Client Calls | Events

Best Ideas

SHORT Idea

AMS LONG Idea

Rekeep LONG Idea

Flora LONG Idea

LONG/SHORT Idea

Maxeda SHORT Idea

Mobico LONG Idea

Amara LONG Idea

Vivion LONG Idea

Branicks LONG Idea:

YIELD based risk profiles

-

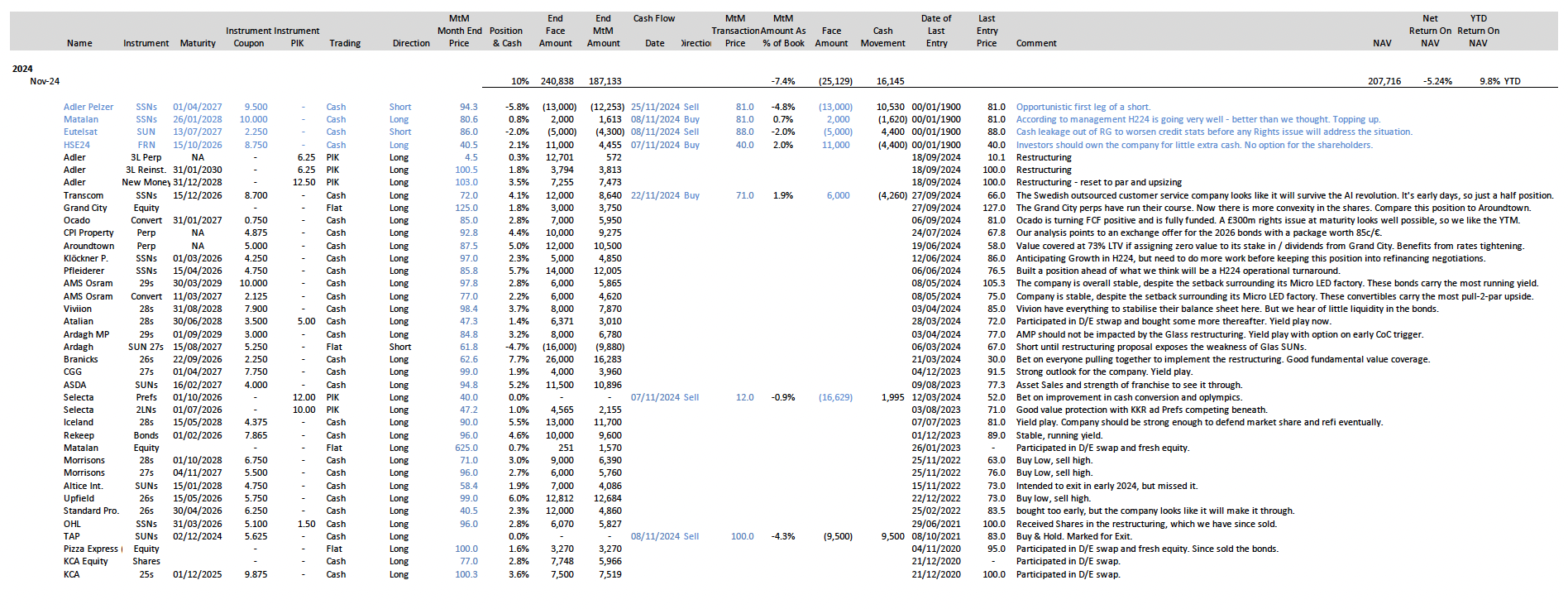

Adler: The 1Ls and 1.5Ls are value covered at 60% and 80% through the structure. The 2Ls are the fulcrum. The structure will have to be renegotiated in 2028 unless management can find an exit for all its assets by then.

The 2Ls yield 9% if Bunds remain at their current levels. If 2-year Bunds, for instance, tighten from the present 2.15% back to 1.8% (some mean reversion), then yield should reach 20%.

-

ams OSRAM: 2027 Convertibles

Downside is limited due to the increased liquidity and the stated intention to partially redeem, subject to market conditions. At 95, there is only a couple of points downside, if the Company announce a delay in its asset sales program. However, with no coupon, upside requires an early call.

2029 Bonds:

Currently yielding 8.5% at a mid-price of 106, the bonds offer modest price appreciation potential (1–2 points). The primary appeal lies in the 10.5% coupon. While potential asset sales may provide incremental upside, proceeds are likely to be allocated toward liabilities such as the Osram put and the redemption of the 2027 Convertibles.

Downside risk could be as much as 10 points. That said, management reaffirmed FY25 guidance as recently as July, reducing the likelihood of material credit deterioration from earnings-related underperformance. A more plausible driver of spread widening would be a delay in the asset sale process. The Company must demonstrate tangible progress on deleveraging through asset disposals during FY25.

-

AroundTown: From current levels, we see very limited upside for AroundTown’s unsecured and hybrids. Operational data has improved, which has removed some of the downside risk. Although a low risk, the bonds would trade off on any squeeze out of Grand City Property’s minority shareholders. However, AroundTown does not have the liquidity to undertake such a strategy.

The downside for AroundTown is very limited. LTV at the unsecured level is 39%, providing ample headroom for further downward revaluations. The hybrids, at 52%, are at an increased risk, but given revaluations have been upwards recently, the risk is low.

-

ASDA: We prefer the new SSNs over the stub of 2026 SSNs; we see the yield pick-up in the 2030 notes as attractive because we see default as a remote possibility. The 2030 SSN Yield is 8.1% (at 100p/£), giving 3 points of upside. The downside is 7 points (if the SSNs widened to 10%). Without significant deterioration in the UK economy, we see this as unlikely, and an 8%+ yield is attractive. The SUNs yield 6.7%, but we expect them to be refinanced in late 2025, which would give a return of around 11%. The upside is 6 points, and the downside is 12 if the SSNs traded wider, pushing the SUNs to 13%. Again, we see this as unlikely. With two large shareholders beneath the SUNs and given their small size, we do not view this instrument at risk of an opportunistic restructuring without significantly impairing the SSNs. Our DCF has £5bn+ in equity value beneath the debt stack. ASDA has £9bn of freehold assets and could engage in sale and leaseback deals to generate liquidity, if necessary, albeit layering for the SUNs and SSNs.

-

Aston Martin: At 89p/£ the SSNs are beginning to look attractive, but there is too much risk of further disappointment on the Q3 call (29th October). We expect a GBP200m cash raise to be announced at the time of the call to bolster cash reserves and see 5 points of upside. However, if the cash delay was delayed, we could see up to 5 points of downside. The company also needs to provide more clarity on its outlook for unit sales and profitability in 2026.

-

Atos:

1L: Under most scenarios, the 1L is fully covered. However, trading at 111%, with a YTM of 11% it offers limited upside. We expect 4pts of upside if better numbers materialise, leaving yields at 10% to maturity. However, any early take-out reduces the yield, with take-out in Dec-27 on the back of strong numbers, the yield falls to 7.6%. The downside is limited for the 1L, but with slightly weaker guidance for Q3 revenue, we expect a more favourable entry point.

1.5L: This is the real fulcrum instrument, with variations in operating margin and restructuring costs resulting in either 2x covered or zero recovery. The current 14% YTM at current prices is not sufficient for that volatility, and we view a fair price 20pts lower at 63% (20% YTM). Upside is potentially 10pts to an 11.5% YTM, but that would require some substantial margin improvement and a significant reduction in cash restructuring costs.

2L: A pure equity instrument, which at 4.3x LTM leverage, is barely in the money. The buy-in multiple is c.4.0x. This instrument will not see any major upside in the short term due to the substantial restructuring still required.

-

BioGroup: Sub Bonds: At 81%, the bonds yield 12% to maturity as of June 2029. However, the bonds will trade up on the potential of a full capital structure refinancing in late 2027. We see 5pts of upside in the next couple of months, as further discussions of an exit for the sponsor, coupled with the realisation that the whole structure will need refinancing during 2027. We expect strong Q4 numbers, which, when released in April, will support bond levels.

The bonds are small relative to the overall capital structure, and any further press leaks regarding potential changes in pricing dynamics in France could cause the bonds to fall 5–10pts.

-

Birkenstock: With the bonds trading 0.5 points below the 102.6 call price (March 2025), the upside is limited. We see four points of downside if the market overreacts to higher tariffs on Footwear imports to the US. The equity cushion of $10bn makes distress highly unlikely. The company may call the bonds in March, but for a saving of 100bp in coupon, Birkenstock is more likely to repay another piece of it €/$ TLB.

-

Boparan: We see little upside, as the bonds are callable at 104.7 from July 2026, and currently trade around 105p/£. We see potential for 6 points of downside (YTW 10%) if Poultry customers begin to pressure Boparan on margins, but do not see this as an imminent risk. Boparan has a long history of leaning on its customers/suppliers as it approaches a refinance and giving ground back after the new bonds are issued, and we see history repeating itself, but it will take time. Q1 results are out on 22/12/25, but we do not expect there will be much new news at that time.

-

Clariane: Unsecured: At 7% yield, we see limited downside in the medium term. The structure has broadly tightened over the last 6 months, with the Company tapping its recent June issuance to improve liquidity. Further tightening is possible with occupancy rates continuing to improve. At 6% yield, the newly issued bonds have 4pts of upside.

With this background, the Hybrid bonds offer a 13% yield which remains attractive, despite it subordination. There remains a significant equity cushion beneath, and with improving operational stats, the hybrid bonds provide decent risk-reward.

Downside centres on the current uncertainty with the French government and the broader impact on French yields. The Unsecured could trade down 4pts for an 8% yield, but the high coupon on the Hybrids are likely to limit any meaningful downside.

-

CPI Property Group: Risk Summary (BB+ Negative outlook) Green, Yield Name CPI’s SUNs are trading between 5% and 5.5%, and the portfolio is yielding over 6%. CPI has already accessed the Capital Markets at yields of 5.5% - 6.0%. CPI is not going to feel pressured into refinancing, as the latest deals saw debt yielding 5.5% replacing debt yielding 1.625%. We see maybe a point of upside, and two of downside in the 2030 SUNs. The pick-up yield to the newly issued Hybrids is inside 200bp, but these may well be tightly held, so a short is unlikely to cover the bid offer spread.

We do not see an imminent return to IG ratings at CPI, but the 3.75% July 2028 Reset bonds will be targeted once the rating increase is achieved. The 2028 hybrids trade at c90/€, we don’t see the trade as compelling, but we will review it in Q1 2026.

-

Consolidated Energy - At 92.25c/$ we see the most value in the 12% 2031 SUNs as they will benefit both from spread compression on improved operational performance and the expected USD rate reductions over the rest of 2025. We see 12 points of upside (with the bonds trading at 11%) in the next 12 months. If the global economy weakens, there are six points of downside. We expect the $253m loan to Proman to be extended rather than repaid, but this is in the price of the SUNs. Methanex will replace OCI as a partner in the Natgasoline plant. We do not expect any immediate change in ownership or control, but Methanex will want to run the plant eventually.

-

Engineering Group: Upside in the SSNs is limited to 2 points due to callability, and whilst we see 6 points of potential downside, we do not see a near-term catalyst for the downside to occur. If non-recurring costs continue, we would see the 2030 SSNs as a potential short. However, our DCF calculation shows €700m of value beneath the bonds. Leverage is high (>5.5x) due to persistent one-offs, but management has said these should be ending. Having recently completed a refinance operation, Engineering has little by way of maturities, and cash on hand plus the RCF show good liquidity. Working capital swings are significant, and the reduction or withdrawal of factoring lines would cause a liquidity crunch, but we do not see withdrawal as likely. The company has a dominant position in the sector in Italy and should benefit from increased digital spending. Other Italian-based IT providers trade at multiples of 9x+ on the expectation that growth is coming.

-

Eutelsat: As €1.3bn of fresh equity come into Communications S.A., the bonds are trading tight. Management has already signalled it will address the front end of the curve, and from April, the expensive ‘29s become callable too and are trading call constraint.

Numbed to the pains at the GEO business, the bonds offer little upside or downside in the near term. We will reassess after the refinancings, as by 2028, we expect the business to require more cash again.

-

Fedrigoni: In the mid 90s, the SSNs are a pure yield play. Significant maturities come only in 2029, and in the current cyclical demand downturn, cash flow still covers interest - just about. We see the downside inside 10% YTM, or around 90c/€, while the upside into the higher 90s should take some time. The current outlook suggests the next two reporting events should be neutral to negative.

-

Upside: For the “sub bonds” we see 6-7pts, with yields potentially tightening to 10%. However, we view this scenario as only possible with a couple of quarters of volume growth, which is unlikely in the short term. The bonds may rise a couple of points if the Company successfully extend its Senior Term Loan Facilities.

Downside: We see 3-4pts of downside on market weakness. Q3 numbers have diminished the possibility of significant margin declines. We would expect buyers to emerge if bonds decline to 80% as even with small declining volumes, there is substantial equity value beneath the bonds. Additionally, the bonds were badly placed, with some institutional investors unwilling to invest in.

-

Grand City Properties: The unsecured trade tight, with limited upside. The Hybrids could trade a couple of points tighter, on a relative basis versus peers. However, this is unlikely unless the equity tightens the discount versus book value it trades at. The equity remains at a 30% discount to Book Value versus c.20% for other listed peers.

The downside for GCP from a downward asset revaluation is low. LTV for the Hybrids is 46% on Book Value. Assuming the equity markets value the assets perfectly, the LTV is 68% through the Hybrids, providing significant asset coverage.

-

Grifols: As a risk arb trade, under a change of control scenario, there are c.10pts of upside in the sub notes, with c. 8-10pts of downside. The only senior Secured Notes trading at a substantial discount to par are the 2027 Notes, which have 8pts of upside, with c.4pts of downside to trade in line with the other pari-passu notes that trade above par.

In the absence of a bid, the bonds trade at fair value, with seniors at 6.5% and subs 100bps back for an additional 1.5x of leverage. If the bid rumour dissipates, both bonds will trade down. We see long-term value at current levels.

-

Heimstaden AB

The bonds also trade very tight, and the structure offers limited upside at current levels. There is, however, scope for material downside should dividend flows from Bostad remain suspended for longer than expected. Offsetting this risk, continued progress with the privatisation programme is improving leverage metrics, and we would expect a rating upgrade during 2026.

-

Heimstaden Bostad : Both the unsecured bonds and hybrids are trading relatively tight. At c.4% for the unsecured and close to par for the hybrids, we see very limited upside from current levels. While there remains a potential downside risk should Alecta attempt a clumsy exit from its investment, we consider such a scenario highly unlikely.

-

HoHR is a B- name with deteriorating operations, which we see turning around, however and well in time before its 2029 maturities. On the upside, therefore, these bonds are constrained to the 8% YTW they generate. On the downside, we see a CCC 10% YTM at 96c/€, or a maximum down-draft of 6 points. So it should be difficult to lose money with HoHR.

-

Upside for the bonds is constrained by the call structure, particularly with a likely refinancing in July/August 2026. The yield to August 2026 across all three bonds is c.6.5%.

Downside is limited. Even in a scenario of an adverse UK budget, the business will refinance next summer. Bonds may drop a 1-2pts on sentiment, but with decent H1 results and Q3 likely to compare favourably to a modest Christmas season last year, we see limited risk for underperformance.

-

Modulaire: Modulaire Q2 numbers were weaker than we expected, and utilisation rates are still low. H2 25 will also be weak as the UK and French construction markets remain soft. We expect recovery to be weighted to H2 26, but with €270m liquidity (between cash and RCF), Modulaire should not enter distress.

The 450bp pickup in spread from the €SSN to the €SUN is attractive, and we would expect that to reduce, but not yet. There are approximately 3 points of downside and 2 points of upside in the SSNs heading into the Q3 results. The SUNs will be more volatile with 5 points of downside and 5 of upside in the same period.

-

Morrisons: The SUNs trade at 85p/£ and yield 12%; we see 5 points of upside in the next 12 months (to 10%) and 3 points of downside (to 13%). A 250bp spread to the 2031 SSNs => 3 points of upside in the GBP SSNs. The improvement in margins at Morrisons has been slowed by the need for price support, and the upside depends on volume drops slowing or stopping. Morrisons has refinanced the forward end of its cap structure, and there are no significant maturities until 2030. If Morrisons needs to raise cash for price support, it can tap the S&L market at <7%. The company can also dispose of the 20% stake in the petrol forecourt business valued at £500m

-

Ocado We liked the 0.75% £350m Jan-27 at 80.5p/£, and we still like it at 91.2p. We do not expect this low-coupon instrument to be called early, but there will be a pull to par next year. We see 10 points of upside and little downside unless there is a significant negative re-rating of the credit. We also like the 11% Aug-30 SUNs at 95p/£, we see 5 points of upside and 5 of downside, but an 11% coupon makes the Total Return attractive on a 12-month hold basis. We value the retail business at 30p/£; the Technology business covers the rest of the debt. We value the equity at 212p, not far from the equity markets’ 225p. With the slower CFC rollout, we see the company issuing up to £300m of equity to bolster liquidity in FYE27.

-

OHLA: As 93% of bondholders accepted the restructuring proposals before the deadline, the company will restructure its bonds via an exchange offer under Spanish law. The current bond price is 96c/€, which includes 2.5% points of consent fees and OID => a normalised price of 93.5c/€. The upside is 5 points if the bonds trade at 12.5%, and the downside is 3 points if the bonds trade out to yield 15%. If the transaction were to fall apart, the downside would be 25 points, but we see this as unlikely. The equity issue is targeted at €150m, with €101m pledged. To the extent the €50m gap is filled either through equity or a convertible, the cash portion redemption of the bonds will rise from €91m to a maximum of €140m, but we are discounting this for now, but it would represent another two points of upside.

-

Pasubio: Downside is limited to a 15% yield, or around 80% (5pts lower), driven by a downgrade and muted FY25 performance, while upside for these bonds is 10% YTM, equating to around 6pts of upside, given the uncertainty in the wider automotive sector. The bonds are therefore likely to remain range-bound between 80–90%, as the Company has ample liquidity and no upcoming maturities.

-

PizzaExpress: Operations are stable and, within the confines of the macro backdrop, PizzaExpress is reasonably profitable. At 2/3 of EV, we find the bonds attractive and are surprised at the low rating. There are worse credits being rated BB. Following the restructuring, we think the bonds should remain in the low 90s for a while, tightening with any growth in performance, which should be dependent on consumer demand only. We do not see more than five points of downside, given the significant coupon and stable operations.

-

Punch: Freshly refinanced, the bonds yield 7% to worst, which would be a 2027 call at par.

On the upside, we could see the name slowly creep up to a 5.5-6% YTW, which would bring the price to 106/7 and provide 3-4 points of upside. On the downside, by contrast, this name could drop into the mid 90s, if the B rating comes into question.

-

Rekeep: The bonds are unlikely to see any meaningful upside until there is clarity regarding the investigation in Palermo. A minor fine would likely prompt a recovery, although the bonds are unlikely to approach par without progress on an asset sale. Operational performance has shown some positive momentum, but with the investigation ongoing, there is no short term catalyst for upside.

Downside is also contingent on the investigation. Based on precedent from the FM4 case, we estimate that any fine, if imposed, could be approximately €1m to €2m. The more material risk would be a prohibition on tendering for new contracts, which could result in an additional 10pt decline. This risk is partially mitigated by the potential for asset sales.

-

SES / Intelsat: In the 7% yield area, these bonds are not very attractive to us. We are doubtful if the long end of the capital structure will ever be repaid. However, a catalyst for a widening is more likely to occur in H225. We are concerned about SES presenting mere 50% margins when the noise from C-Band compensation dies off. Also, we are concerned about H2 operating expenses, which appear high for the second year. If financials show these margins, or if the current euphoria over European Defence spending does not materialise in SES contracts, then that would trigger a drop in the bonds of approx. 10 points at first, back to the wides in early 2025.

-

Tele Columbus : Fair value of the bonds is 67c/€ vs a current price of 69c/€. We see 10 points of upside if TC raises fresh cash and customer additions improve in line with our model; this would be a return to where the bonds traded before the disappointing Q1 results. In contrast, there are 3 points of downside if the bonds trade to their fair value.

We forecast that €150m - €200m of fresh cash will be needed by Q1 2026; Tele Columbus has options, but they are difficult and will be expensive.

The current bond pricing points to market scepticism that the build-out will be funded. We will update our stance once the Q2 numbers are published.

-

The Very Group: At 98%, The Very Group bonds yield 8% to maturity (August ’26) but offer some additional upside from an early take-out. This is driven by debt held by Carlyle maturing in November 2025 at one of the myriad holding companies outside the restricted group. Asset coverage is sufficient to meet not just the bonds but also the Carlyle debt, which is solely secured on the equity of The Very Group.

The downside will be gradual, likely prompted by further deterioration in retail sales. There is the potential for an increase in default rates, but given the long history of strong repayment profiles of its customers, we see this as low risk.

-

Viridien (CGG): Viridien has refinanced its SSNs, pushing maturities out to 2030; the SSNs are already trading at or above their 2027 call prices. Upside is limited as the bonds are call limited. The downside is 5 points (YTW 7.5% on the €SSN) if oil prices fall beneath $50 a barrel, but this is not something we expect. The family rating of B and the bond rating of BB- will attract bids from CLOs. Management has said it intends to call 10% of the bonds in 2026 and 2027 at 103 in accordance with the bond indenture, which means the bonds are trading point lower than they would be absent the call feature.

-

Vivion: Vivion is still a macro play on continued recovery in RE valuations, bolstered by rate cuts. The 2029 bonds yield 9.5% (including 1.5% PIK). We see 8 points of upside if the company proceeds in getting new investors and/or falling rates push valuations higher. We see 6 points of downside if the current tariff rows stoke inflation. Vivion has pushed its bond maturities out to 2028, and privately placed €250m in additional 2028 bonds back in December. With €544m outstanding, we expect good liquidity in the 2029 bonds. The next catalyst will be the publication of H1 25 results in mid-September.

-

VMEDO2: Currently, There is little to prompt volatility in the VMO2 debt stack. Most of the debt is at least three years out from maturity. Also, the $ SUNs (Jul 30) are only 100bp wide of the Jan-30 $ SSNs. The EV covers the debt stack, and 7.6% for senior paper is not a bad return vs bank deposits or IG paper. VMO2 was able to issue €2032 SSNs inside 6% in H1 2024, so access to the market is not an issue. The next significant maturity for VMO2 is £2.6bn in TL which falls due in Jan-28.

EVENT DRIVEN risk profiles

-

Accentro: The SUNs are trading at c40%, and we value the package being offered to SUN holders at 32%, so we see eight points of downside to the current price. Failure to execute the restructuring is unlikely. The transaction will convert 35% of the SUNs to SSNs, with the remaining 65% reinstated as deeply subordinated notes. There will be €77m of New Money, which will be Super Senior and will get 86% of the equity. Accentro will utilise the StaRug process to obtain court approval, and the Ad Hoc Committee already represents 80% of the outstanding SUNs (75% needed for court approval). The transaction is due to be completed by the end of September 2025.

The immediate upside is limited, but longer term, we see significant potential in the underlying assets, particularly the Inventory in Berlin. However, we will need to see the publication of audited numbers, which is likely to occur after this recapitalisation completes.

-

Adler Pelzer: Q325 beat expectations and so the fully drawn S.S. RCF has little to lose from extending, which should give bondholders time to October ’26 to negotiate an A&E or move on to Plan B. In the interim, any negative results in April (Q425) or June (Q126) would almost certainly sink the bonds. We calculate recoveries in cash and debt form in the 70s, in a restructuring and in the 80s or 90s, depending on the generosity of the shareholders in a deal. Higher nominal recoveries would trade at lower prices afterwards.

On the upside, we struggle to see the shareholders approaching the bonds early, since there should be a negotiation ongoing between them. Even if a proposal came, we doubt it would initially be worth more than 95 c/€.

-

Altice Intl.: It is impossible to separate Altice International from its more troubled sibling, Altice SFR, which results in depressed prices for the Altice International structure. The level of fear is highlighted by the fact the 4-month, fully cash-collateralised, near-term bonds still trade at 7%. Everything else is priced back of this.

Upside: The Company are seeking to differentiate between both silos and any meaningful (legal) efforts should see both seniors and subs trade up, to those seen before the call. However, with leverage likely to remain in the 4.0-4.5x range, the seniors' upside is c. 5-8pts, which would bring yields back to c. 8% from the current 10-11%. Sub bonds, due to their size will be more volatile, but a 15% YTM is easily attainable, implying 10pts plus upside.

The downside is centred on adverse shareholder actions, but from current levels, we see limited downside for seniors and subs. The risk of Drahi plundering the business is small, given he already relies on the dividend stream he achieves from the company.

-

SFR Altice France: Bluntly, we view it as un-investible at the moment. The cat can be made for the seniors, at c. 70%, on the back of sum-of-the-part estimations and the fact that they are trading at “recovery” values. However, we are taking a more cautious view, especially given the poor performance, and although recovery may be in the 70’s, this is very much an upside scenario. The downside has increased, possibly even 20pts, as maturity extensions and partial debt forgiveness appear to be already seen as the base case scenario.

The subs remain a binary trade. The downside is zero, with sub-bond holders having limited control in any proceedings. Upside could be 10-20pts, but very much at the discretion of the Company via a generous tender offer or a pact between Senior and Subordinated bondholders.

-

Amara: The bonds earn a running yield of 20%, which should prevent them from falling much further for the time being, as Amara has enough liquidity to avoid having to approach its creditors for the foreseeable future.

- On the upside, the business has merely had to re-settle into a normal energy price background. The down-cycle of solar on the back of postponed climate goals is so far more a spectre than reality and Amara generally operates in a growth sector.

- On the downside, this company will probably have to restructure in two year's time. So we would not expect bonds to return to a yield-driven price-range unless the macro environment turns out much better than we fear.

-

Antolin: This could be a volatile name. Trading currently in no-man ’ s-land at 67c/€, or around 23% YTM. On the upside, the bonds could jump conceivably up to 10 points to perhals 15% YTM, if Q3 results in November turn out far better than expected. On the downside, these bonds may struggle to find a bottom when FCF approaches zero in the coming six months.

-

Ardagh: SSNs - The SSNs are being made whole in this restructuring. We see up to seven points of downside initially as some investors look to exit through a small liquidity window. We see two to three points of upside as the notes are NC 0.5, 50%/Par. If the bonds trade down to the mid-90s, this is a long. The new SSNs should trade no more than 150bp – 175bp wider than the first lien.

The SUNs will be equitized, and recovery will be when Ardagh Group is finally sold. We expect this process to take two years, as the industry remains depressed. The SUN's holders will have an illiquid equity instrument. Applying an annual equity return of 20% to a recovery of 72c/$ in two years gives a fair value of 50c/$.

We estimate the 7.5% of Ardagh Group equity attributed to the PIKs to equate to a fair value of 5% ($131m). The Holdouts are hoping that the nuisance value of forcing Ardagh to go via a court process will be enough for the company to throw the PIKs a bone. In a court hearing, we would expect the PIKs to be crammed down. The Holdouts control virtually all of the bonds not already signed up to the restructuring agreement.

-

Atalian: We value Atalian bonds at around 80c/€, about 10c lower than when the restructuring was completed. The SSNs trade at 50c/€ and we expect they will trade sideways until Q4, we see 30 points of upside over the next two years and about 5 of downside. Trading at Atalian has not improved as expected in 2024; the failure to pass on inflationary costs has seen EBITDA margins in France fall to 5% from 5.5%. H2 24 will not see much relief, but we expect 2025 to be better and 2026 to improve further (as inflation drops). The company has €100m in cash and should be free cashflow positive, including earn-out payments of up to €63m in Q1 25 (we have applied a 50% discount to this in our model).

-

Branicks: We see fair value for the Branicks SUNs at >93c/€, whilst they trade at 63c/€. An A&E backed by a StaRug process is our base case. There are 30 points of upside and 15 points of downside if the A&E process is mismanaged by the company. However, a German insolvency process is unlikely, as demonstrated by the buy-in from Promissory noteholders in the Q124 debt rescheduling. We cannot rule out a liquidation, but see it as unlikely. We expect the Amend and Extend operations will offer bondholders (and Promissory note holders) partial redemption in return for a four-year extension, with the package worth 90c/€.

-

Cerba: With a concentrated holder base, we see limited price volatility in the near term. Downside risk is 5–10pts on further negative developments from the French government regarding the regulatory structure of the laboratory sector. Upside is capped: the bonds are unlikely to trade above 80 (c.5pts upside) given the need for an eventual comprehensive restructuring.

-

Emeria: The SUNs are a bet on the sponsors supporting the company in 2027, ahead of maturities in March 2028. They are a binary instrument.

The SSNs are value covered, but at 85c/€ are trading 10 points above where stubs would be reinstated. Value coverage is high at Emeria, due to its strong translation of EBITDA to FCF and the stability of the business. The problem is the lack of growth in the current macro environment, which will prevent Emeria from generating sufficient cash for an orderly refinancing in 2027.

-

Graanul: The bonds were unable to do a traditional refinancing, and now the extended bonds are stuck in the mid-80s. Given the prevailing uncertainty, upside is capped at around 95% or a 10% yield. While an agreement with Drax appears likely, the details will be critical. The contract structure, combined with other long-term customer agreements, will have broad implications for the wider market. Graanul may be able to mitigate lower demand by adding new customers, but the impact of price adjustments will be the primary driver of bond performance.

The downside case, driven by weaker prices, is severe, and we see scope for as much as 20pts of downside. With no near-term maturities, there is no immediate catalyst, and as such, we are remaining on the sidelines.

-

HSE24 : The High Court has approved the HSE24 restructuring, and it will be implemented by the end of June 2025. We see the package as trading at 50c/€ out of the box, which leaves around 4 points of downside vs 15 points of upside. We expect the movement to the fair value of 69c/€ to take 12 months. After the restructuring, leverage through the SUNs (which are structured to stay stapled to the SSNs will be 7.5x. We assess the amount of debt being equitized as too small (15% of the total) and expect a more comprehensive debt-equity swap after two years. The existing shareholders will continue to run the business, but the 15% (€98m) will be exchanged for an instrument allowing bondholders 37% of the equity value. We value the participation note at around €40m based on our DCF.

-

Ineos Quattro: We see limited upside across the capital structure, reflecting the ongoing weakness in the chemical market and the likelihood of a further delay in any cyclical recovery. The 2027 bonds currently trade at approximately c 20pt premium to the longer-dated issues, and we would expect some flattening of the curve over time, implying a higher downside risk for the 2027s.

That said, the 2027 bonds are likely to retain a degree of relative support given the need for Ineos to pursue either a refinancing or an amend-and-extend transaction. Despite the group’s sizeable cash balances, we believe it would be imprudent to deploy a material portion of available liquidity to repay the 2027 maturity outright, making a refinancing or amend-and-extend the more probable outcome.

-

Intrum: On the upside, we see little potential. The Exchange Notes are expensive as they await a funded tender offer in the coming two months.

On the downside, however, asset coverage is now only 25% and the market agrees that the mere 10% debt reduction was insufficient to put the company on a stable footing.

Without a CEO in place, Intrum could lose focus on its cost control, which could send the bonds down 10 cents/€ as this is the primary pivot between being paid par one day and having to restructure again.

-

Isabel Marant: The Company has positive momentum, and under optimistic assumptions, the enterprise value exceeds total debt. However, we see limited upside above 80 given weaknesses in the debt documentation. With no near term triggers, the bonds may trade in the 70s for the coming months.

Downside could ultimately be 30pt to 40pt, but in the short term, with no imminent maturities, the risk before FY25 results in April is limited. The larger downside risk is tied to an eventual restructuring, as EBITDA growth is unlikely to reach a level that would allow for a refinancing.

-

Kem One: From current levels (c.30c/€), it is difficult to project any upside from the bonds specifically. There will be a further restructuring, and bondholders may be in a position to provide fresh cash and obtain the majority of the equity via for debt-for-equity swap. However, with a significant super senior facility ahead of the bonds, the doomsday scenario of a zero recovery is possible. With the requirement of fresh cash, the downside is realistically another 20pts.

The PVC market can rebound quickly, but from current levels, there is limited upside in the short term.

-

Klockner Pentaplast: The process risk embedded in the current CH11 Prepack is probably contained. On the upside, 1L creditors should recover 36c/€ in new Exit Financing, priced at 8% coupon for 1.5x projected FCCR from 2027. 1Ls also receive 100% of the equity, but at a price of 42c/€, holders of this tranche (class 3) already pay for 20% of that equity.

The fresh cash, which is reserved for participants in the Bridge facility (check your upstream) receives a mere 5% PIK over the future interest it will earn in common with the pari passu reinstated 1L above. So it is unlikely to trade up following the conclusion of the Texas process.

On the downside, we have not had fundamental business data in a year. We have theories for what the structural headwinds could be, but no confirmation. Should they materialise, the company may yet again prove overleveraged.

-

Lowell: The New Money Notes will recover par under all circumstances..

On the upside, the SSNs may hope for a sale of the business, in which case they might be treated pari passu to one another and therefore recover potentially as much as 45p/£.

On the downside, in a multi-staged restructuring process, non-participating SSNs face full wipe-out and must accept nuisance value in an ultimate UK RP.

-

Matalan: Matalan needs to extend its maturities, and the previous SSN holders remain in control across the capital structure. Even though there is room under the covenants, the need for an incremental £35m short-term facility to help fund its ambitious growth plan and associated WC outlay could well be the trigger to effect the wider transaction.

The SSNs will likely remain unaltered, safe for the longer maturity. Danger could come from any uneven distribution between shareholders and SSN holders now, whereby the former could benefit in their left pocket from reducing the value in their right pocket, respectively. However, we think this is unlikely.

For now, we value the SSNs (EV covered) on their running yield of nearly 15%. This could rise going into the transaction, but should recover thereafter.

Matalan have an overall good chance to refinance this bond in 2-3 years’ time.

-

At 91, the bonds have up to nine points of upside if private creditors refinance the company. That being (despite the boom) somewhat unlikely, a more reasonable upside would be in the mid-90s, since a HY transaction would probably have to be an A&E with a sub-par outcome.

On the downside, a Debt/Equity swap is becoming more likely, which should result in reinstated debt worth no more than 75-80c/€. The company has had time to broker a deal all 2025, while LfLs were positive and the market was open. Now the market has swung against marginal refi bets, and a deal would have to be reached by March 2026.

-

Mobico: We see the share’s fair value around £60p, where they traded before the sale of the School Bus division. The Perps are about to step up, and the company’s handling of its balance sheet will strongly influence trading levels of all its securities. On the upside, Mobico now has sufficient cash to approach all its nearer-term creditors and the Perps with a good A&E proposal. This should return shares at least mostly to the above-indicated level and return the Perps to a 6% yield (where they could be reset). The bonds would benefit too. On the downside, if the company mismanages the extension, it could be forced to either tender for the short-term PP and create a difficult-to-scale 2029 wall, or drop assets down and refinance with non-recourse debt, layering the remaining Topco bonds.

All else equal, positive fundamental newsflow should float the shares back to somewhere near that level. On the downside, we think a maximum one-day downdraft would take the shares back to the recent lows.

At a restructuring table, the Perps would have no seat. They have as much upside as downside.

The SUNs are trading on a yield basis, but in a downside scenario, they would suffer from light documentation and would be vulnerable to coercive uptiering.

-

Pfleiderer : In the mid 70s, the bonds still trade to a YTM of 20%. With negative FCF, however, the company is likely to run out of money in the next 18 months, even if we apply available baskets. If anything but the best case materialises, the company at that time will have no debt carrying capacity, and unless the sponsor comes early with another fistful of cash, the bonds would fall at least into the 50s.

On the upside, if Pfleiderer scrapes through 2026, we do not foresee any scenario in which the bonds would be refinanced at par in 2028, as that would presuppose a strong rebound in German residential real estate renovation, which we do not foresee so quickly. Any upside from the mid 70s is therefore a bet on the sponsor and hard to quantify.

-

SBB: The Community Assets deal has provided an additional SEK11bn in liquidity to meet maturities through the EUR 2.25 Jul 27 bonds (SEK7.5bn outstanding). The 2027 bonds are trading inside 6.5% so they offer little value. The SEK7.3bn €0.75% bonds due in November 2028 are trading at a YTW of 7.5% (82.7c/€). The SEK7.3bn €0.75% bonds due in November 2028 are trading at a YTW of 7.5% (82.7c/€). We see a potential for 10 points of upside and 6 points of downside if they trade out to >10%. We expect that SBB will need to deal with this maturity by selling parts of its stakes in Community/Residential (or Education to Brookfield), as the alternative is hoping a rising Real Estate market bails them out. SBB doesn’t need to rush this fence, so the upside will take time to come

-

Selecta: Following an exceptionally disappointing quarter and news that the company has hired advisors, we conclude that the A&E we were previously envisioning will likely give way to a full-blown restructuring.

We see the SSNs as unimpaired - possibly receiving 5% in cash to extend 95% of their exposure. The 2LNs should receive some 60c/€ in new bonds, a good 10% in cash and some 30c/€ worth of new equity. There should further be an opportunity across classes to participate in the fresh cash that is funding the above pay-downs and is receiving primarily equity and, together with any other equity, receiving control in return.

Upside comes from a renewed injection by shareholders KKR, whereas downside should be mostly driven by inter-creditor negotiations and any fundamental weakening of a credit that is set to suffer from low and falling consumer confidence on the continent.

-

Upside: Our DCF results in an EV of €300-350m, which theoretically results in a par recovery. However, with fresh capital required, the majority of value could leak to new money providers. The realistic upside is 30-40 points, based on the debt capacity of Standard Profil based on FY25 figures, which is predicated on new money injection. The timeframe for any positive recovery will be long, as the value will only accrue once the OEM orders are converted into cash, which is late FY25/FY26.

Downside: Given the lack of senior debt, and the strength of the order book, we see limited downside at the current prices. Bondholders are in a strong position to provide the additional liquidity and we see 10pts max of downside from current levels.

-

Stonegate: Priced apparently as an 11% yield name, Stonegate is not that. The company is losing too much cash too fast to hold together through maturities setting in at company level by 2029. The company will have to sell assets to raise liquidity - we don’t believe the shareholders will inject more funds. The shape of the deal will determine what Stonegate do with any cash and what a future company and balance sheet might look like. The strong asset coverage from the pub estate limits downside in the name.

-

Synthomer: At 84c/€ we see the SUNs as a short. We expect that the weak margins in the chemical market will continue and that the winter statement at the end of January, followed by the FY results in March, will lead to softening in the SUNs. We see 5 points of downside (to 16%) and 1 point of upside (to 13%). - DCF fair Value is c75% and 65% on a sum of the parts (distressed) basis. The bonds already yield 13.5%, so this is not a cheap short. Our FV for the bonds is 80%, we expect weakening, but the significant liquidity and lack of near-term maturities will limit weakening in the SUNs.

-

Thames Water: The Class A debt should be reinstated with a stub worth approx. 70cp/£. We see a downside around 60p/£ and an upside of approx. 78p/£ if creditors receive a bigger sliver of equity. For an unlikely, but still possible Special Administration followed by Nationalisation, the downside for creditors is be hard to measure. We see the reinstated stub paying approx. 5.75% coupon and the equity yielding just over 10%.

-

Transcom: The bonds have risen to 85%, potentially due to short covering. A realistic upside is 5pts under our base case scenario, where the bonds are extended c.3yrs with a similar coupon. The bonds should trade at 10-12% yield to the new maturity, implying a c. 90% bond price. There is the theoretical upside of 15 points in the event of a par refinancing, especially if Altor provide additional equity. But we see this as unlikely.

The downside risk has lessened somewhat due to the recent operational rebound, although an assertive stance from the sponsor could still lead to bond prices declining by 10 to 15 points.

-

Tullow: Although the theoretical upside is par, we view this as unrealistic. Our base case remains an Amend and Extend transaction, given the limited prospects for new capital entering the structure and the Company’s reliance on a single producing asset. We had previously speculated that Tullow might have pursued the sale of its Ghana assets before the appointment of the new CEO; however, the September appointment likely reduces the probability of a short-term exit strategy.

The downside risk could easily exceed 20 points. We are unable to model the Company’s NPV estimate of $1.5bn, especially in light of recent production issues at Jubilee. Further production issues will definitely lead to a debt-for-equity swap. Regardless, we see debt-for-equity as the logical conclusion. This scenario would lead to a fall in the bonds to sub 60. An adverse ruling in the tax arbitration would raise serious questions regarding directors’ responsibilities and potential trading while insolvent. This further emphasises the need for conversion.

-

Victoria Plc Both bonds are pari-passu but with 18 months differential in maturity dates, we have separated them out.

2026 Bonds - Trading at 90%, with a YTM of 10%, we see limited upside in the name. The bonds have rallied on the back of the potential for a senior secured bond refinancing these bonds and layering the 2028 bonds. The upside is an early call on the back of refinancing but that is not likely until Summer 2025. Yield to August 2025 is 18%. The downside is from continued weak demand, where the bonds should trade to 15-20% yield. Bond drop off 10pts equals 18% YTM.

2028 Bonds - We don’t see any short-term upside beyond the carry, with any improved guidance likely to have a muted impact. The downside, if layered, would be 20 points, especially if accompanied by continued weakness.

-

Worldline: Organically, Worldline should be strong enought to pull through the current crisis. However, if the FS division unravells on clients re-insourcing their business, then the capital structure will need a solution.

Despite the large cash balance, there is little downside protection for the SUNs, as this bank-like company cannot be restructured. Clients would pull their business and the french jurisdicitons would prioritise its large number of employees over bondholder recovery. Also, the business will be systemically important to France, inviting the Ciri onto the plan.

On the upside, the Q3 reporting on October 21st ad the CMD in November ’25 could provide a few points of upside if we learn that no further clients have re-insourced their business, and if management explains structure, cash balance and interest income.

LEGEND

📕 icon indicates credits currently on our book, please see Track Record.

Likelihood of restructuring/LME process within 18 months: 🟦 Current 🟩 Unlikely 🟧 Potential 🟥 Certain

NAMES UNDER CONSIDERATION

ASK Chemicals, Synthomer (WIP), UBISoft