- for speed listening, go to the settings wheel on the bottom right of the video and choose playback speed - after one minute video becomes high-resolution.

Intro and Cap Structure-27 Sep 23

Cash Flow Model - 27 Sep 23

Asset Valuation - 27 Sep 23

Recapitalisation - 27 Sep 23

Investment Discussion - 27 Sep 23

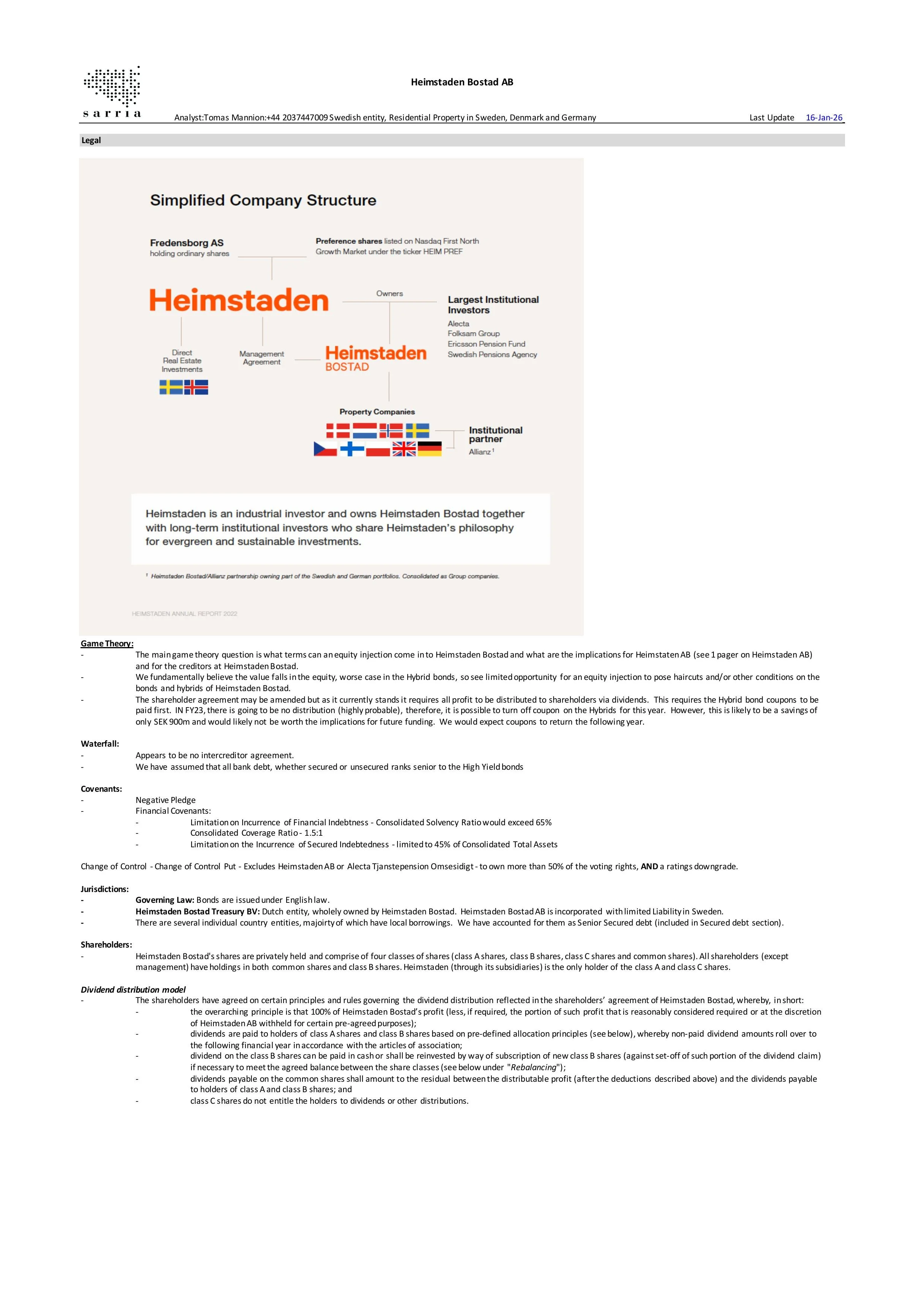

Heimstaden Bostad

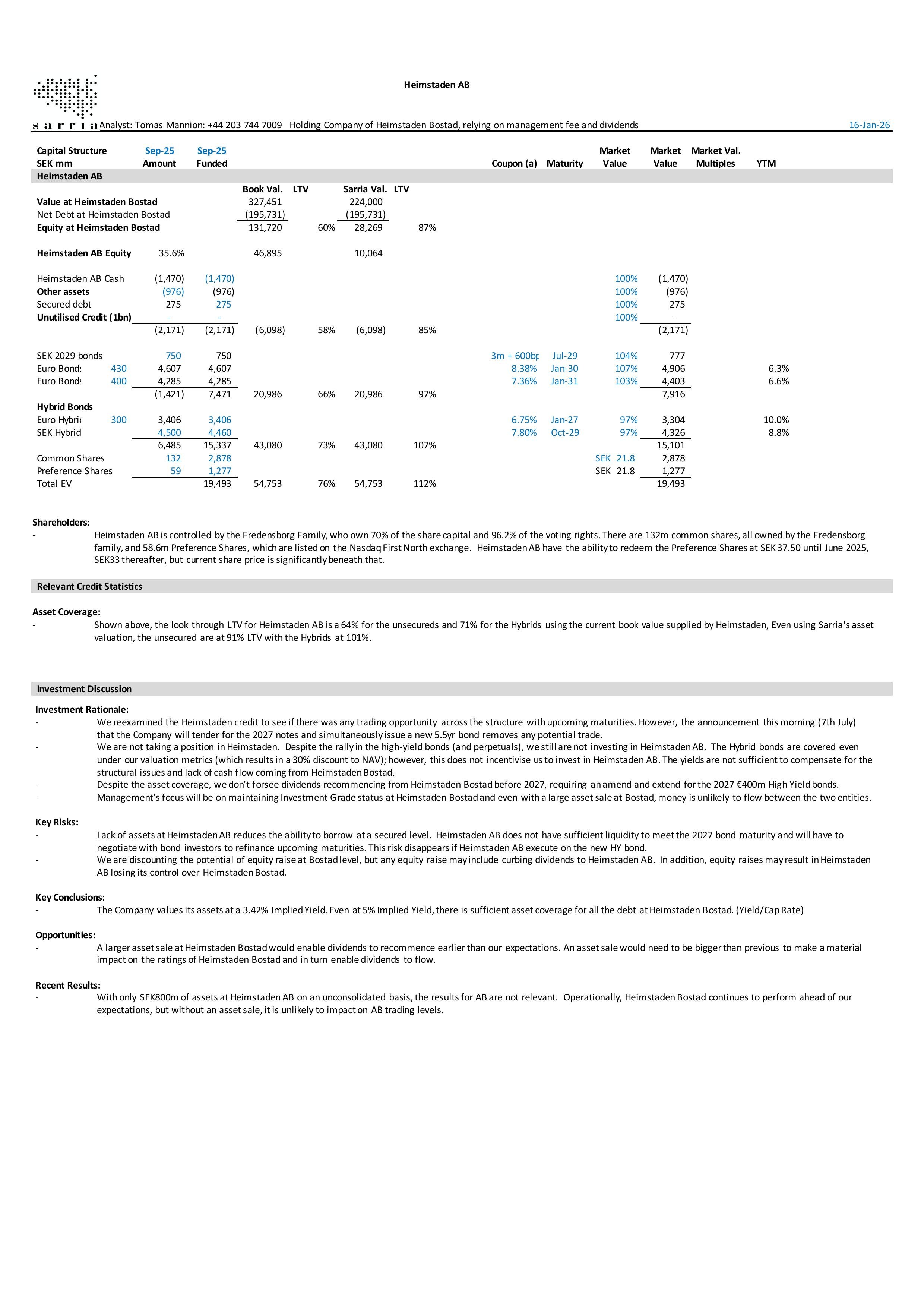

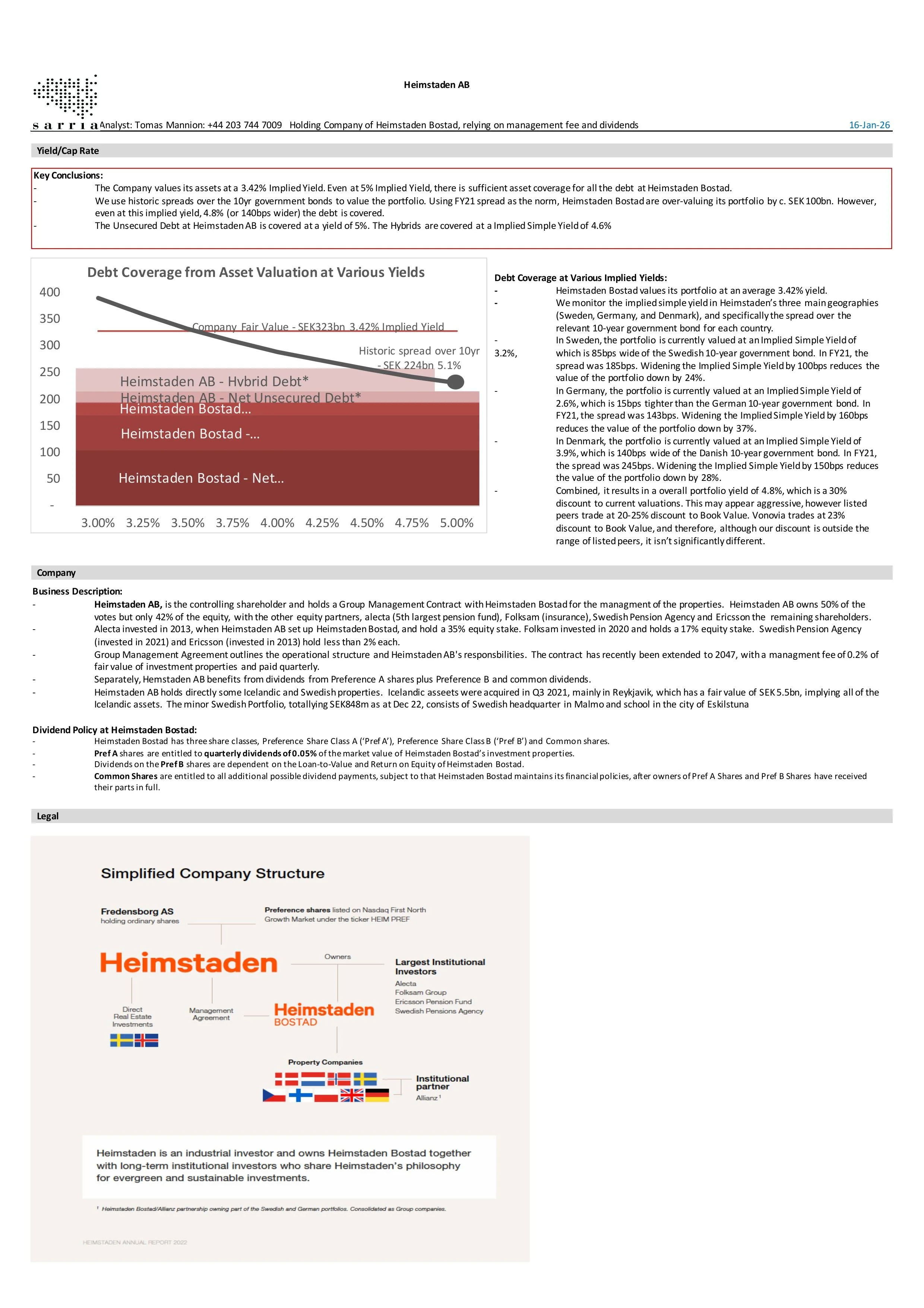

Heimstaden AB

Heimstaden Bostad AB reported FY25 results showing broad-based improvement across all key credit and operating metrics. Occupancy remained

Please find our updated analysis on Heimstaden Bostad and Heimstaden AB here.

We have revisited the Heimstaden group structure in anticipation of Heimstaden Bostad receiving an upgrade, potentially allowing dividends

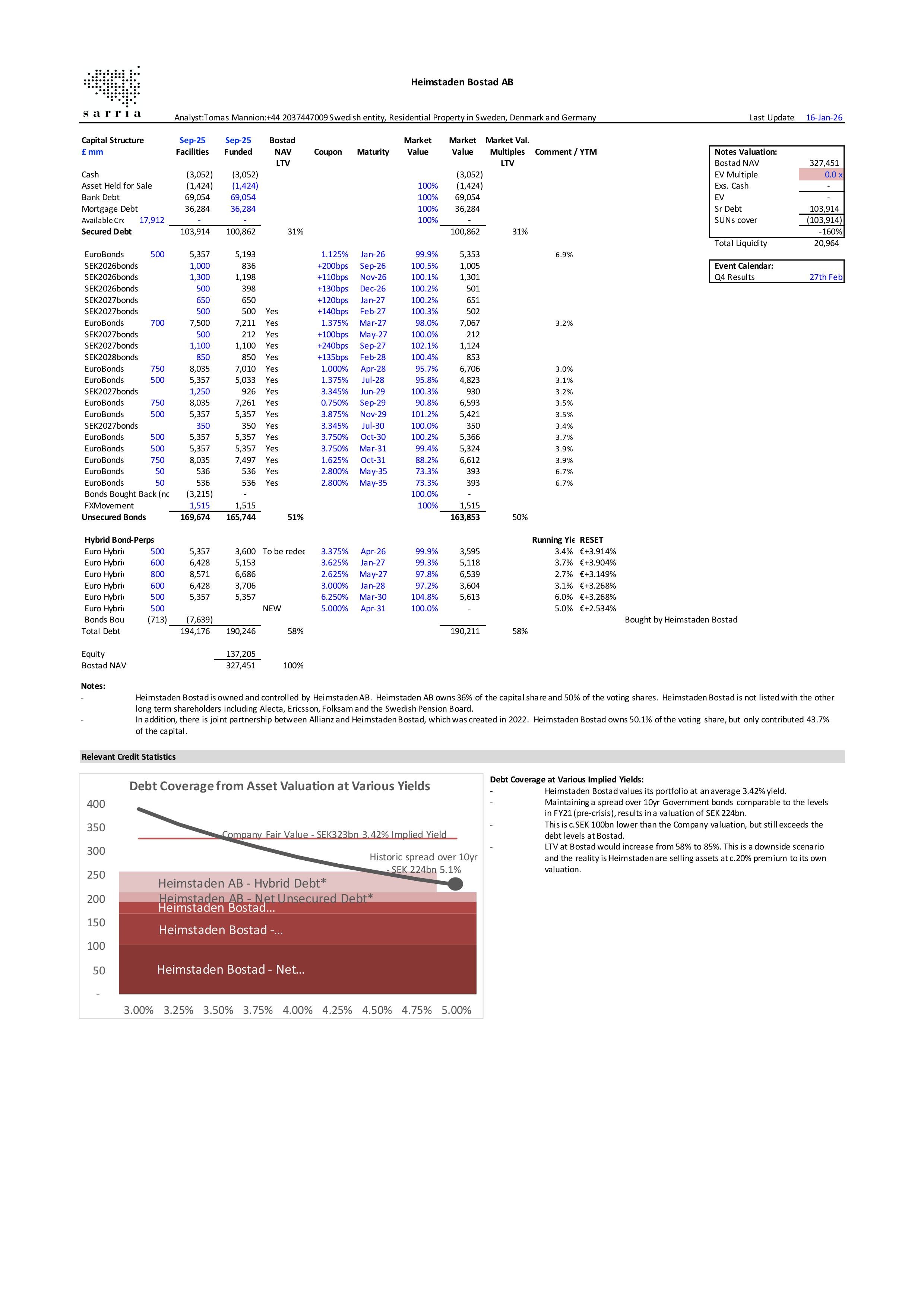

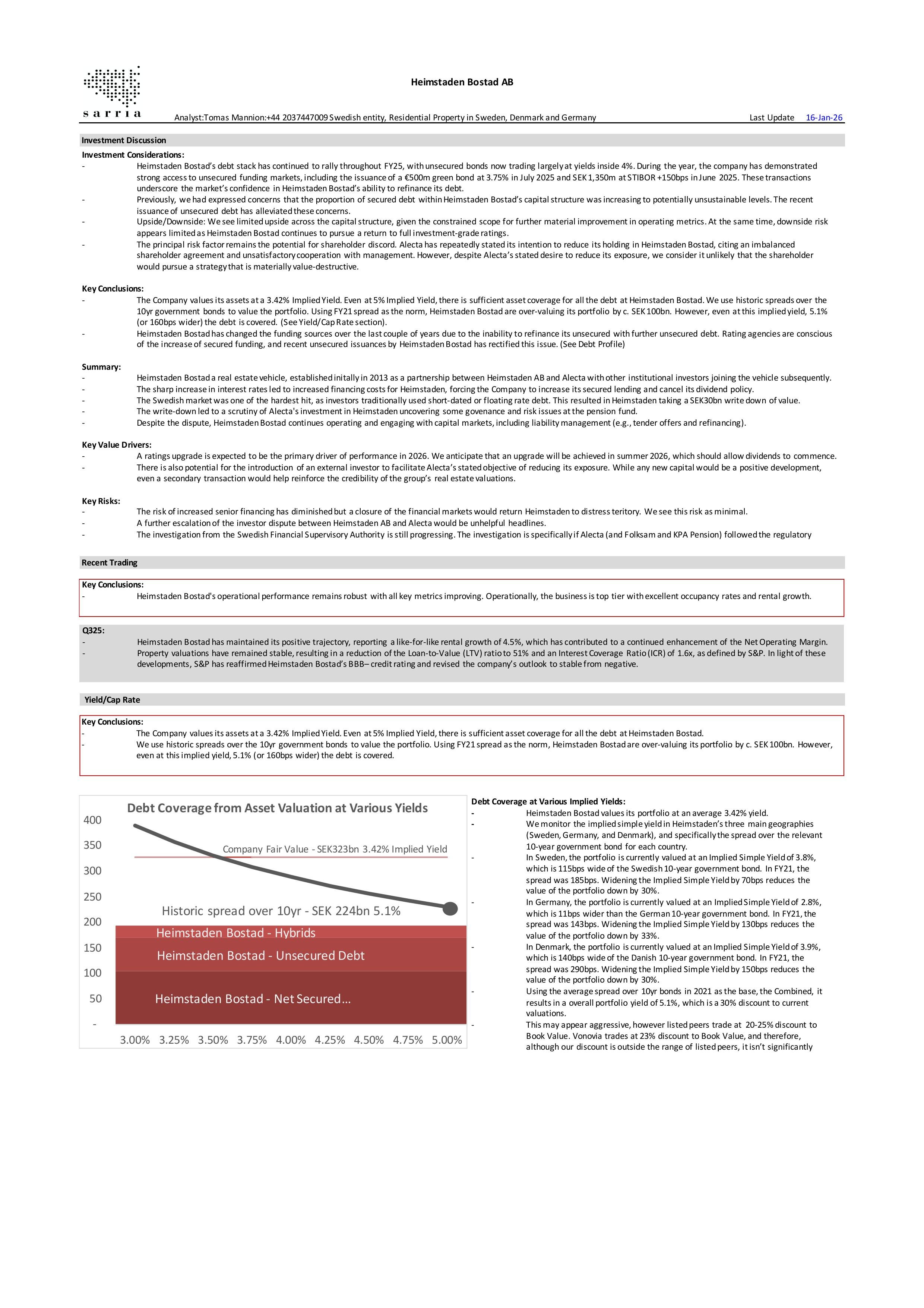

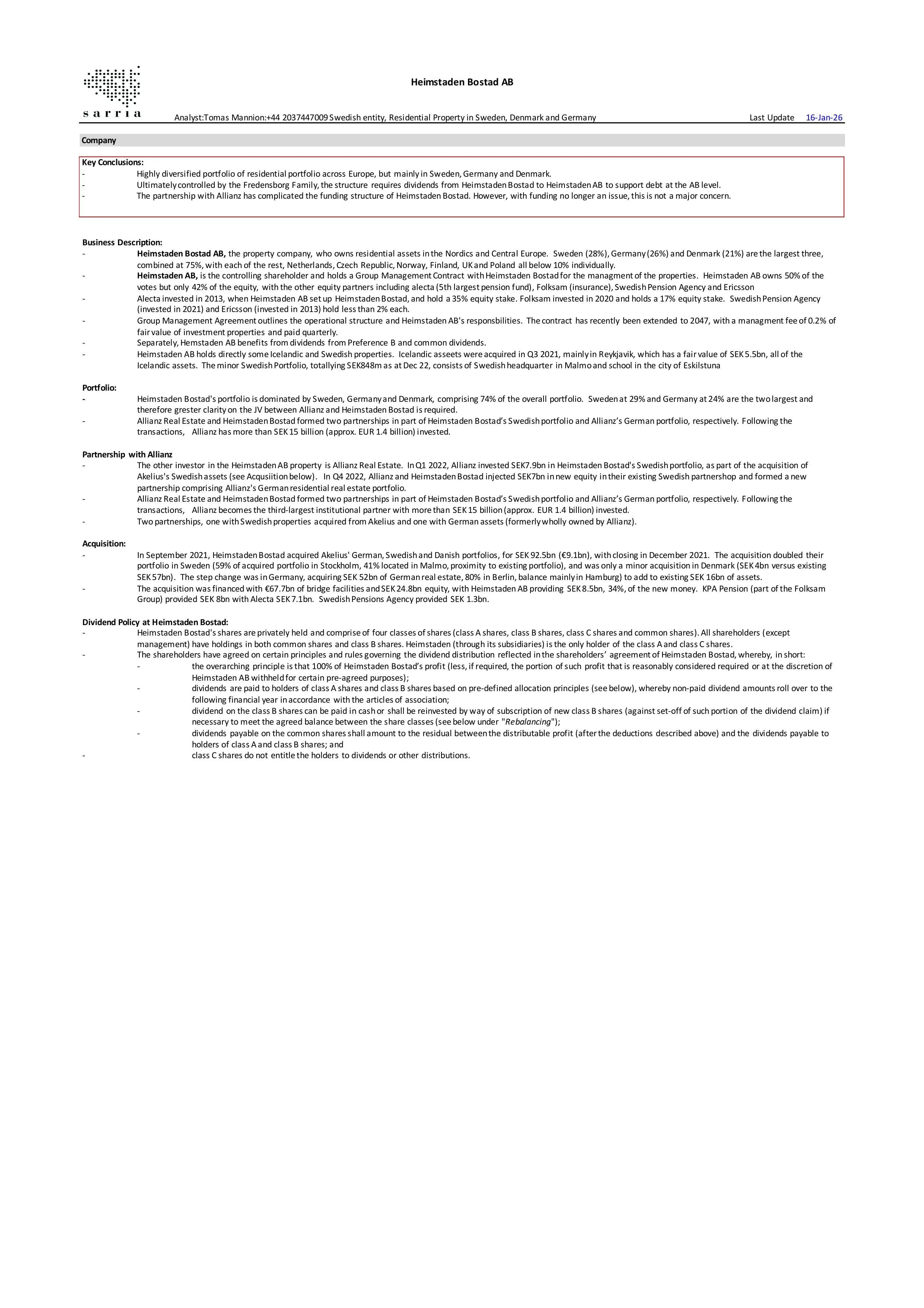

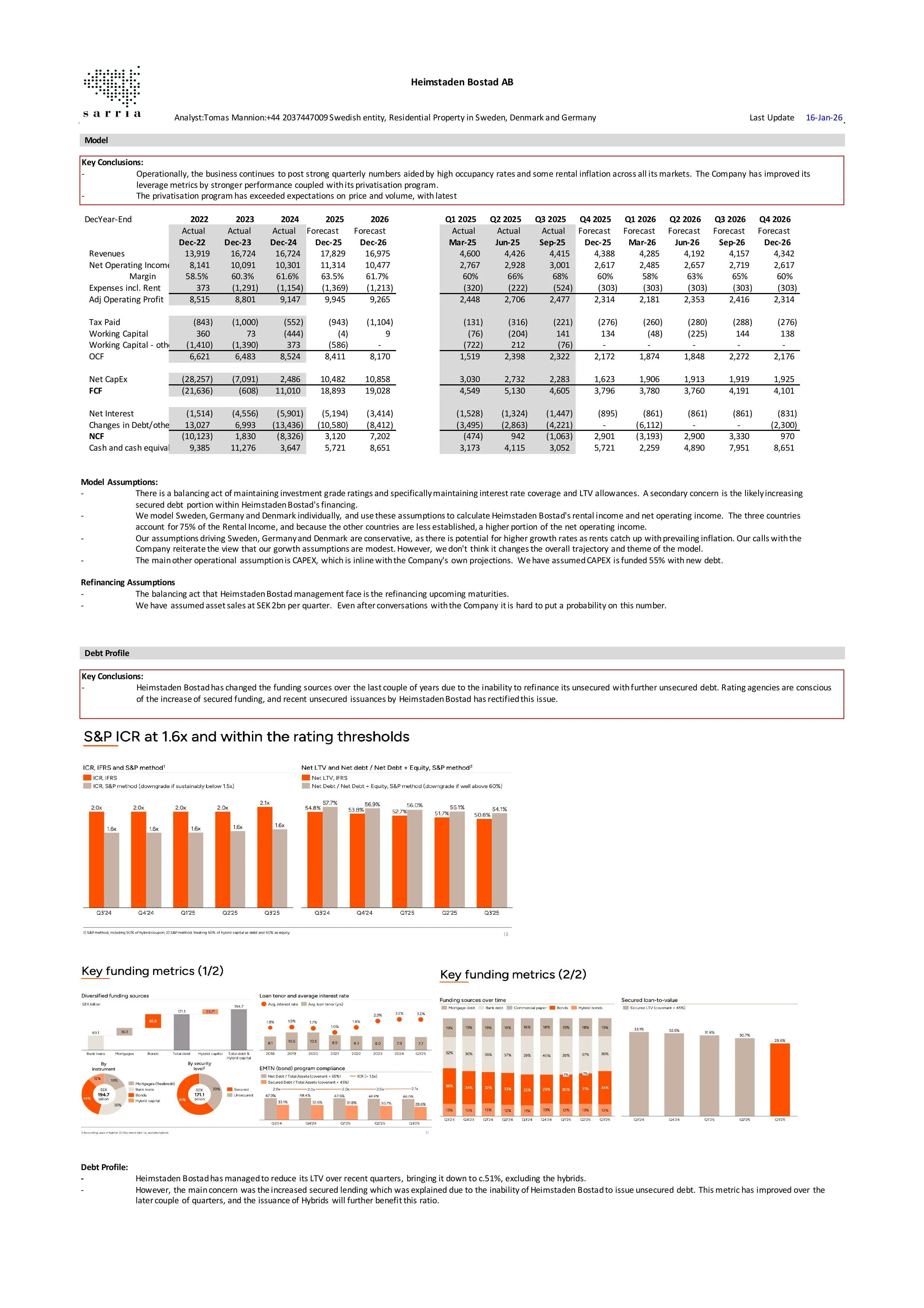

Heimstaden Bostad has maintained its positive trajectory, reporting a like-for-like rental growth of 4.5%, which has contributed to a continued

Reaffirming our recent observations that the stress experienced in the European real estate market is now firmly behind us, Heimstaden Bostad is issuing a

Alecta, the largest investor in Heimstaden Bostad, stated that it wishes to reduce its exposure to Heimstaden Bostad by at

[Aengus on behalf of Tomás] Operating cash flow was in line with our forecast at SEK2.4bn, but better-than-estimated asset sales meant that net capex was lower than

The tender offer (at par) for the 2027 bonds has been successful, with €345m of the €400m outstanding tendering. We expect the

Please find our updated analysis on Heimstaden Bostad and Heimstaden AB here.

We re-examined the Heimstaden credit to see if there was any trading opportunity across the structure with upcoming maturities. However, the

Heimstaden AB is issuing a new 5.5-year senior unsecured note, with Deutsche Bank, J.P. Morgan, Nordea Bank, and Swedbank mandated

Heimstaden are issuing a 4-year SEK-denominated bond, hosting a call tomorrow. With the proceeds, Heimstaden Bostad will

Heimstaden Bostad continues to see strong momentum in its occupancy and rental growth, resulting in a 1% increase in property values. LTM Ne

Minor news from Heimstaden Bostad this morning, with the Company tendering for two small NOK bonds. Heimstaden Bostad already owned a significant portion of

Only three questions on the Heimstaden Bostad call this morning, reflecting how the market has moved on. No longer on the stressed list, Heimstaden Bostad’s Q4 numbers continue its

Heimstaden AB has successfully extended its maturity profile cheaper than we had expected. Heimstaden AB issued €430m 5NC3 bonds at 8.375% and

Times have changed. Heimstaden AB, the holding Company, are contemplating an Amend and Extend for its two 2025 SEK bonds and 206 Euro bonds. This