Intro, Legal and Cap Struct - 31Mar23

Real Estate Business - 31 Mar23

Ed.Business and Invest-31Mar23

Value Buckets - 31 Mar 23

Maturities and Layering-31Mar23

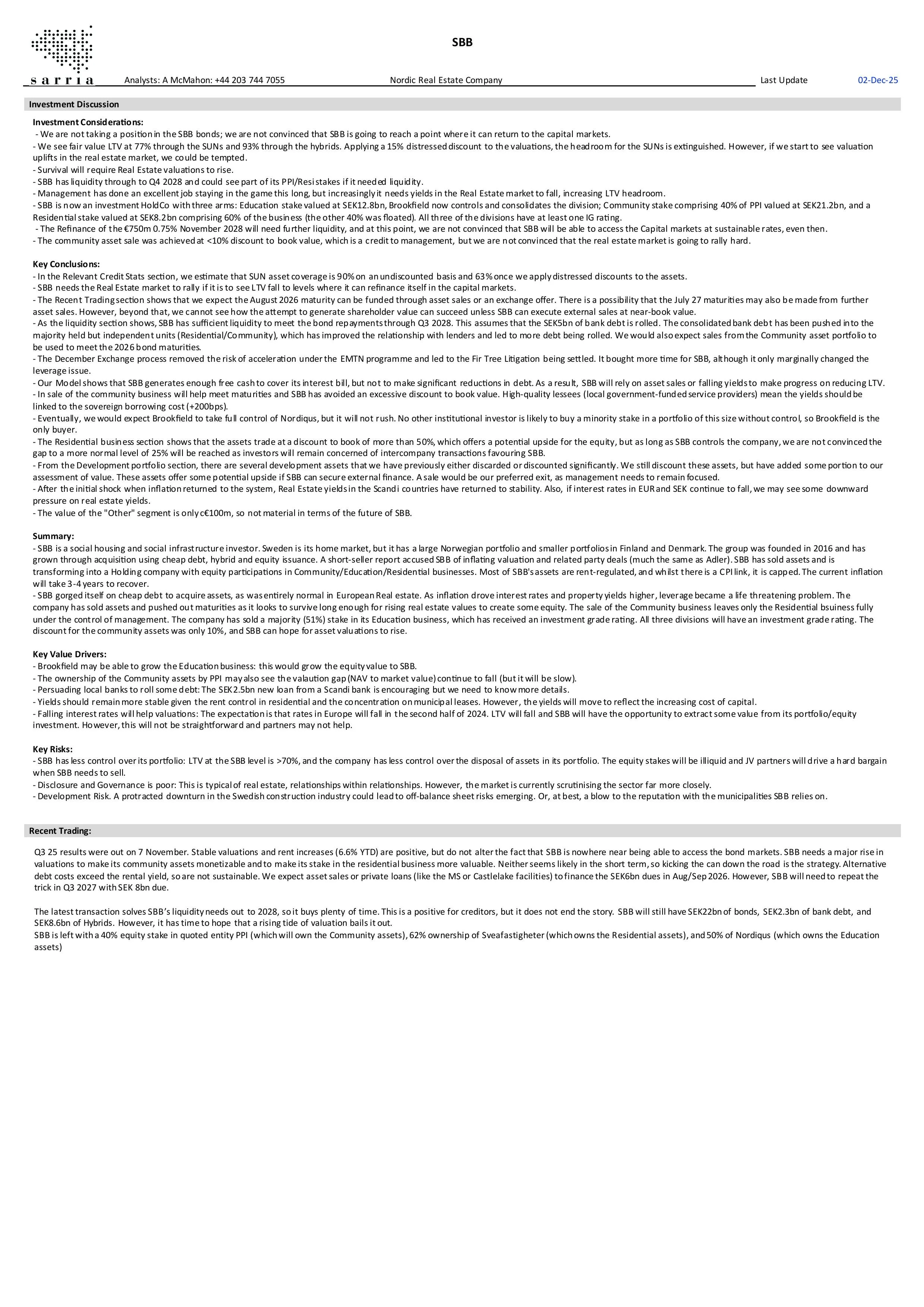

Investment discussion-31Mar23

The Fitch Upgrade reflects a change in rating methodology rather than a fundamental shift in risk. We are still sceptical that the

The Q4 25 numbers are almost secondary here. SBB has sufficient cash to cover maturities to November 2028, but we are not convinced

SBB needs Sveafastigheter’s equity to continue to rally if it is to reduce its own leverage, and the successful placing of €300m of

PPI’s EGM approved the SBB Norden Community asset transaction yesterday. The SBB AGM is on the 12 December,

This morning’s tender announcement from SBB is in line with the announcement of the Community Asset sale to PPI. As we said at

Please find our updated analysis here

The recent swap of the Community Assets for a stake in the Norwegian company Public Private Invest will leave SBB with sufficient liquidity to

The latest transaction solves SBB’s liquidity needs out to 2028, so it buys plenty of time. This is a positive for creditors, but it does not

Q3 25 results were out on 7 November. Stable valuations and rent increases (6.6% YTD) are positive, but do not alter the fact that

The bond tender at Ilija Batljan’s personal vehicle doesn’t impact SBB. If investors are bounced into exiting the Hybrids at 20%, Batljan could look to repeat the

The Q2 earnings were better, but the leverage issues will only be resolved with significant increases in property valuations. At present, valuations are

Sveafastigheter tapping its 2030 SUNs at just above par is a positive for SBB Norden as it demonstrates that the subsidiary companies

Dear all,

Please note that the commentary sent earlier today regarding the SEK 2.0bn SUN exchange offer related to SBB Norden SUNs and Hybrids was based on information that is 12 months old.

We apologise for the oversight and any confusion this may have caused.

Should you have any questions or wish to discuss further, please don’t hesitate to reach out.

Kind regards,

Aengus

SEK 2.0 bn SUN being offered to SBB Norden SUN and Hybrid holders gives a chance to get closer to the assets and will be attractive. The exchange offer will be via an unmodified Dutch auction satisfied by 80% new notes and 20% cash. The 2027 SUNs and Hybrids trade around 70%, and we expect there will be plenty of demand. The main thrust of the reorganisation of debt is the SEK10.4bn of bank debt that Sveafastigheter is moving closer to the resi assets.

Please find our updated analysis here.

The uncertainty surrounding the value of the SBB assets is receding, although the bonds are trading at near-fair value. There is an upside if

The call shows that SBB slowly continues to rehabilitate its balance sheet. The problems at the Holding Company remain, but SBB has some time

Ilija Batlja looks to have taken the up-tiering of Hybrids at SBB in December as a template. His personal investment vehicle has

Please find our updated analysis here.

Despite all of the noise, at its heart, SBB is still an over-leveraged business reliant on surviving long enough for a rising real estate market to bail it out. We expect management will sell

The SBB results were better than we expected operationally, with LFL rental growth of 5.5%, but the balance sheet is still overleveraged, and the holding company is a long way from

SBB released a statement this morning that Fir Tree will drop its legal proceedings in relation to its EMTNs. Well played SBB.

Fir Tree has reassessed the risks of losing its litigation to claim a par repayment and reduced its position accordingly. The success of the recent

Please find our updated analysis here.

The latest liability management exercise by SBB Norden has the same element of smoke and mirrors which matches the previous exercise. The main

The tender and exchange offer from SBB for the SUNs/Hybrids is designed to reduce the impact if the English High Court finds SBB is in breach of the

The tender/exchange offers announced today seem to offer plenty to investors without a significant increase in risk. We suspect this operation has a lot to do with

The additional €53m of EMTN holders seeking to accelerate their holdings makes little difference to the case being heard in the English Hig

If Fir Tree wins the litigation to accelerate the EMTN notes, SBB would immediately have to file for court protection as all EMTN holders

Some relief for SBB that the writedown pace is reducing (>SEK5.5bn YTD but <SEK1bn in Q3). SBB needs the Real Estate market to continue to

The latest care home sale is near book value (2% discount), but it is small and extrapolating it to the whole Care Home portfolio may

The Resi business (Sveafastigheter) priced its IPO at the bottom of its SEK39.5 – SEK45.5 per share range. SBB will be glad for the

We doubt any SBB investors were expecting an immediate stream of dividends from the Resi business, and Sveafastigheter (the Resi business) has

We preferred an option that would have seen a strong institutional partner take a stake in the Resi business (rather than an IPO). Lacking anchor