- for speed listening, go to the settings wheel on the bottom right of the video and choose playback speed - after one minute video becomes high-resolution.

Intro Cap and Legal Structure - 22 Jul 24

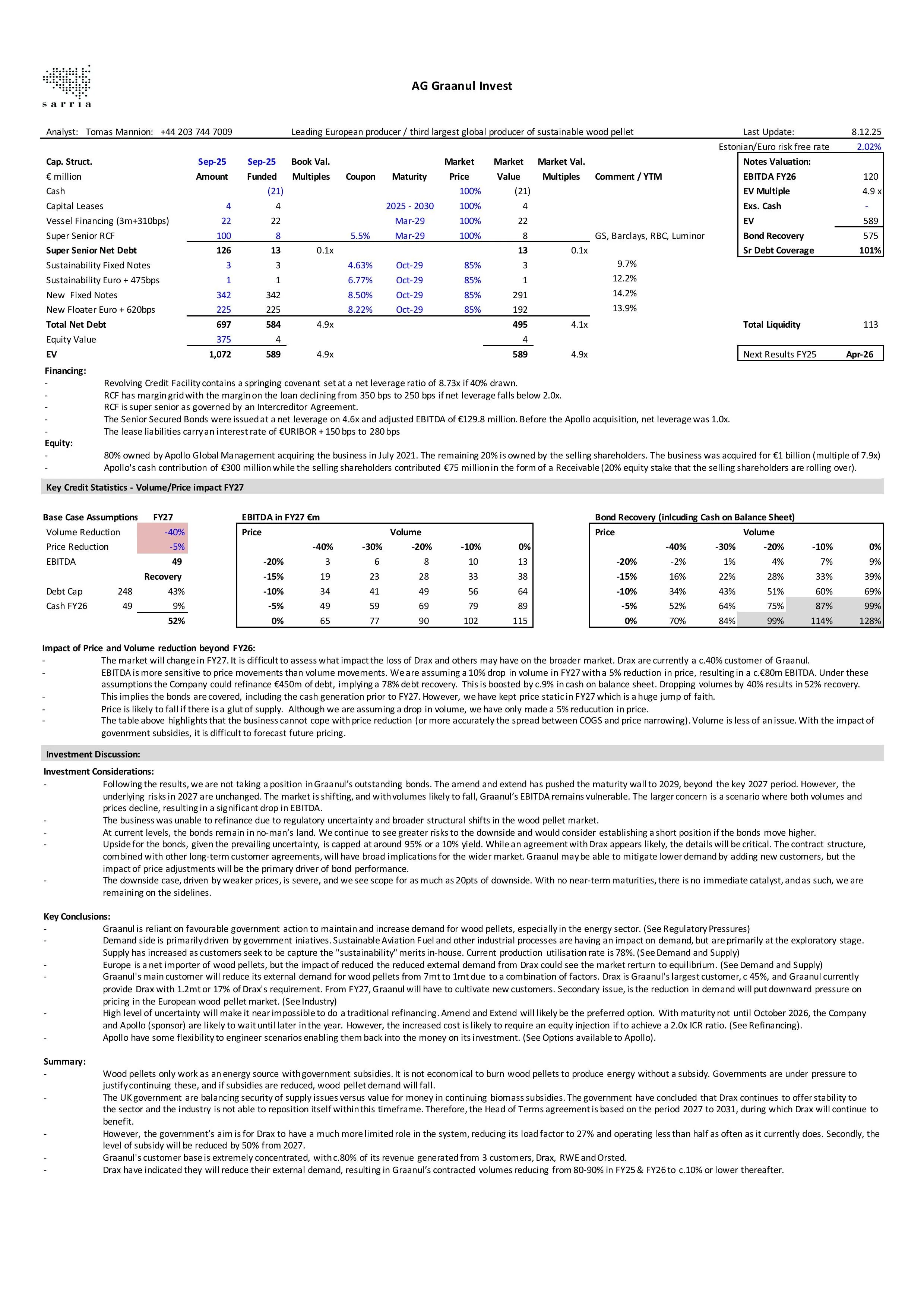

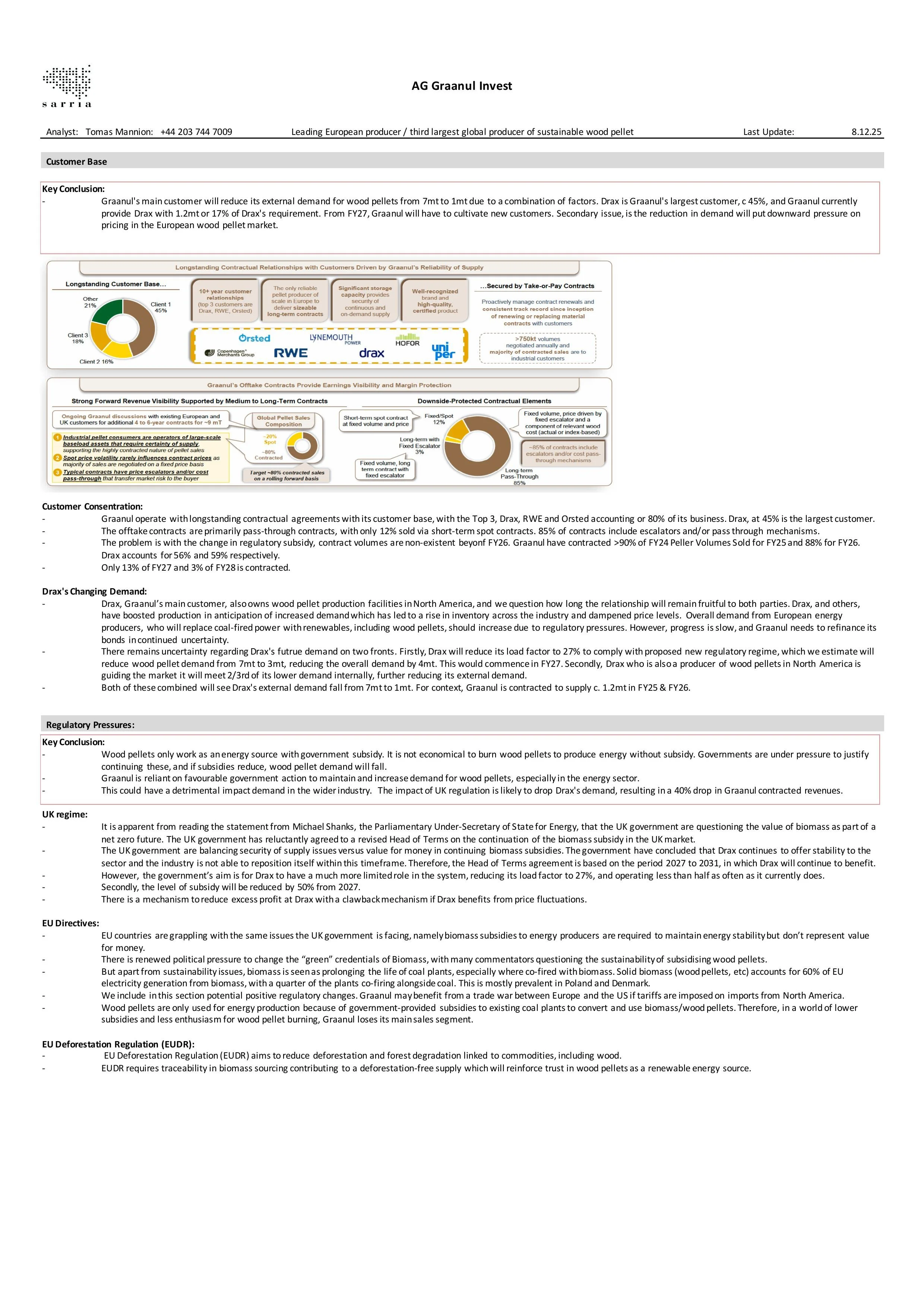

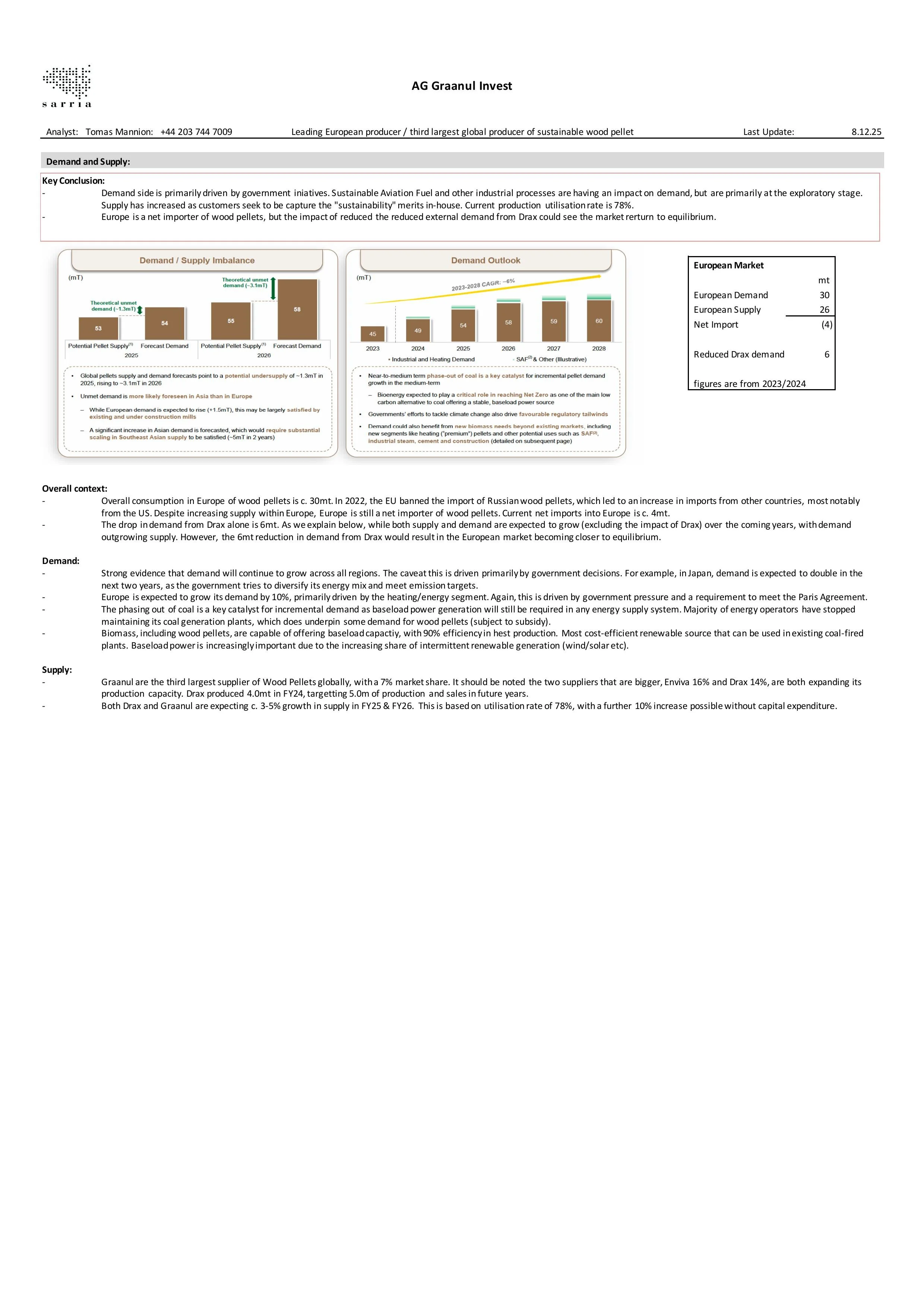

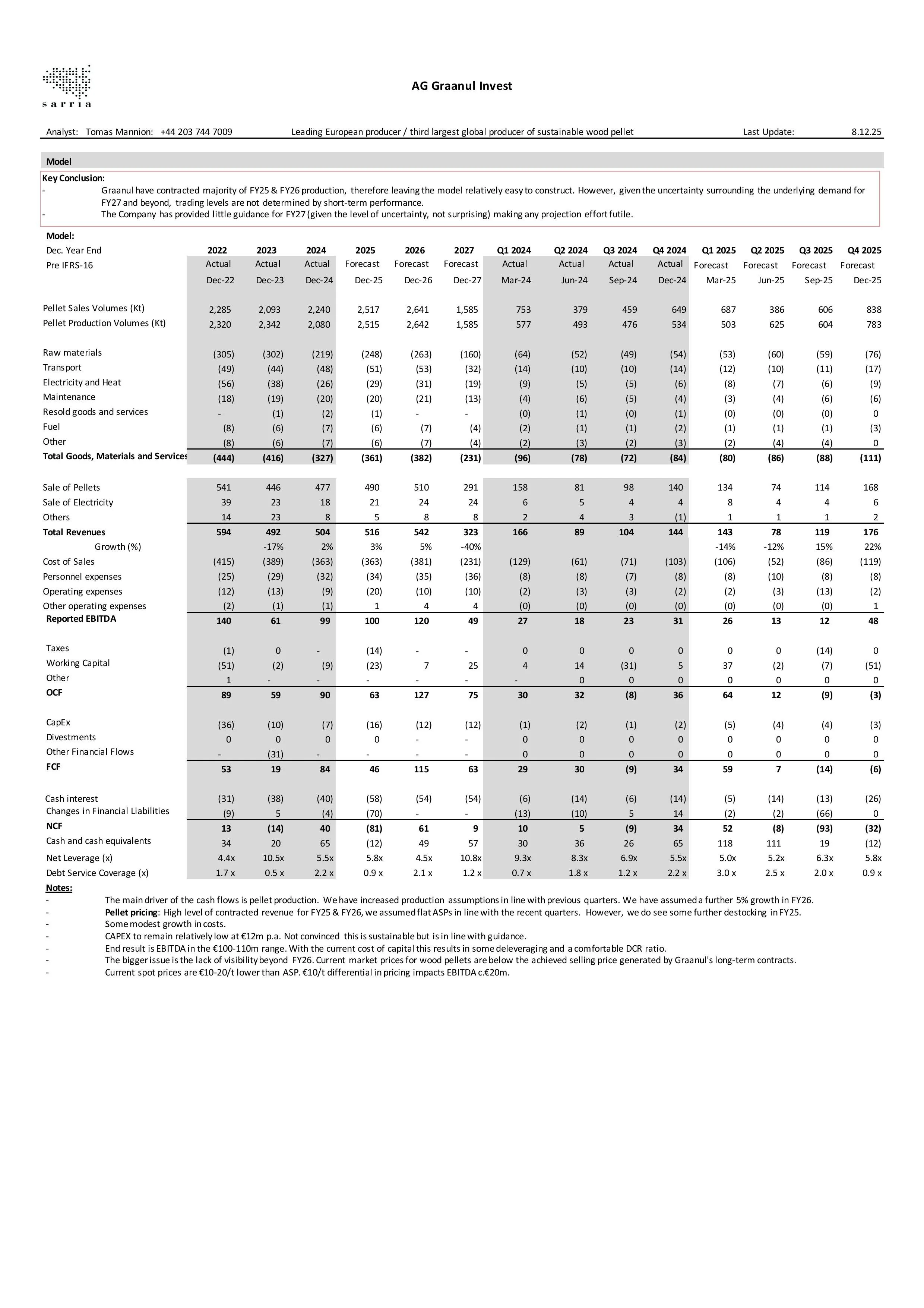

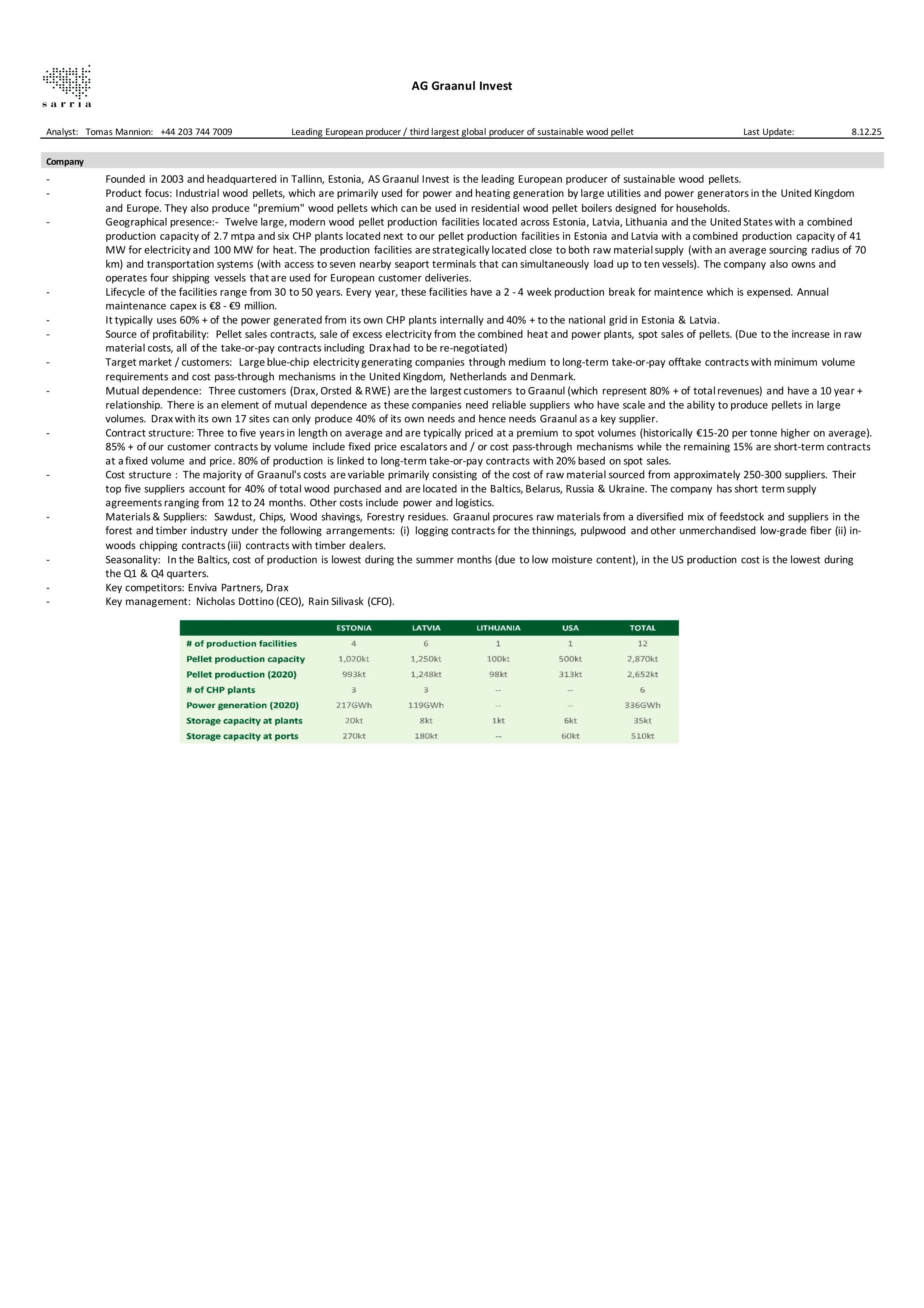

Company - 22 Jul 24

Company - 22 Jul 24

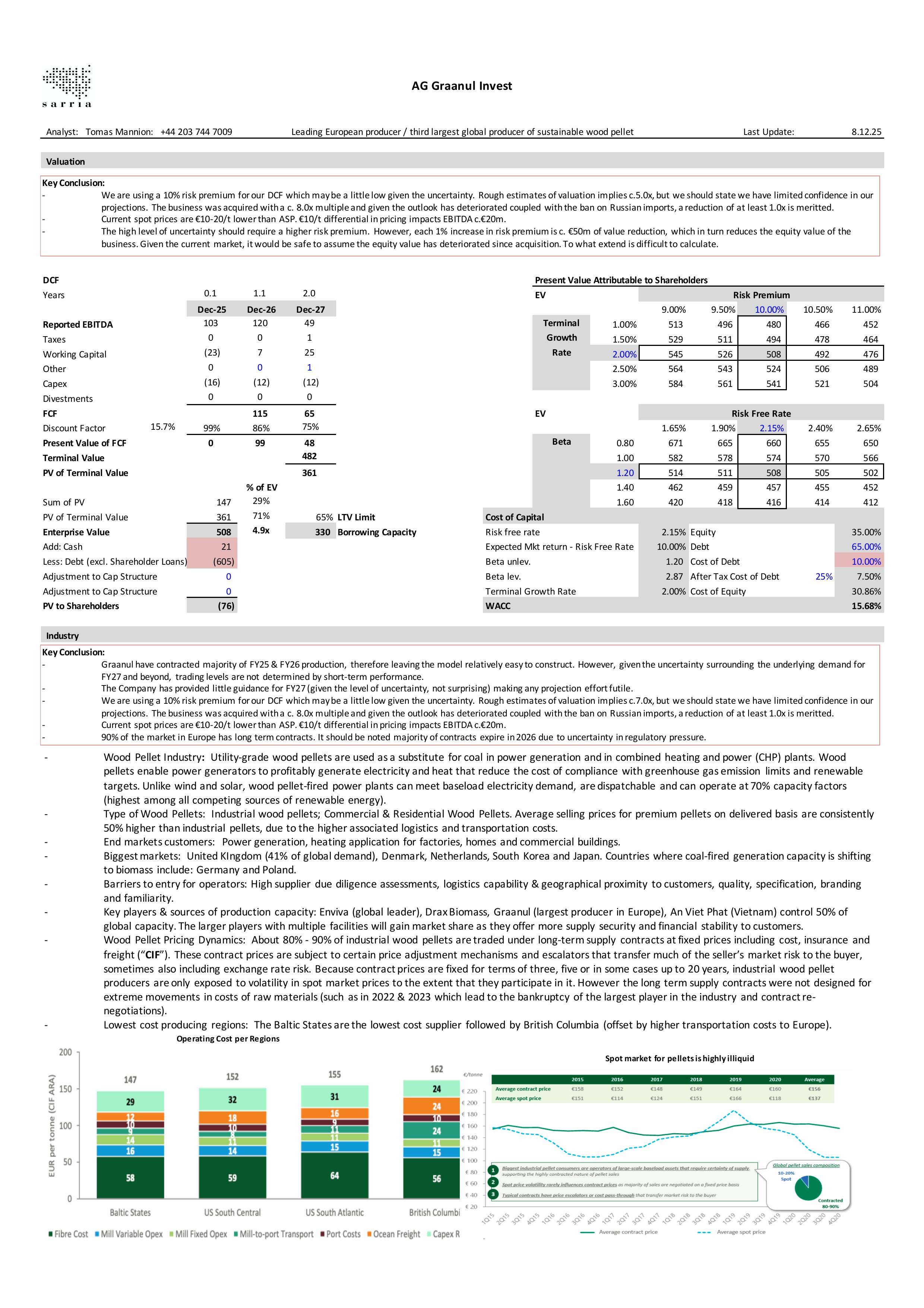

Financials and Valuation - 22 Jul 24

Investment Discussion - 22 Jul 24

The FT reports that the Japanese government is reducing subsidies for the biomass sector, framing the development negatively as a cut to

Please find our updated analysis on Graanul here.

Graanul reported its Q3 results recently, but given that the majority of FY25 and FY26 production is already contracted, the figures were

Graanul reported its Q3 results, which were broadly in line with expectations. Demand for wood pellets has strengthened since the

Drax announced this morning that it has entered into a contract with the UK Government to continue operating its biomass

Graanul released its Q2 results this morning, with a conference call scheduled for tomorrow at 1 pm. The initial reaction to the results is that

Graanul provided an update on the consent solicitation process, as over 75% of existing noteholders have acceded to the Amend and Extend agreement. The early

The Drax results yesterday, and management’s subsequent comments, reaffirm our view that Graanul will remain under pressure post FY26. We view the

Fitch has downgraded Graanul’s credit rating to B minus from B plus, citing refinancing risk as the primary concern. Notably, Fitch does not

This is broadly the deal we were looking for - safe perhaps for at least a token of shareholder contribution. Absent any information from Drax et al., neither

Please find our updated analysis on Graanul here.

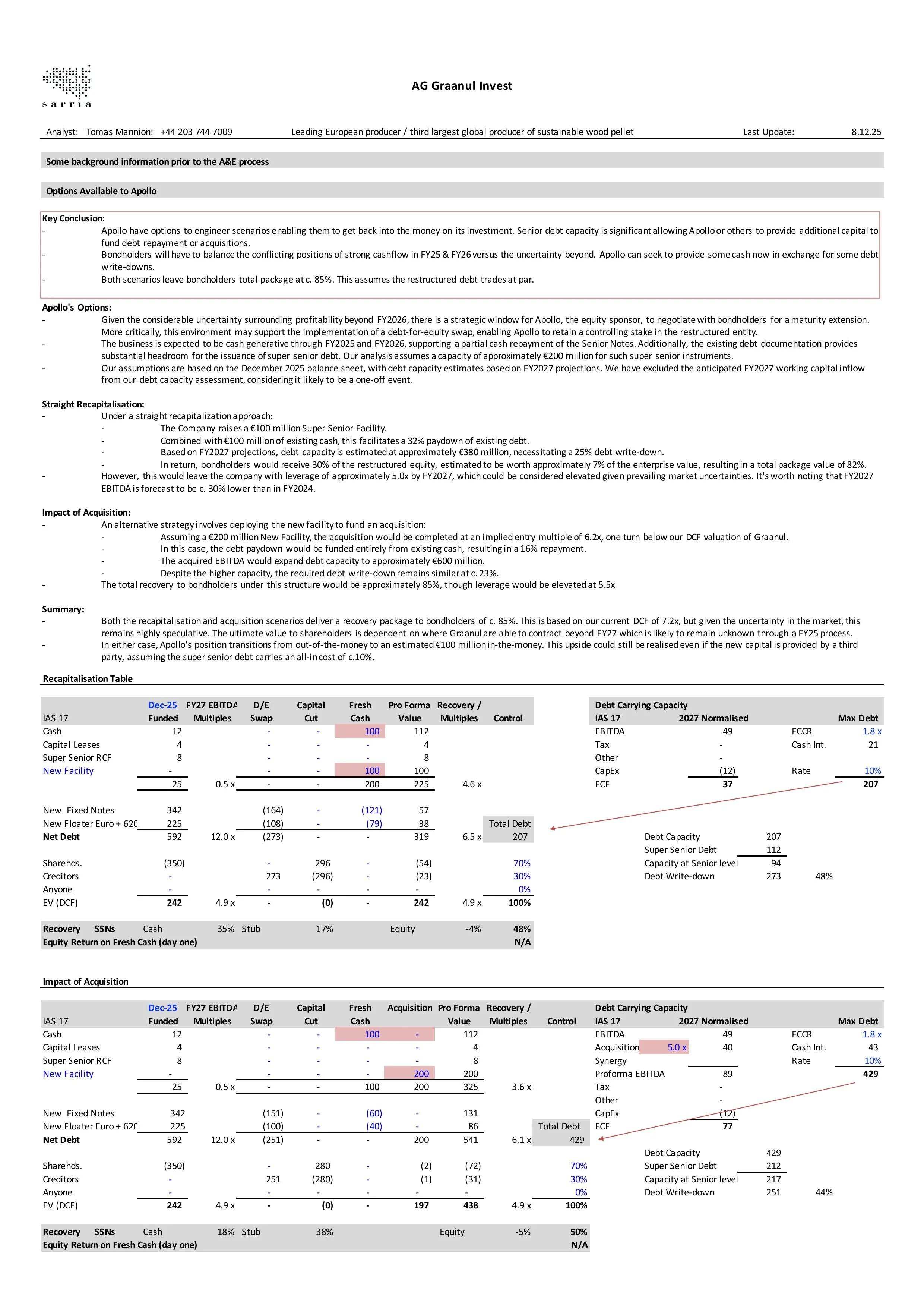

We wrote extensively on Graanul before the numbers, and therefore this update is more focused on the options available to Apollo

The Q1 numbers are in line with our view. The financials are the secondary focus for Graanul, and all eyes will be on the Company’s plan to secure

Please find our updated analysis here.

We have changed our model substantially, which gives us a better understanding of the business. However, the ultimate issue remains the

Time is ticking. We are revisiting the name after receiving several questions about it. The bonds have been stuck in the mid-80s since April as doubts

Graanul released its FY24 annual report yesterday but most of the numbers were already in its non-deal roadshow presentation in February. Despite

Drax released its FY24 numbers but we await the Q&A to glean new information about its agreement with the UK government regarding subsidies for

Post the investor meetings last week, we have added our thoughts to the potential refinancing debate.

Ultimately, we don’t believe a refinancing is currently possible given the debate around the name. The uncertainty beyond FY26, with limited contracted sales coupled with public doubts about the “green” credentials of biomass, is juxtaposed with

The 5pt drop in Graanul bond price reflects the realisation that refinancing isn’t imminent. The Company presentation yesterday highlighted the

The Graanul call has just ended. Due to overlapping call schedules we are only listening to a replay now. We will revert with an update.

Drax confirmed in a RNS that it has a Heads of terms agreed with UK Government for low carbon dispatchable CfD, ensuring Drax’s biomass plants

Following Graanul’s trading statement earlier this week, the Company announced investor calls/Roadshow next week. Register for the call https://evercall.co/oacc/53645 on

Graanul released a decent trading statement for FY24 but the focus will remain on its ability to refinance its 2026 bond maturities. Leverage remains at

Please find our updated analysis post the Q3 2024 results on Graanul here.

Graanul is still suffering from transitory issues (inventory de-stocking & non existent spot market) though it has made progress in its contracted business and

The Estonian wood pellet producer reported Q3 2024 revenues of €103.9. million (which was below our expectations of €127 million for the quarter.) Q3 EBITDA was

Please find our updated analysis post the Q2 2024 results on Graanul here.

We remain on the sidelines (post our Initiation Note) as Graanul is still suffering from transitory issues (inventory de-stocking and demand weakness for

Please find our initiation and financial model on AG Graanul Invest here.

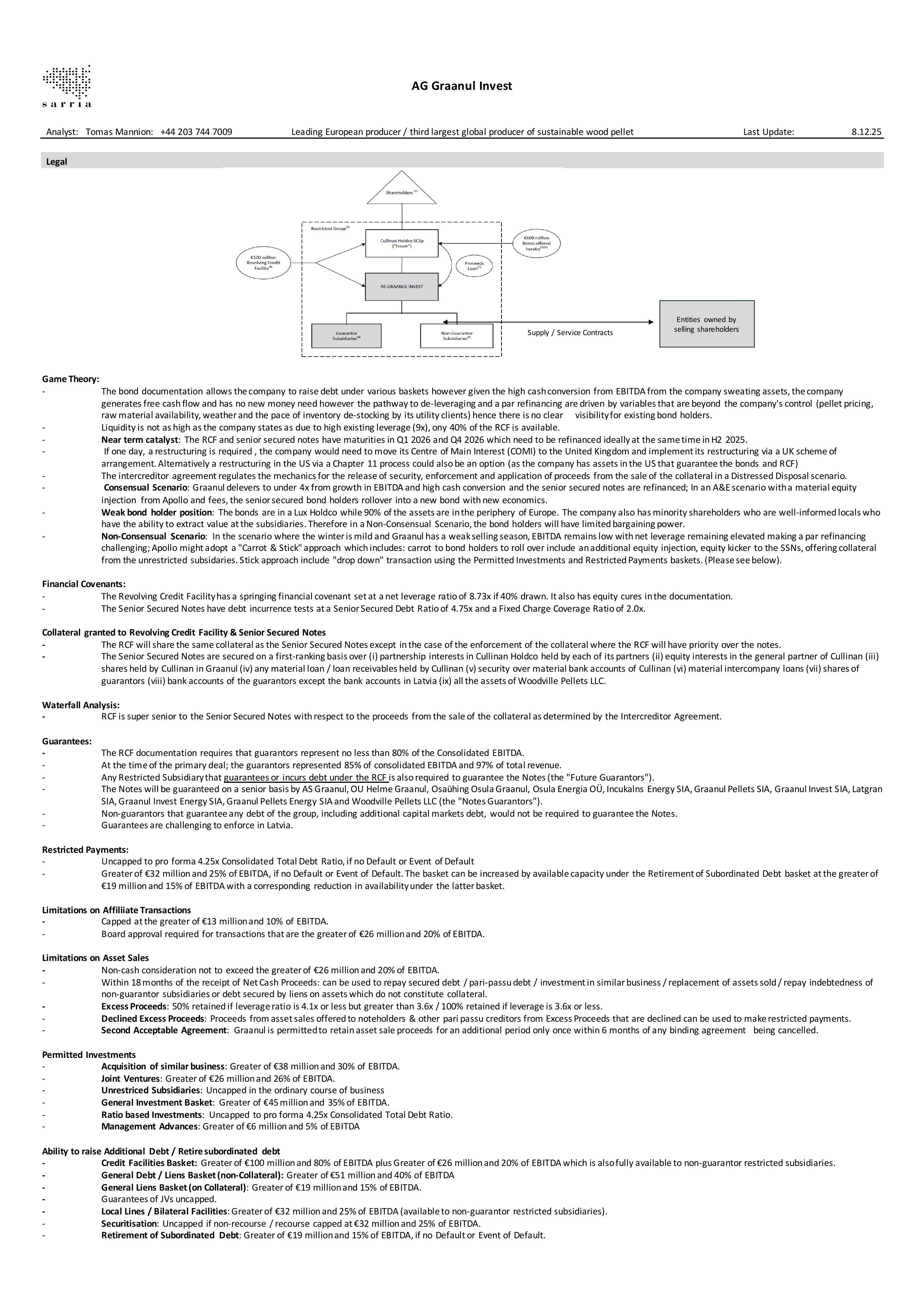

Due to variables that are beyond its control (pellet pricing, raw material availability, weather and the pace of inventory de-stocking by its