LONG/SHORT Idea

- for speed listening, go to the settings wheel on the bottom right of the video and choose playback speed - after one minute video becomes high-resolution.

Intro, Capital and Legal Structure - 20 Mar 24

Industry, Economics - 20 Mar 24

Business & Transformation - 20 Mar 24

Refi Dynamics - 20 Mar 24

Investment Discussion - 20 Mar 24

The family appears to be shifting a gear with the generational succession of Ernesto Antolín Calzada by his daughter Emma Antolin. He will remain in

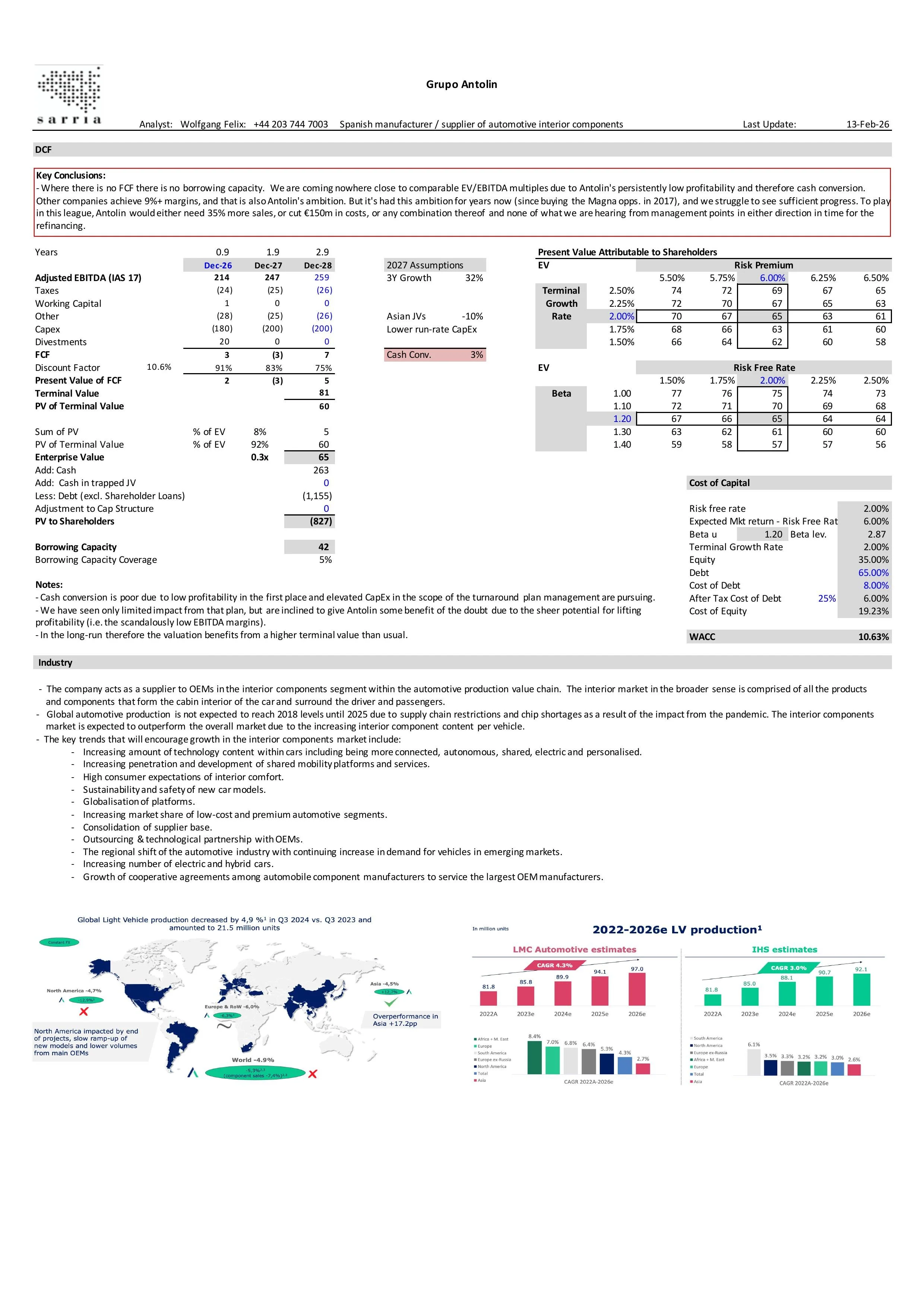

Please find our updated analysis on Antolin here.

As it looks unlikely that the bonds can be refinanced in the market by late 2027, Antolin is building a liquidity war chest, which should

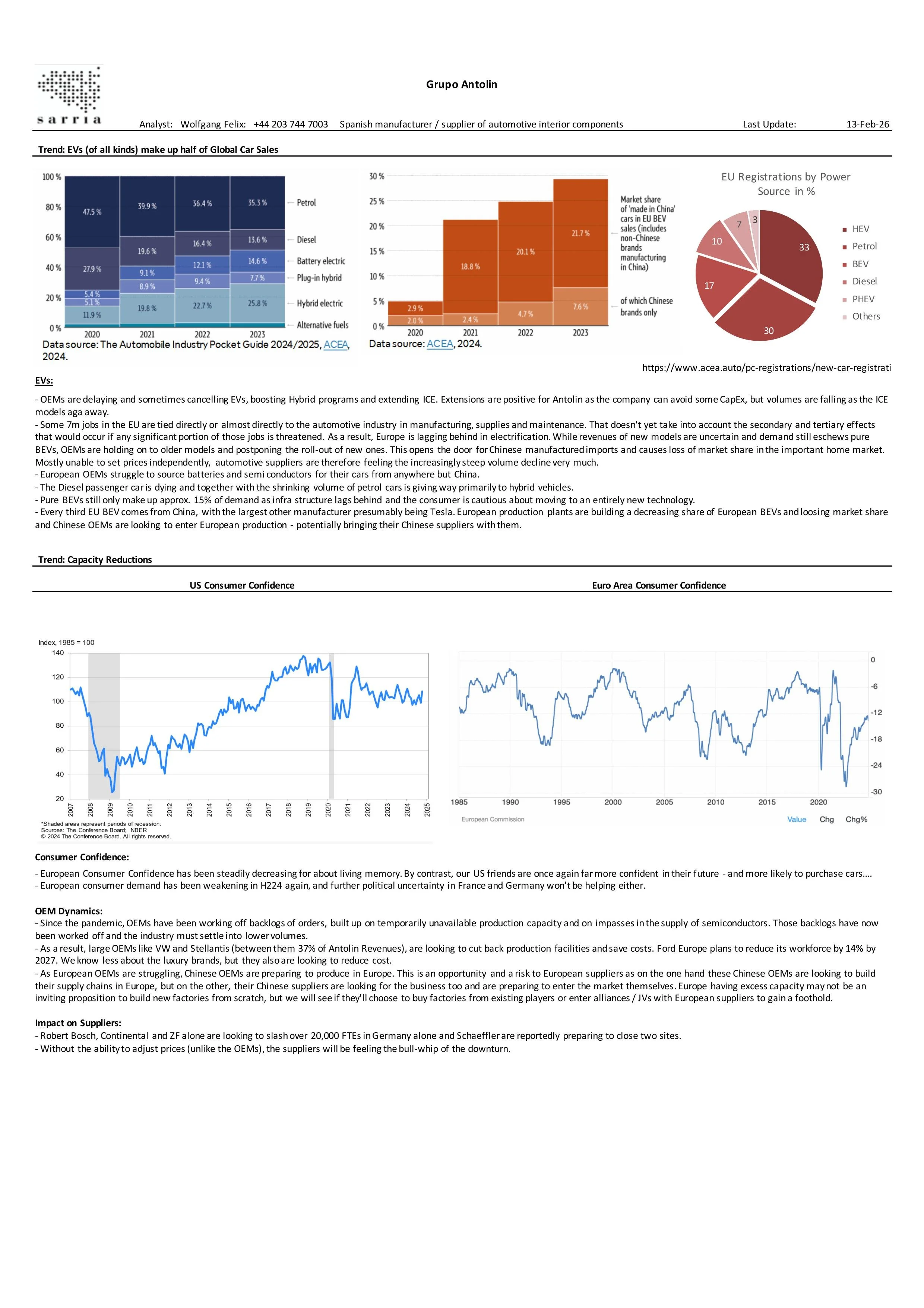

The EU is reportedly considering proposals to ease the planned 2035 ban on combustion engines. The objective is to support European OEMs and

Both bonds are up this morning by approx. 5 points on the sale of the €110m revenue Indian business for a respectable €159m to

Following yesterday’s call, we are maintaining our positioning in the name. Upon several requests from the audience, management indicated again that the

We had dropped our forecast only slightly following the poor Q2 results, in order to test our thesis with a more constructive outlook (we are

The company is playing for time. Following the publication of a Spanish press article in the summer, conversation surrounding Antolin seems to

Antolin Idea Pitch video is now live. You can find it on the Sarria website landing page and on the dedicated Antolin page.

Please find our updated model on Antolin here.

The hunt may be on for underperforming European auto suppliers, and Antolin is a well-known case, but this name seems to have taken a turn for the worse in

We were discussing with some of you that the bonds would drop a little this morning - mostly because there is a continued search for underperforming automotive suppliers on the back of weak volumes in Q2 - in turn driven by steep tariffs, flat macro growth and

The new €150m 2032 ICO-backed loan (funding available to companies affected by US tariffs) is great news. The company had been alluding to negotiations, but we

Please find our updated analysis of Antolin here.

While risks in the short term are skewed to the downside, the bonds are difficult to short into a H225 picture that has been obscured by recent

The company performed better than model in Q1. Revenues were lower, but management had been renegotiating supply contracts, which is beginning to

We shorted Antolin10 3/8s at 82 in March, but are now buying back the position at 70 as we are getting carried out. The bonds had reached the

The financials were very much on target in Q4, but they were already guided and won’t be the focus of today’s call. The presentation includes only a

As tariffs continue to influence market dynamics, we've taken a comprehensive look across our coverage to highlight the names most likely to be affected. For full transparency, we've also included those that remain unaffected—it's just as important to understand where the impact isn't being felt.

The idea here is

Antolin Idea Pitch video is now live. You can find it on the Sarria website landing page and on the dedicated Antolin page.

We took that short just in time. It turns out, however, that we don’t have to wait for Q1 to look forward to covenant discussions. We hear that not

Please find our only slightly updated analysis here.

We have been critical of Antolin for a while. But as covenants, creditors and rating agencies are set to define the next months for the auto supplier, we think that a breach

A little More revenue, significantly lower EBITDA and more CapEx are not boding well for the Autosupplier as we go into the first round of tariff discussions on Auto imports to

In what could be a cautionary note for other auto suppliers, Schaeffler issued a profit warning this morning reducing its EBIT margin from a market consensus of

Please find our all-new analysis of Antolin here.

We have been reviewing our automotive names side-by-side, so as to create a bit of an industry view and ensure we view each bottom-up name in a

In line with the downturn in the auto parts industry, the Spanish auto parts group reported Q3 results that were reflective of the industry. Revenues declined by

Please find our updated model here

Antolin reported at best mixed Q2 2024 results yesterday. The company was held back by weaker-than-forecast vehicle sales (especially production delays in

Antolin’s Q2 2024 were held back by weaker-than-forecast vehicle sales, but cost control meant EBITDA (and margins) beat our expectations. We will be

Antolin today priced their €250 million senior secured notes due 2030 at 10.375%. Use of proceeds is to refinance the existing

Post an agreement with the lenders on an A&E, non-core asset sales and favourable market conditions, the Spanish auto-parts supplier launched a

The company is speeding towards a refinancing of its 2026 notes after reaching an agreement with its lenders on €530 million debt facilities

The company reported Q1 2024 results which confirmed our negative view. Revenues declined by 10% to €1.04 billion and below our estimate of €1.2 billion as revenues from

Post the earnings call yesterday, the company’s guidance on the call was mixed with flat topline growth (due to model volatility) and slower order intake of €5.5 billion at 6% margins but better than expected EBITDA margins of 9% and €400 million for