Victoria -Who is paying for future growth? - Model Update

All,

Please find our updated analysis on Victoria PLC here.

The reason for the existence of Victoria has historically been to consolidate the carpet/flooring manufacturing market, resulting in higher volumes and stronger margins from economies of scale. Even while undergoing financial restructuring, the business continues to invest in reorganising its business, undertaking operational reoganistations extracting further costs from the business. But all of this results in cash costs upfront, which the Company can ill afford. We expect further cash restructuring costs in the coming years, and without an uptick in volumes, there will be a cash requirement in 2028. Coupled with the inability to refinance the now layered 2028 bonds, a further restructuring is inevitable.

Investment Discussion

- We are not taking a position in Victoria. We would need to see volumes return across Europe prior to contemplating a long position. We are wary of any long investment given the cross-

holders and the prior restructuring, which treated the 2026 debt differently from the 2028 debt, although both were pari-passu.

- Although we accept that the Company has significant operational leverage, there are limited signs that the end-market will provide any support. The business has a cost base for higher volumes, and with higher volumes, the Company's EBITDA would grow rapidly. However, fundamentally, the business is still adjusting its manufacturing footprint, with £50m of restructuring expenses expected via the Rugs reorganisation, which has commenced.

- Trading levels in the short-term will be muted, but with a curtailed debt capacity, the 1PN Notes have limited upside from current levels. Bonds may trade to a 15% yield (7pts upside), but this is probably unrealistic unless significant uptick in volumes.

- The 1PN Notes are partially equitised under our model, leaving the bonds with further downside. This could be 10-15pts, especially if fresh cash is provided on terms that are to the detriment of 1PN holders.

- The Original Notes, at 17% have limited upside unless they can successfully challenge the prior uptiering, especially if cash runs out within the look-back period. The downside for the Original 2028 Notes is zero, as a full equitisation is the most likely outcome.

- The Company are due to report FY26 numbers (March 2026) in July. Prior to this, there is likely to be a trading update in May. Post numbers, focus will return to upcoming maturities and the high probability of further restructuring.

Recent Results:

- Recent results show the benefits of cost-saving measures and improved operational discipline, but these gains are more than offset by persistently weak volumes, particularly in the UK. Soft demand continues to pressure revenues, reducing the impact of cost initiatives, exposing the company to further earnings volatility, and limiting its ability to deleverage organically.

- Victoria’s H1 FY26 results broadly aligned with guidance issued in early November. Revenues and volumes remain weak across core markets, but EBITDA was roughly flat year-on-year, reflecting cost savings rather than underlying demand improvement. While guidance suggests a potential revenue improvement in H2, full-year FY26 revenues are still expected to fall short of the prior year.

- The refinancing completed earlier in the year has deferred, rather than resolved, the company’s underlying credit risk. Leverage remains elevated, and the investment case continues to be driven more by creditor dynamics than operational momentum or balance-sheet repair.

- Despite significant cost reductions, demand remains subdued. A key medium-term risk is a potential structural shift in end-market demand, with lower carpet penetration versus hard flooring, which could constrain volume recovery and limit long-term growth and deleveraging prospects.

Bigger Issue - Volumes:

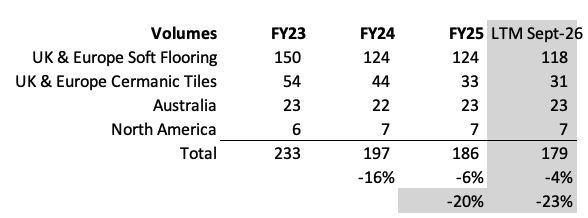

- This simple table illustrates the key challenge for Victoria: volumes have declined by 20% over FY23–FY25, 23% through September 2026.

- Sales trends are largely volume-driven. While we do not have sales-by-volume data by country, sales by value fell approximately 24% over the FY23–FY25 period.

- Contrary to perception, the UK has not been the primary source of weakness, with UK sales down only 8%. The main drivers of underperformance are Belgium and Spain.

Model and Valuation:

- Victoria’s operational initiatives, including the V4 ceramics line and the Rugs reorganisation, demonstrate management’s commitment to investing for the future and positioning the business to benefit from a potential recovery in end-market demand. From a credit perspective, these actions support medium-term margin improvement and earnings recovery. However, they require significant upfront capital expenditure and restructuring costs, which keeps near-term leverage and liquidity under pressure, with most benefits back-ended.

- Our valuation model is highly sensitive to assumptions around cost savings and future volume recovery. In our base case, we assume modest volume growth in FY27 and FY28, though activity remains well below historical levels. Even under this scenario, refinancing the 2028 bonds at maturity is not feasible. Volumes are a key driver of value: for example, a 5% growth in FY27 and FY28 would add roughly £20m to FY28 EBITDA. The model is even more sensitive to the cost savings programme and the exceptional cash costs associated with ongoing reorganisations.

- Projected cash requirements highlight the near-term pressure on the business. We model reaching a cash balance of £10m in September 2027, driven largely by £60m of cash costs from the reorganisation. Under these assumptions, enterprise value reaches only around £680m, which is insufficient to cover the IPN, indicating that any investment in Victoria relies on a strong operational and market rebound.

- We view a restructuring of the 2028 notes at maturity as inevitable. Our base case assumes that this restructuring is confined to the 2028 bonds, which would be equitised, leaving the remainder of the capital structure largely unaffected. However, this would likely necessitate further restructuring in subsequent years. Depending on the associated cash restructuring charges, an equity injection may also be required.

Recap of Solicitations

- In August 2025, Victoria Plc announced an extension of its 2026 debt maturities. The 2026 Notes moved to a springing maturity structure with a nominal maturity of July 2029, while the super-senior RCF matures in January 2030. The 2028 bonds, now layered and maturing in March 2028, highlight that this transaction defers refinancing risk rather than resolves it, suggesting a more comprehensive restructuring will likely be required by late 2027.

- Under the amended terms, 2026 Noteholders were offered an opportunity to improve their position through additional security, although this ranks behind the new super-senior facility. The coupon on the 2026 Notes was reset from 3.675% to a combination of 1% cash and 8.875% PIK, with a springing maturity ahead of the 2028 Notes. While the elevation strengthens relative positioning, the notes remain structurally subordinated to the super-senior RCF.

- The original €500m 2026 and €250m 2028 senior secured notes were issued under the same indenture and vote as a single class for amendments. As a result, amendments approved by a majority of the aggregate principal bind both series. This allowed changes that were disadvantageous to 2028 holders to pass, even if some opposed them.

- In October 2025, Victoria’s proposed exchange offer for the 2028 Notes was rejected, with the 50% participation threshold not met. This outcome, while somewhat unexpected given cross-holdings, highlights the view among 2028 bondholders that the offer was distressed and value-destructive. The company noted that “more advantageous solutions” may still be possible, but flagged that preferred equity could be elevated above the 2028 bonds, further weakening recovery prospects.

- The rejection leaves 2028 Notes facing a looming maturity while the restructured 2026 Notes now carry a springing maturity ahead of them if they are not extended. This creates a structural incentive for 2028 holders to resist any deal that would further subordinate their position, particularly if there is potential for recovery or refinancing in 2028.

- The offer targeted non-cross holders, who had already been disadvantaged by the earlier 2026 exchange. The proposal would have furthered the restructuring at their expense, reinforcing perceptions of unequal treatment and undermining confidence in the process.

- Under the terms proposed, the remaining 2028 holders were offered new 2031 Notes at 52.5% of face value, with a 2.5% early tender incentive if tendered by 3 October. Any residual claim would be written off. The new 2031 Notes carry a 12% PIK coupon and are subordinated to the 2029 Notes issued under the 2026 exchange, while ranking senior to untendered 2028 Notes. The rejection means the company will need a broader restructuring, increasing uncertainty around recovery and seniority for 2028 holders.

Happy to discuss.

Tomás

E: tmannion@sarria.co.uk

T: +44 20 3744 7009

www.sarria.co.uk