LONG Idea - video

- for speed listening, go to the settings wheel on the bottom right of the video and choose playback speed -

Capital and Legal Structure 24/11/22

Industry and Company 24/11/22

Model 24/11/22

Investment Discussion 24/11/22

USDAW is understandably angry that its members working for Morrisons are receiving lower pay rises, but the government's additional

A commendable set of Q4 (Oct 2025) results from Morrisons in a tough trading environment. The Q4 and FY Revenue figure is

Our valuation of the Rathbones bread business in November 2024 was c€80m based on FYE 2023 results, but the business has

Supermarkets are looking for ways to boost gross margins, and a more aggressive approach to lagging outlets

Having store staff walking about the store filling baskets is the least efficient solution, particularly when it is their second job. In-store picking

Please see our updated analysis here.

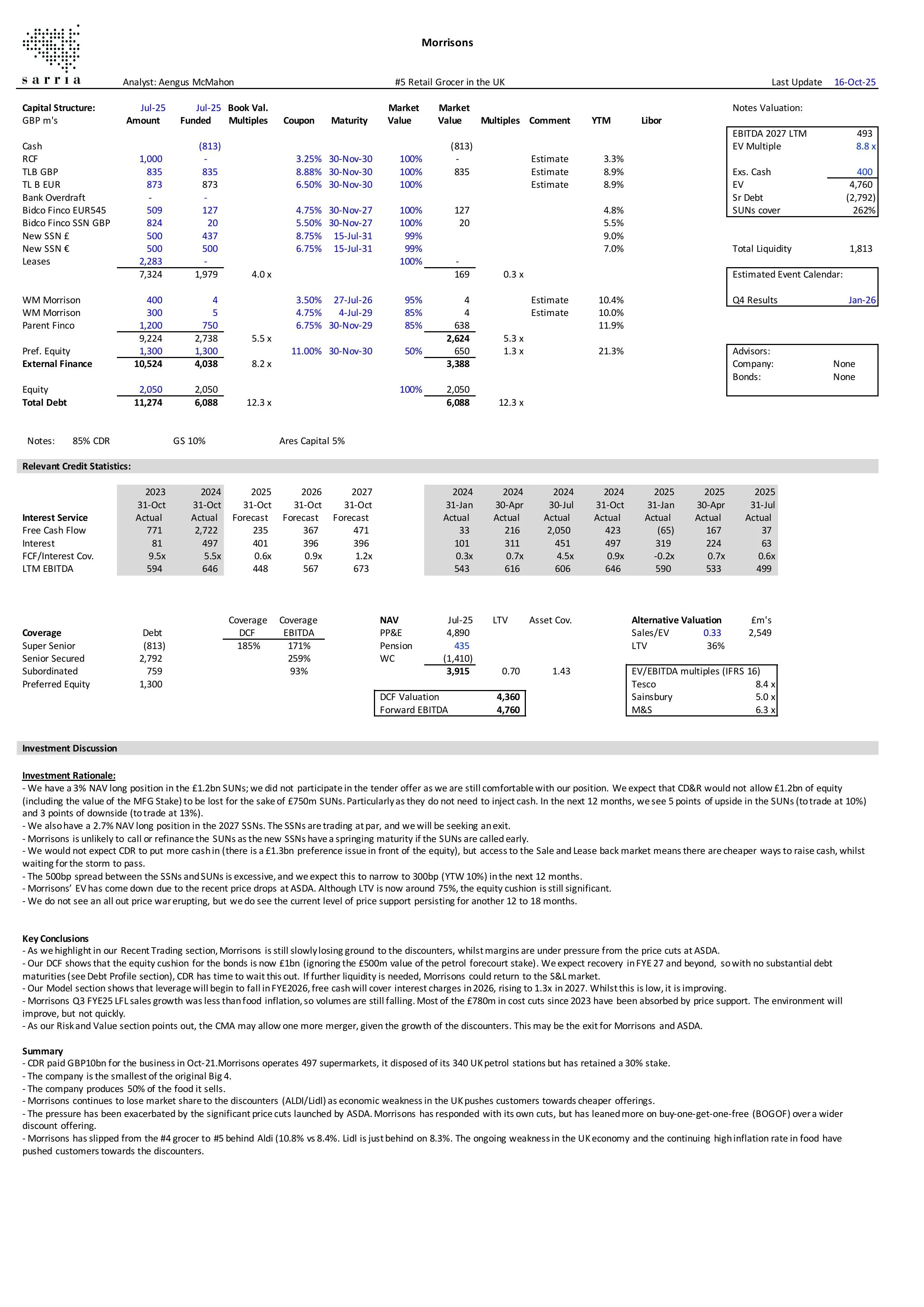

Morrisons is being squeezed by the growth of the discounters and the cost cuts from ASDA. Leverage is already high and will continue to rise in

The in-store pharmacy business at Morrisons is worth about £170m, so a sale would be useful but not game-changing. The rationale behind owning

The new instant delivery service will not significantly impact volumes at Morrisons. Morrisons Now is not intended to replace the weekly shop (online or in-store), but it does

Morrisons will remain under pressure as price competition continues. However, Morrisons has access to capital via the S&L market (at

Given the competitive UK environment, Morrisons' loss of its marketing director after two months reflects poorly on the company. CEO Rami Baitiéh will need to

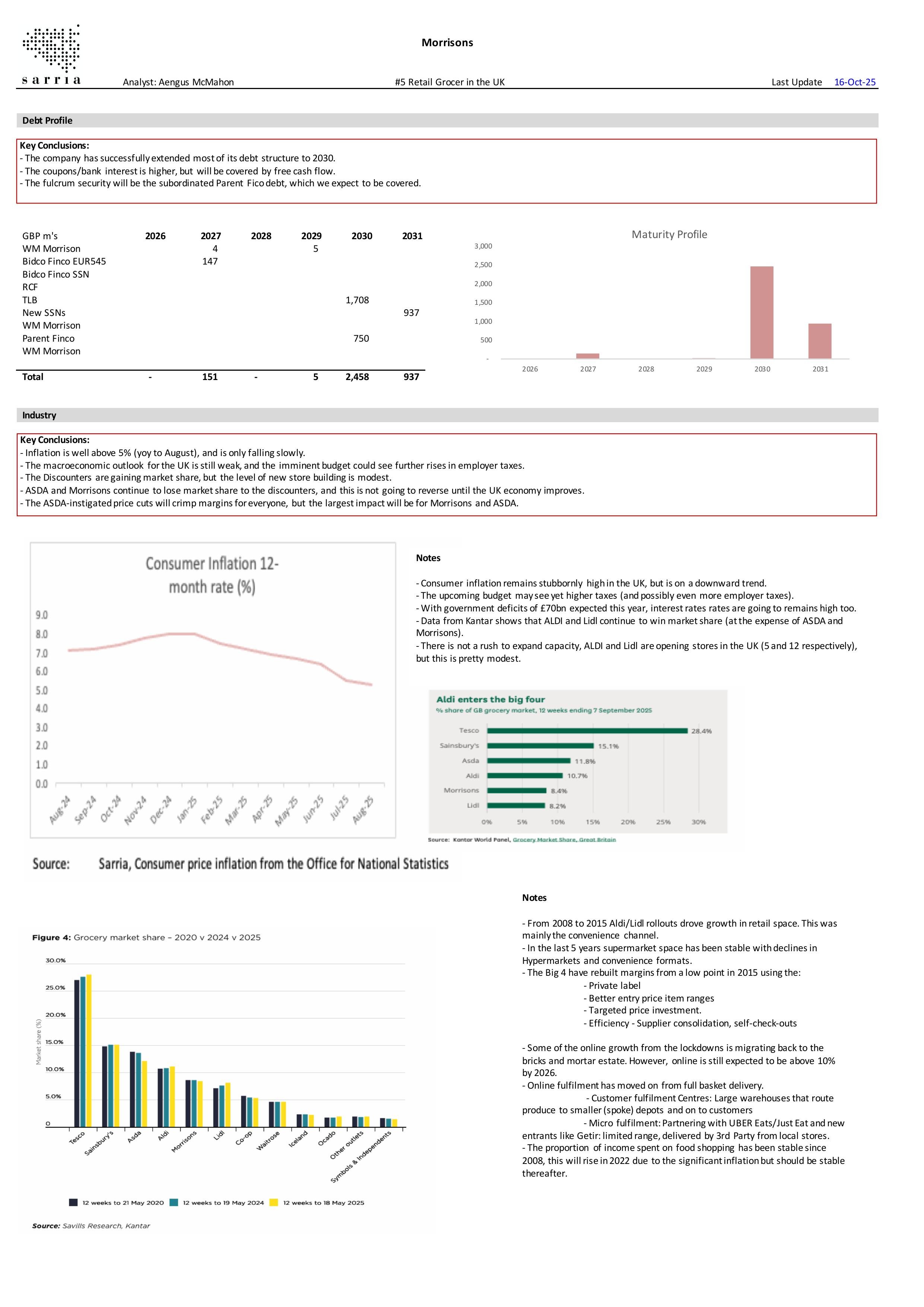

Aldi grew sales 6.3% (vs inflation of 5.2%) and continues to close the gap on Morrisons. Given that grocery inflation is at the same

Please find our unchanged analysis here.

Morrisons is pushing out some of its senior secured debt and up-tiering around half a turn of SUN’s debt. The transaction makes sense as

The tone of the release suggests that staff are hiding in store rooms, and the new policy will speed up shelf restocking. The move will not

Morrisons’ comment that competition remains significant but rational is supported by the latest data from The Grocer. ALDI/Lidl are

Strong cash flow and recovery from the Hacking issues in Q1 were a relief. Higher taxes will be a headwind in H2, but management is still

Margin preservation has pushed Morrisons to source non-British beef. Price pressure in the UK is going to continue to rise, and

A new marketing director with a background in e-commerce is a good fit for Morrisons as it looks to combat the

If the rumour of a £200m sale and leaseback deal is true, this would add around £14m to interest costs. Morrisons has no

Morrisons’ decision to expand its loyalty programme is a ripple caused by the ASDA price cuts, and the impact on Morrisons’ margins will

Allan Leighton has decided not to wear the Chief Customer Officer hat, and ASDA has appointed Rachel Eyre from Morrisons. Eyre has the

Morrisons had a good start to the year (to end Jan). Q1 sales +2.1% LFL, in contrast to the -4.2% at ASDA. The company has increased its

Morrisons is cutting costs rather than prices. There are only 365 in-store redundancies, so the cash impact will be

The senior appointments made at Morrisons show CEO Rami Baitiéh stamping his authority on the business. Revamping the

The company has an equal pay case similar to ASDA. If the workers are successful, we estimate the potential costs of £150m -

The competitiveness in the UK Grocery sector is not going away. ASDA is looking to cement its position, while Morrisons is looking to win back customers

Morrisons pivoting towards online order fulfilment via store picking is a negative for Ocado but partly reflects Morrison’s need to utilise its largely

The ransomware attack on a supply chain IT provider will have a short-term impact, and not all costs will be recoverable. We expect the cash cost to

The potential closure of the Rathbones business surprises us, but selling a business where Morrisons is almost the sole customer may be

A sale of Morrisons' own label bread business would bring in £75m - £85m in our analysis. Not insignificant but not a

The loss of a senior executive to Morrisons before he even started work at ASDA is not a good look. However, the relative stability of Morrisons is