- for speed listening, go to the settings wheel on the bottom right of the video and choose playback speed - after one minute video becomes high-resolution.

Intro, Cap and Legal Structure - 5 Mar 24

Description of Divisions - 5 Mar 24

Cash Flow and Valuation - 5 Mar 24

Value Leakage - 5 Mar 24

Investment Discussion - 5 Mar 24

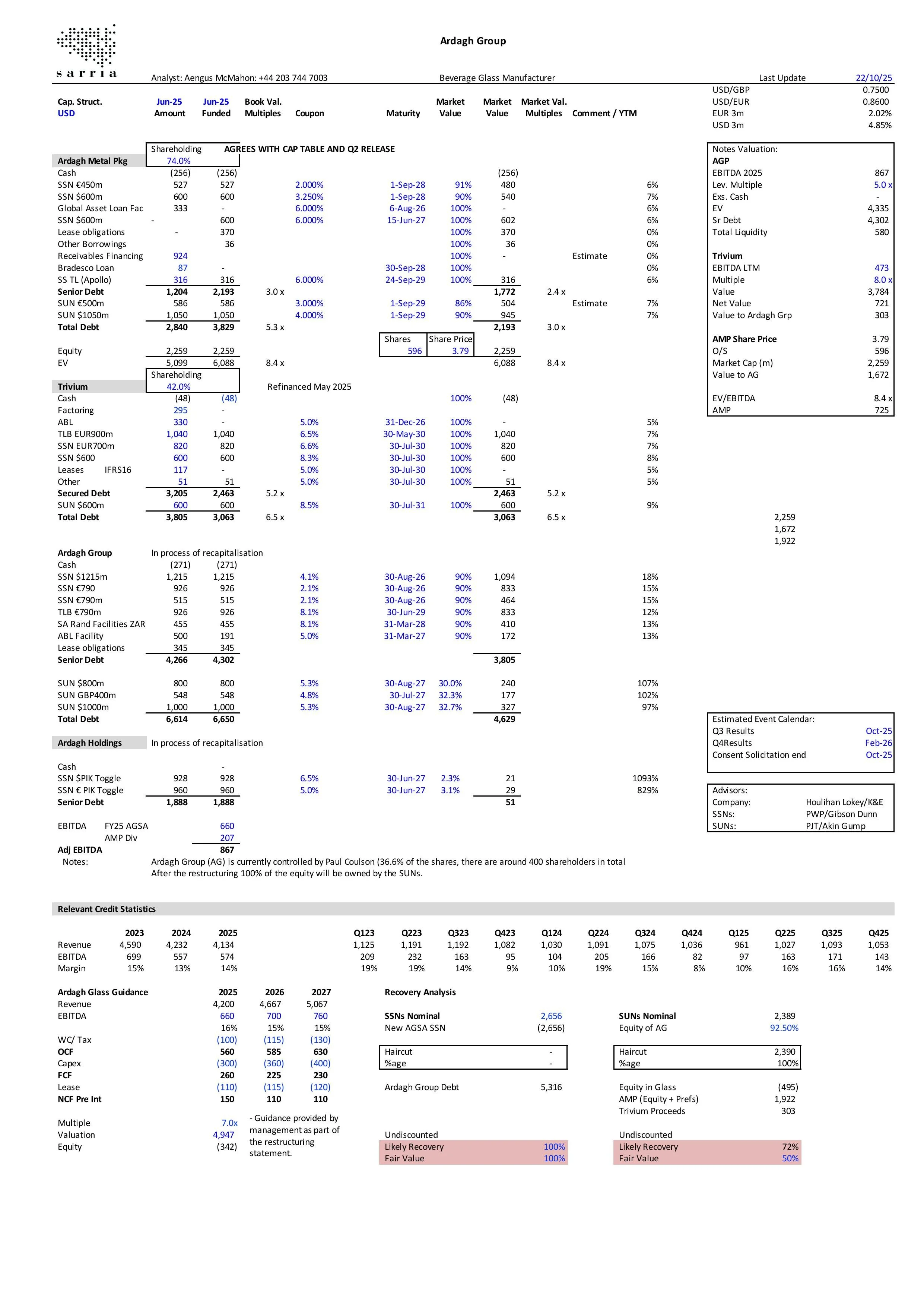

The Ardagh Group is moving beyond the restructuring story it has been for two years. AMP stock is up on the day, which is good news for

The ARD Finance litigation in New York continues; PIK holders are seeking to prevent the Ch 15 filing of ARD Finance. PIK holders are being

The CDDC voted for its own survival when it determined that Ardagh had triggered a credit event

The delisting of the AMP warrants will not prevent trading. The warrants, which expire in August 2026, have a strike

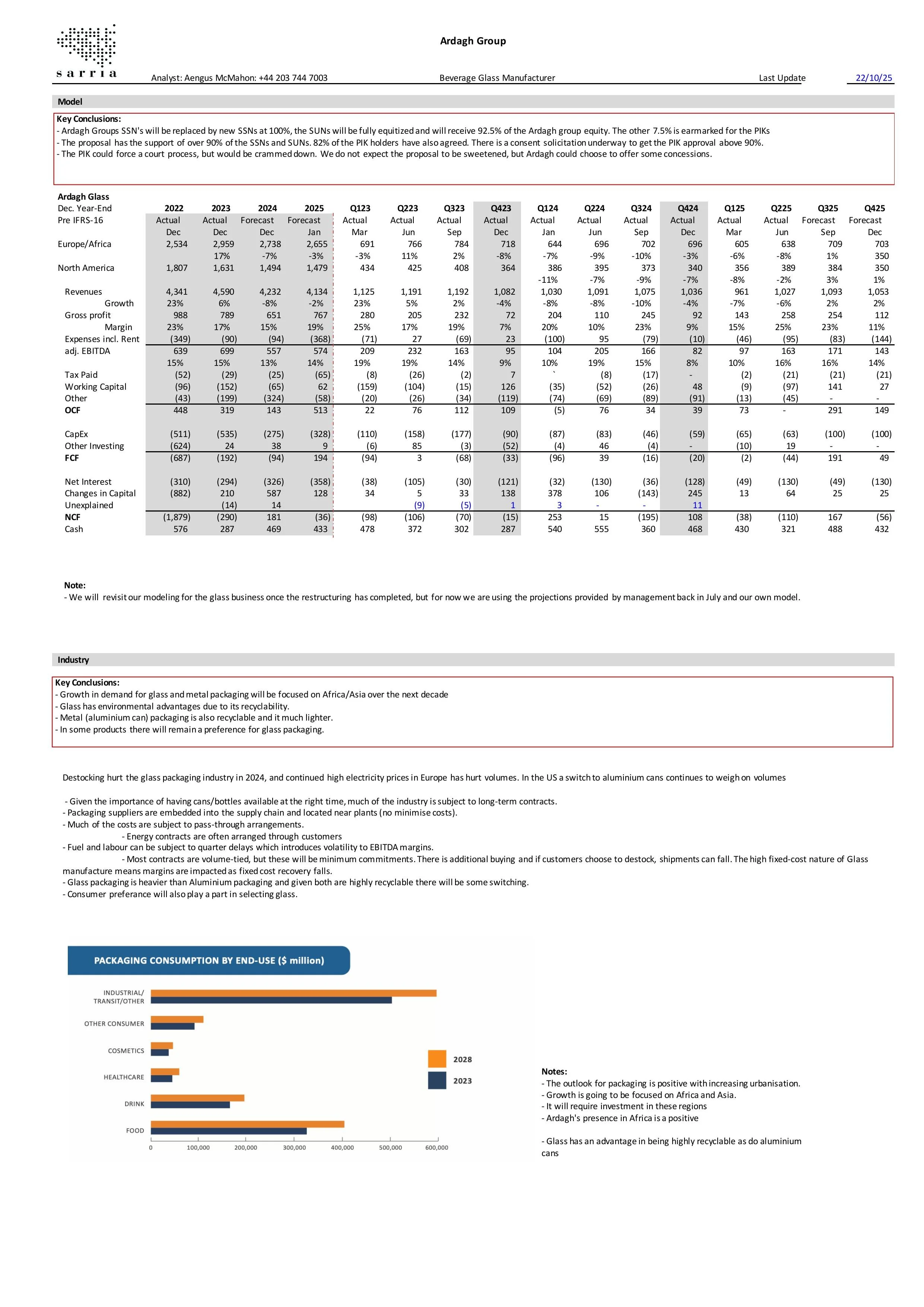

US glass operations are smaller but more profitable, and Europe/Africa is seeing low single-digit volume growth. There has been little by way of

Redeeming the $260m Preference shares (held by Ardagh Group) makes sense for AMP, as these shares were originally put in

The appointment of Mark Porto as Executive Chairman adds experience in working through a restructuring and is a positive. With Coulson exiting the business,

The Amicable Agreement announced by Ardagh does not mean they have reached an agreement that binds the PIKs yet. Unless an agreement is

The Q3 Revenue/EBITDA numbers in the Ardagh trading statement are in line with our forecasts; volume growth was -1%. We estimate that

By not reopening the consent solicitation with the PIK holders, Ardagh will be heading down the Scheme of Arrangement route. We expect the

The consent solicitation announcement indicates that Ardagh will need to complete its restructuring through a scheme of arrangement (SoA), unless

There was no results announcement from Ardagh Group (Aengus) yesterday, likely due to the ongoing consent solicitation process. Meanwhile, AMP

Please find our updated analysis here.

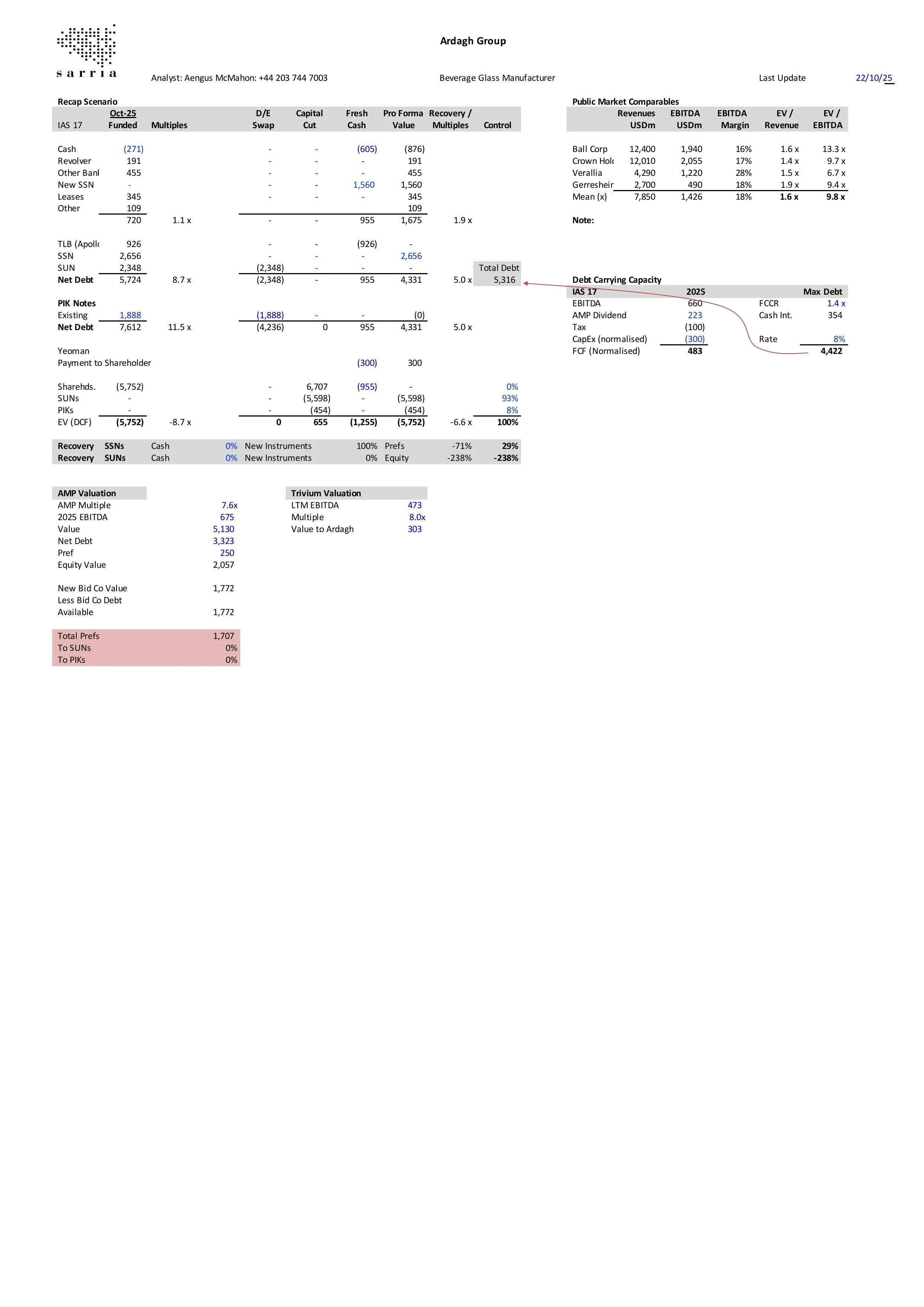

There is still some drama around the PIKs, but whether the process is consensual or vis the courts, the restructuring of the Ardagh debt structure is nearly

DB/Carronade are holdouts in the Ardagh restructuring with 13% of the PIKs. They have nuisance value as they can prevent Ardagh reaching

We expect the consent solicitations to succeed; even if the PIKs hold out, they will simply force a court process that will result in

Nothing substantial changed with the announcement yesterday. The PIKs are in a weak position and will be crammed down in a

Ardagh has over 75% support from the PIK holders and over 90% from the SSN and SUN holders. The PIK holders could force a court

Press reports have the PIK holders appointing White & Case to advise on accepting the restructuring plan put forward by the Ardagh Group. The Ardagh HoldCo PIKs are in a

Please find our unchanged analysis here.

The restructuring of Ardagh Group (AG) is finally nearing completion. It is largely as we expected at the beginning of the process, with the

Please see our unchanged analysis here.

The Ardagh restructuring announcement is imminent, so we are taking off our short position in the SUNs. The restructuring transaction looks likely to

The final bill to extract Coulson will be $300 million rather than $250 million originally reported, but the deal appears to be close to being

Coulson’s exit would pave the way for a consensual deal re-instating the SSNs, with the SUNs being converted to equity. This deal would be

Ardagh Group can support its senior debt, reinstating the SSNs with an uplift in coupon, with the SUNs getting the equity is the

Ardagh Group will want to clear the legal challenge by Arini and Canyon before finalising a deal with creditors. Currently, the only transaction under

The ending of discussions between the SUNs and Ardagh Group is bad news for the SUNs. Ardagh looks to have rejected the latest SUN's counterproposal and

Glass operations are not what’s driving bond prices, and the maintained 2025 guidance doesn’t change much for creditors. AMP stock jumped

The SSNs are turning the screw over the crumbs being offered to the current shareholders at Ardagh Group (AG) in the restructuring. Inevitably, the equity

As tariffs continue to influence market dynamics, we've taken a comprehensive look across our coverage to highlight the names most likely to be affected. For full transparency, we've also included those that remain unaffected—it's just as important to understand where the impact isn't being felt.

The idea here is

The litigants have around 7% of the nominal value of the SUNs, which on their own is not enough to block the current proposals. Increasing the potential value of the

Please find our updated analysis here.

Ardagh Group (ARGID) has finally accepted that its capital structure is unsustainable. The SSNs and SUNs have different plans for the company, but we expect the