- for speed listening, go to the settings wheel on the bottom right of the video and choose playback speed - after one minute video becomes high-resolution.

Intro Capital and Legal Structure - 18 Feb 25

Business Description - 18 Feb 2025

Tariffs - 18 Feb 25

Model - 18 Feb 25

Investment Discussion - 18 Feb 25

Birkenstock had already released the headline results in January, so the results didn’t contain much by way of surprises. Birkenstock will benefit from

The upgrade to BB+ reflects the expectation that the revenue growth and EBITDA margin strength in recent years will continue. S&P calculated

The small miss on revenue growth (11.1% vs guidance of 13% - 15%) is a negative, without being terrible. Constant currency growth

The headline is a modest increase in guidance, but we think the €18m acquisition of a facility in Dresden is more important. It underlines the growth

The secondary offering raised $950m for LVMH, whilst reducing its shareholding from 72% to 62%. The $52.50 price per share is

Q2 results were ahead of our expectations. Improved cost absorption at Birkenstock’s new plant and rising volumes pushed gross margin up by

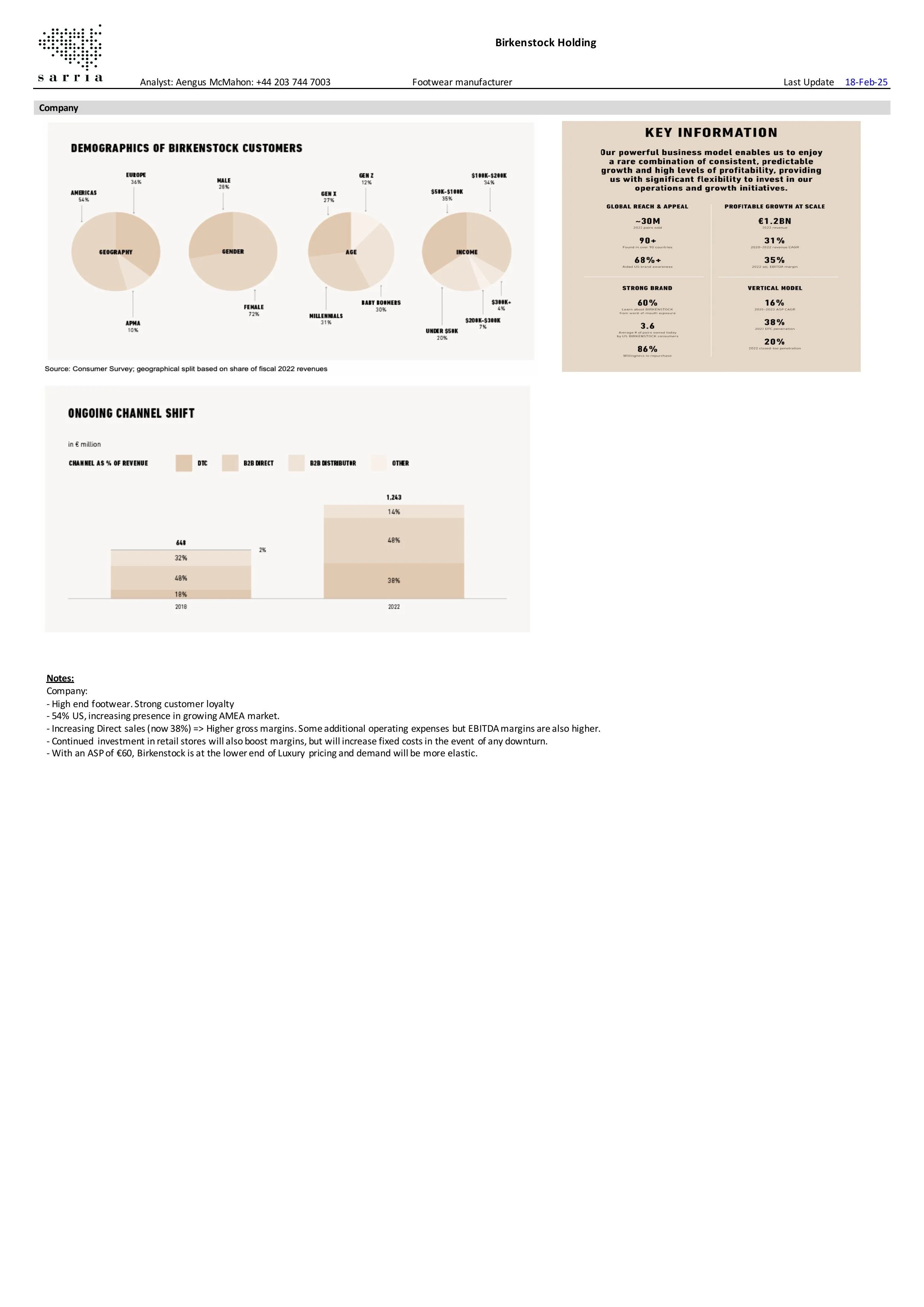

Opening retail stores to capture more of the margin on shoes is logical. Nevertheless, virtually all of Birkenstock’s production is in

As tariffs continue to influence market dynamics, we've taken a comprehensive look across our coverage to highlight the names most likely to be affected. For full transparency, we've also included those that remain unaffected—it's just as important to understand where the impact isn't being felt.

The idea here is

With a price point of nearly €60, Birkenstock is inevitably going to attract cheaper competition. Birkenstock is aggressively trying to prevent

Q1 was a strong quarter, but management maintained guidance for FY2025 due to macroeconomic uncertainty (including tariffs). We expect little change in the

Birkenstock videos are available on the website, here.

Please find our new analysis here.

Several clients have asked us about Birkenstock. With a YTW of 4.6%, this is not a name in our universe, and we do not expect it to come our way. The equity market values