LONG Idea

- for speed listening, go to the settings wheel on the bottom right of the video and choose playback speed -

Update Positioning - 8 May 2024

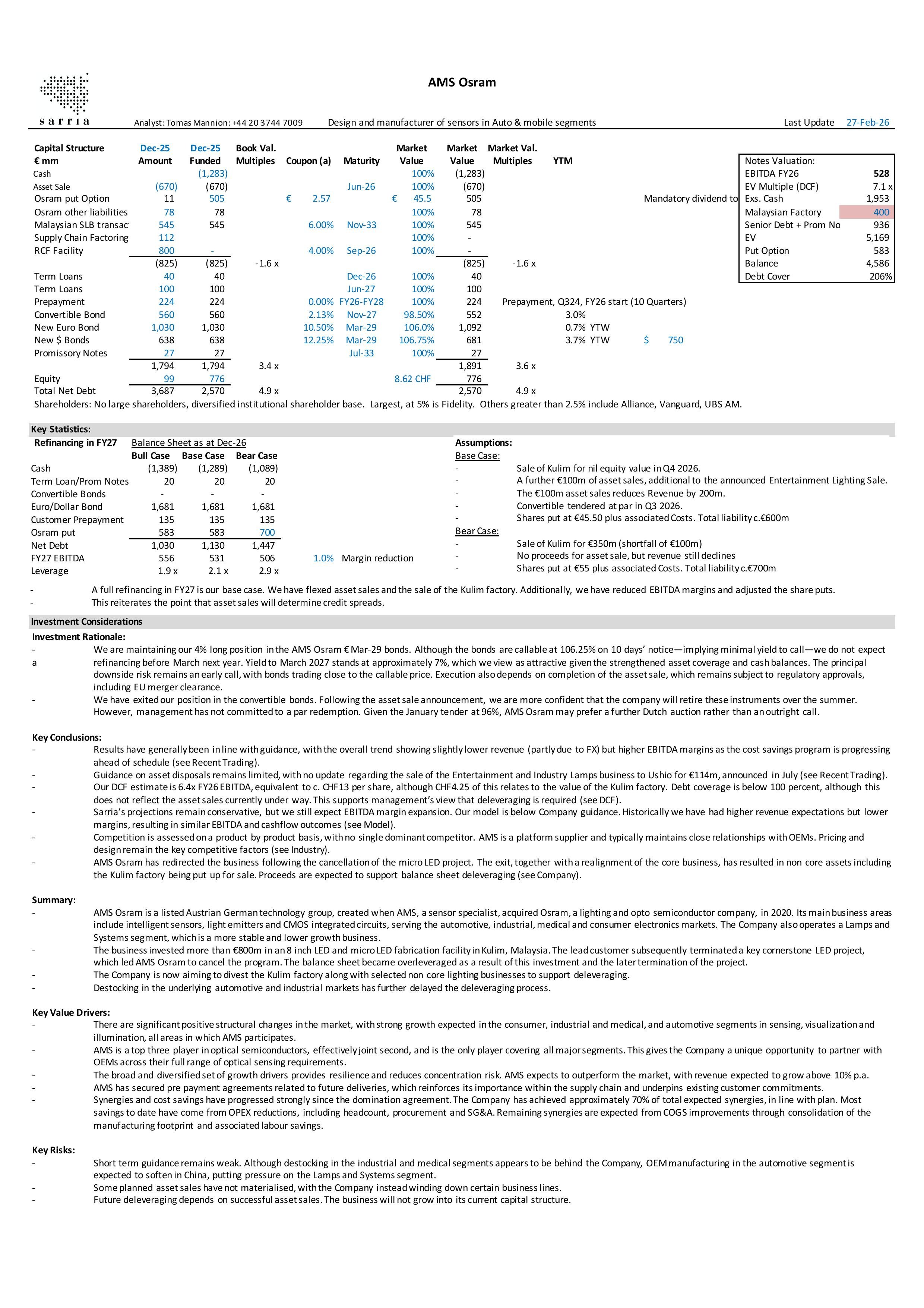

Intro, Capital and Legal Structure 26/01/23

Company and Merger 26/01/23

Cash Flow and Model 26/01/23

Investment Discussion 26/01/23

AMS Osram completed the sale of the Entertainment and Industry Lamps business announced in July 2025. Proceeds is

Please find our updated analysis of AMS Osram following the announced asset sale and the Q4 results, here.

AMS Osram’s credit profile has materially improved. Following the announced asset sale to Infineon, which the company expects to

Following last week’s divestment announcement, the Q&A was largely forward-looking, with analysts focused on understanding the shape and

AMS Osram has delivered on its promise, deleveraging the business substantially. Infineon are buying the non-Optical Analog/Mixed-Signal Sensor Business for

AMS Osram has extended its long-term brand licensing agreement with Traxon Lighting, securing continued use of the OSRAM brand in

AMS Osram is targeting approximately €500m of asset disposals as part of its deleveraging strategy. Against this backdrop, it is unsurprising that

AMS Osram announced the tender of its convertible bonds, with approximately €200m tendered at 96%. While the tendered amount was

Our key takeaway from AMS Osram’s statement is the reaffirmation of its asset disposal strategy and, notably, the absence of any

We exited our convertible bond position in AMS Osram at 95% in July, as we did not believe the Company would pursue a tender for

The new Idea Pitch videos are now available.

You can find them on the Sarria website landing page as well as on each individual company’s dedicated page.

Please find our updated model on AMS Osram following the Q3 results here.

With AMS Osram shares down c.20%, the bonds have moved lower in sympathy. In our view, the equity reaction is excessive, and bondholders should

Creditors received no update on the two key issues that will drive credit spreads in the medium term during AMS Osram’s Q3

A brief update ahead of AMS Osram’s analyst call this morning. The Q2 results were largely expected, following guidance from the

AMS Osram has announced an agreement to divest its Entertainment & Industry Lamps business to Ushio for €114 million. The transaction is expected to

Dear All,

Please find our unchanged investment analysis here.

AMS Osram is scheduled to release its Q2 results next Thursday. However, following this morning’s announcement, we are reducing our

AMS Osram has successfully raised €500 million by tapping its 2029 Euro and Dollar bonds, with the proceeds primarily used to fund the

AMS Osram extended the RCF by 12 months to September 2027, which was well flagged by the Company. In addition, the Company

Fitch has downgraded AMS Osram to B, from B+, citing the weaker-than-expected demand from end-markets, leading to lower utilisation of

AMS Osram has successfully concluded its long-standing legal dispute with Renesas Electronics, securing a settlement of $51.7 million. Although the

Following the release of AMS Osram’s Q1 results, management is currently engaging with both equity and credit investors. The only feedback

AMS Osram has launched a consent solicitation for its convertible bonds to amend the guarantees, making it rank pari passu with the rest of the

Please find our updated analysis post Q1 2025 results here.

We had previously pointed out that AMS Osram was more of an equity story than and credit, but with company management accepting asset sales are

The numbers were slightly ahead of guidance, but that is not the pertinent issue for AMS Osram. Details are a little light, but the Company has acknowledged the need to

Please find our unchanged analysis, after the Q4 numbers released in March, here.

With the bonds trading down 10-15 points in the downdraft of tariff concerns, we have revisited our analysis of AMS Osram. The Company’s guidance during the

As tariffs continue to influence market dynamics, we've taken a comprehensive look across our coverage to highlight the names most likely to be affected. For full transparency, we've also included those that remain unaffected—it's just as important to understand where the impact isn't being felt.

The idea here is

AMS Osram released its Annual Report this morning. We are reviewing the details but have already commented on the Q4 numbers released

AMS Osram Idea Pitch video is now live. You can find it on the Sarria website landing page and on the dedicated AMS Osram page.

Please find our model post Q4 numbers, here.

We have not made any major changes to our projections post Q4 and final FY24 results from AMS Osram. This is mainly a reflection that the credit continues to

The numbers are OK but don’t justify the 15% increase in share price seen this morning. However, the rally in the equity and bonds this morning is more likely to do with