Heimstaden - Asset coverage versus cash flow.

All,

Please find our updated analysis on Heimstaden Bostad and Heimstaden AB here.

We re-examined the Heimstaden credit to see if there was any trading opportunity across the structure with upcoming maturities. However, the announcement this morning (7th July) that the Company will tender for the 2027 notes and simultaneously issue a new 5.5-year bond removes any potential trade.

Although our valuation is significantly lower than Book Value, the asset value remains sufficient at Heimstaden.

Investment Considerations:

- We exited our position in Heimstaden Bostad too early in May 2024, and have since seen the whole structure rally as fear subsided in the European real estate market. Both the straight bonds and the perpetuals are now priced to near perfection, removing any meaningful upside in any long trade. Asset coverage remains strong at Bostad, and with the Company’s main focus on maintaining an investment-grade rating, we see very limited downside.

- We are not taking a position in Heimstaden AB at the current time. Despite the rally in the high-yield bonds (and perpetuals), we still are not investing in Heimstaden AB. The Hybrid bonds are covered even under our valuation metrics (which results in a 30% discount to NAV); however, this does not incentivise us to invest in Heimstaden AB. The yields are not sufficient to compensate for the structural issues and lack of cash flow coming from Heimstaden Bostad.

Our Valuations:

- We monitor the implied simple yield in Heimstaden’s three main geographies (Sweden, Germany, and Denmark), and specifically the spread over the relevant 10-year government bond for each country.

- In Sweden, the portfolio is currently valued at an Implied Simple Yield of 3.2%, which is 85bps wide of the Swedish 10-year government bond. In FY21, the spread was 185bps. Widening the Implied Simple Yield by 100bps reduces the value of the portfolio down by 24%.

- In Germany, the portfolio is currently valued at an Implied Simple Yield of 2.6%, which is 15bps tighter than the German 10-year government bond. In FY21, the spread was 143bps. Widening the Implied Simple Yield by 160bps reduces the value of the portfolio down by 37%.

- In Denmark, the portfolio is currently valued at an Implied Simple Yield of 3.9%, which is 140bps wide of the Danish 10-year government bond. In FY21, the spread was 245bps. Widening the Implied Simple Yield by 150bps reduces the value of the portfolio down by 28%.

- Combined, this is a 30% discount to current valuations, which appears aggressive. However, listed peers trade at 20-25% discount to Book Value. Vonovia trades at 23% discount to Book Value, and therefore, although our discount is outside the range of listed peers, it isn’t significantly different.

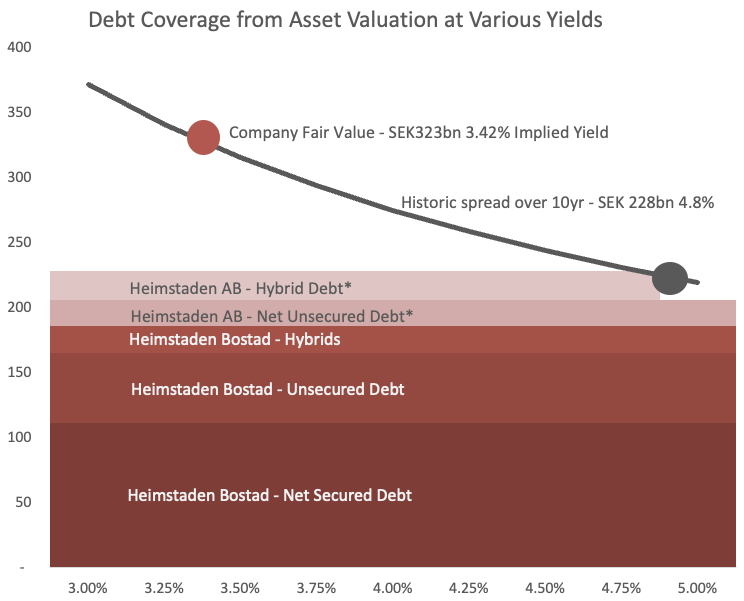

- It is a little easier to view visually. The graph shows the Debt coverage at various Implied Simple Yields. The Company’s Valuation is at 3.42% yield, and covers all debt instruments. Our valuation is 140bps wider, which just fails to cover the Hybrid debt at Heimstaden AB. Again, we reiterate that the discount is wider than those visible for listed peers. A 25% discount to NAV equates to 4.5% Implied Simple Yield, where all debt instruments are covered.

* Note: The Heimstaden AB debt is scaled up to account for the 35.6% equity stake held in Heimstaden Bostad.

Next Steps:

- We will watch to see the pricing on the refinancing of the 2027 bonds, although early pricing would indicate it will trade similar to the January 2030 bonds at 8-8.5%.

- Because of ratings constraints, Heimstaden Bostad has not recommenced dividends to its equity holders, including Heimstaden AB. The trapping of cash at Bostad is improving the credit ratings at Bostad, with Fitch removing them from negative watch earlier this year. We do not envisage dividends to recommence before FY27. This will result in the March 2027 HY bond at Heimstaden AB requiring refinancing before any meaningful cash flows from Bostad.

- Management is solely focused on maintaining Investment Grade status at Heimstaden Bostad, and therefore improving its ICR. We had previously expected a large asset sale and/or equity injection from its other shareholders, but neither was required. The Company continue to divest properties via a privatisation program (small-scale divestment) and, with a favourable interest rate environment, has managed to maintain its rating. Heimstaden Bostad will continue to see operational improvements, in line with previous quarters.

We continue to monitor the Heimstaden structure, but at this moment we don’t see an investible opportunity.

Happy to discuss.

Tomás

E: tmannion@sarria.co.uk

T: +44 20 3744 7009

www.sarria.co.uk