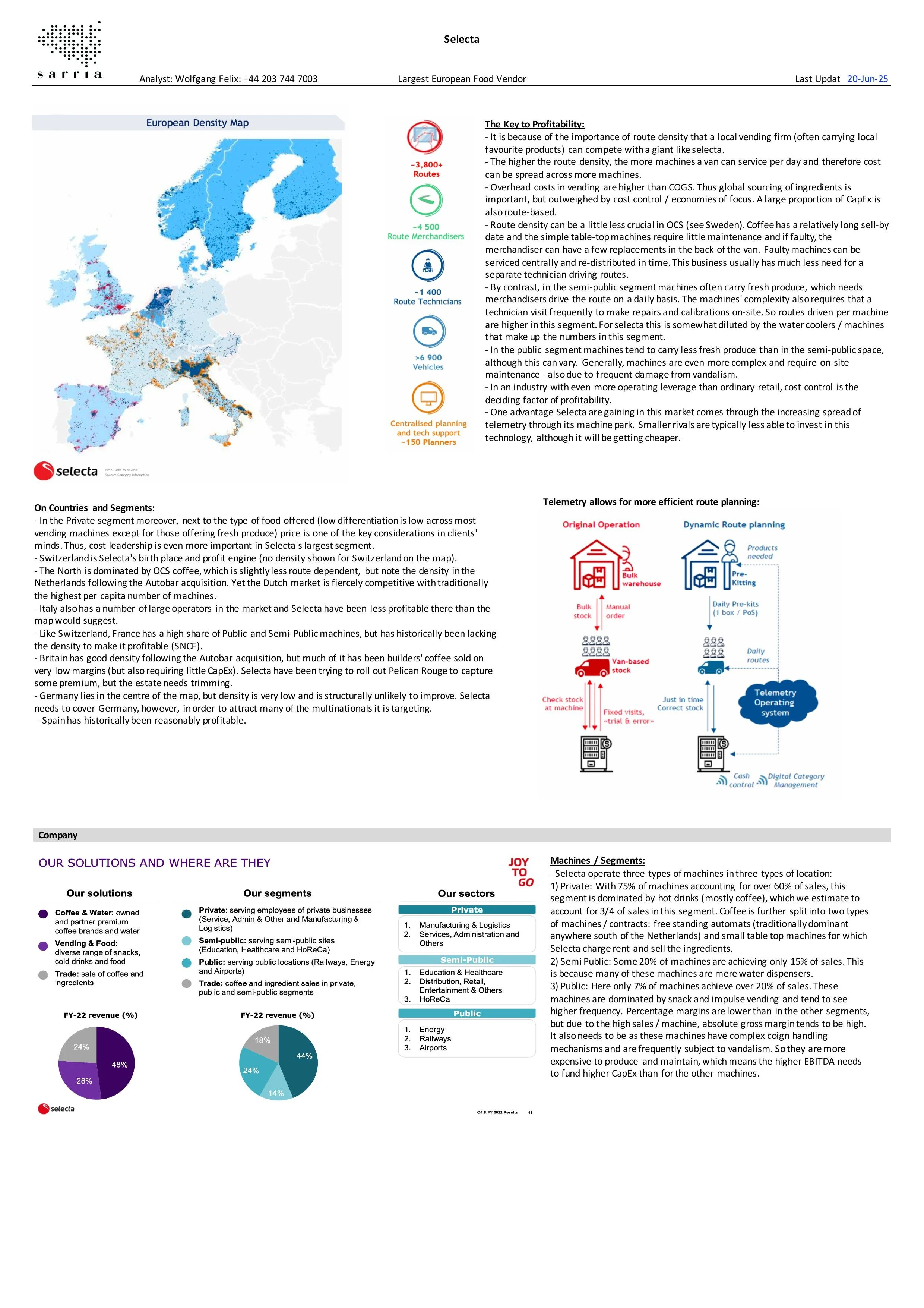

Industry 25/01/23

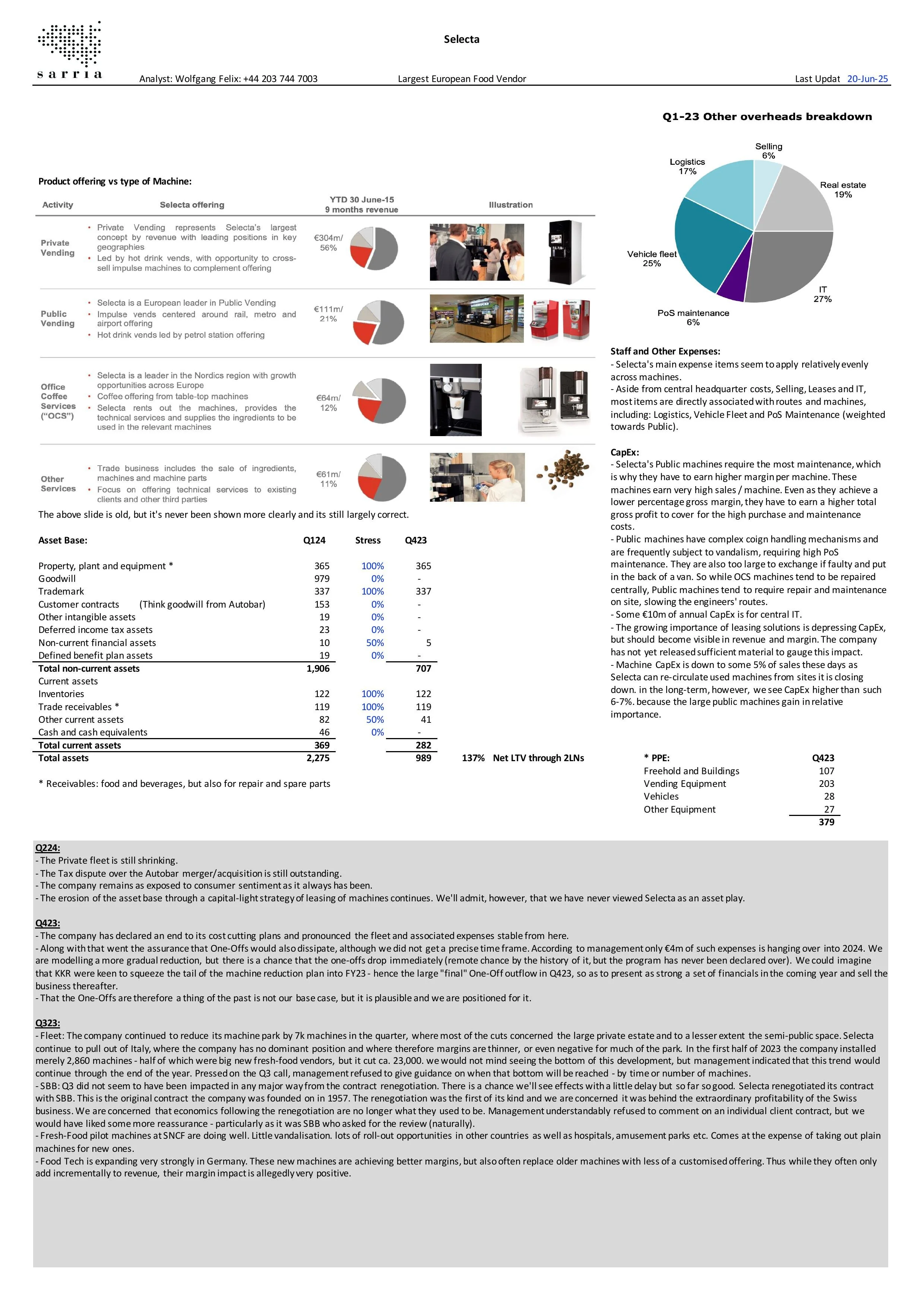

Company 25/01/23

CashFlow Forecast 25/01/23

Investment Discussion 25/01/23

Not that there was ever a doubt around last week's consent request, but we note that 97.98% is a higher consent level

According to the documentation, the 1Os should be paying a mix of PIK and Cash when above €600m. However, the situation on

The replacement of Nicole Charrière was expected, although we like that she will be staying on to transfer affairs in order. What we very much welcome, however

We are not sure exactly what today’s announcement meant to convey, but the 2) paper is fully subscribed now. Of all remaining

Please find our updated analysis of Selecta here.

In light of the spectacular collapse of Selecta revenues in H224, it is naturally with great scepticism that we view unsubstantiated growth

Selecta are moving fast with the implementation. The Exchange Offer Memo is out (for holders only). The offer is set to expire in

First thoughts this morning are that we are paying a lot for an equity layer that is structured as a mere option. Liquidity seems adequate, the

So we missed the subtitles the other day. The restructuring is agreed. As far as we interpret the cryptic note, substantially all bonds will equitise via

Yesterday’s consent request to slightly lift the facilities basket back to its original size of €200m, is modest and will be agreed. The required threshold is

The company won’t be releasing results while in restructuring conversations with its stakeholders. It’s value vs. debt carrying capacity for

The 1Ls are creating Selecta now at a mere 40% of what it was worth only a year ago. We are not suggesting that was the right valuation then

Ratings at this stage are secondary, but interestingly, and perhaps rightly, S&P do not care about grace period extensions. The SSNs have now been

We understand the company has not paid coupon this month. We have been expecting negotiations to

Please find our updated model here.

Selecta has always been good for disappointment. To be fair, we tried to overlook the warning signs that intensified in Q2, concentrating on that

Selecta yesterday reported dreadful results. The thesis that the Olympics and football would drive revenues as the Germany Worldcup did back in 2006 did not play out in an